- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to report an investment loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

You don't need a 1099-B to report investment losses. Capital gains, losses, and 1099-B forms are all entered in the same place:

- Open or continue your return.

- Navigate to the investment sales section:

- TurboTax Online/Mobile: Go to investment sales.

- TurboTax Desktop: Search for investment sales and then select the Jump to link.

- Answer Yes to the question Did you have investment income in 2024?

- If you land on the Your investments and savings screen, select Add investments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

Thank you! I found that page but it looks like it requires a 1099-B. I can't seem to find a place to enter information without one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

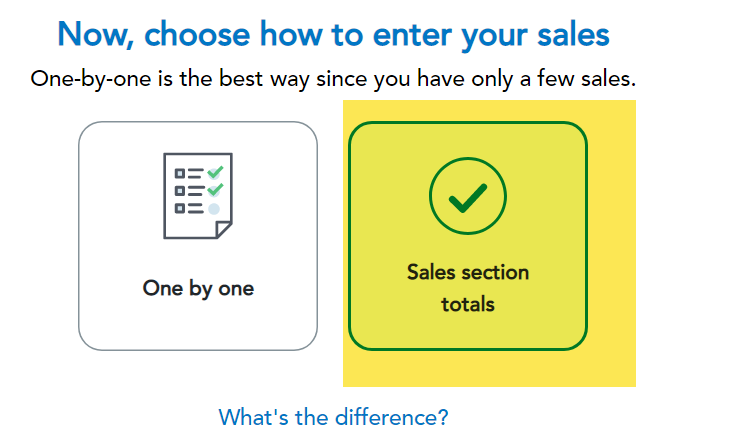

The entry screen will reference a Form 1099-B so you can enter your investment sale as though you had that form. When asked for the name of your broker, you can enter "NA" for not applicable. It will be easiest to choose the Sales section totals option on the screen that says Now, choose how to enter your sales:

On the next screen, enter in your sales proceeds and cost basis. You'll see a reference to mailing in your Form 1099-B, but just ignore that as you don't have one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

The online version still asks for 1098-B form. Pls see attached screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

An IRS form 1099-B or IRS form 8949 or similar form is uploaded into TurboTax Premium Online to provide documentation for a sales summary entered under Sales section totals.

An entry reported under the One by one method is not required to be uploaded or reported to the IRS.

Are you also reporting a worthless investment? If so, the investment may be reported under the One by one method.

If the stock is worthless, you may be able to report your complete investment in the stock. Worthless stock includes abandoned stock, permanently surrendered for no consideration.

Enter a worthless stock like any stock sale but with a sales price of zero and the word worthless in its description. Enter the correct cost or basis, date acquired, and December 31 as the date sold.

See IRS Publication 550 Investment Income and Expenses, page 54.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

@JamesG1 thank you for your response. I have worthless stocks that the brokerage didn't put in the 1098-b. I also have a bunch of investments in some startups which went under. In the past with the Desktop version, I was able to deduct those loss from regular income, but I don't see how to do it with the online version this year. I will try the one-by-one method to see if it offers me that option. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report an investment loss

I figured it out: still use the 1098-B one-by-one method, but later select "small business" option, which will lead to a screen to select whether that is a 1244 small business stock.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

abarmot

Level 1

dinesh_grad

New Member

ddm_25

Level 2

scatkins

Level 2