- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How much information do I need to enter from my 1099-B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

First time filing my taxes after having started trading. I missed the auto-import time frame or else I'd just avoid this headache entirely. I made around 120 trades back in 2018, so it'll be a pain to enter them in one-by-one.

On the 1099-B I got from my broker, there's the "Form 1099-B Totals Summary" section, holding a summary of proceeds, cost basis, wash sale adjustments, and realized loss and gain.

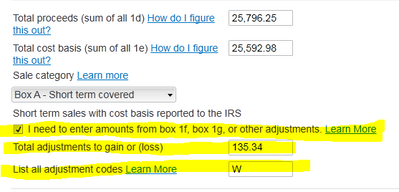

I see in TurboTax that I can either enter in every sale individually, or I can "enter a summary for each sales category". From what I understand, it says if there's any wash sale adjustments, I can't just use the summary field. However, there's still a box in that selection that allows me to enter in my total adjustments.

So this has me confused. Do I need to enter in every trade individually? Or can I simply just enter in the one Totals Summary field, with the included total adjustments and leave it at that? I only have wash sale adjustments, no others.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

You can enter summaries. There are two ways to show the summary entries on the tax return. One way allows adjustments and the other way doesn't. TurboTax automatically chooses the correct way, but the TurboTax screens don't make a clear distinction between the two ways of reporting it.

Enter the summary in TurboTax exactly as you showed in your screen shot. Check the adjustments box and enter the total adjustments and the code(s). When you enter a summary with adjustments, you must attach a statement to your tax return showing the details of each transaction. The attached statement can be a photocopy of the pages of the 1099-B from your broker that list the individual sales. Since e-filing has ended for 2018, you have to be filing your tax return by mail, so just attach the required pages at the back of the mailed return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

also as an adjustment code there should be the letter M. it tells the IRS multiple transactions have been entered on the same line

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

@Anonymous TurboTax automatically puts in the code M when you make a summary entry. It is not necessary for the user to enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

IRS requires details to be listed on Form 8949,

or on your own forms (e.g. consolidated 1099-B) which have the same information and in the same manner as Form 8949.

Either way, if you choose to summarize, you have to mail the transaction details to the IRS within three business days of IRS accepting your tax return.

Form 8453 is just a cover sheet you will include when you have made the mail-in election. It is not to be signed.

Exception: if you summarize Category A or Category D, Form 8949 is not needed for transactions without adjustments. No mailing is necessary. TurboTax won't ask you about wash sales if you don't check the box.

As an active investor, be aware that your category Box A sales without adjustments do not require Form 8949, so there is no reason to import those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a.

--

If you have wash sales, it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

Enter the wash sales on Form 8949, then use the subtotal results on the bottom of that form to know how much to subtract. Be sure to NOT check the adjustments box in the summary window.

TurboTax does not have an "import transactions with adjustments only" option ; it should !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

My problem is that my adjustment to the 1099b is entering the figure i have listed in BOX 1g - turbo says it is not correct ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

I would suggest that you schedule a callback with a TurboTax expert to get this resolved.

The expert will be able to see your TurboTax screens to guide you screen-by-screen and offer advice.

To schedule a call, click on 'Help' in the top of your screen on the right.

Then select 'Contact us'

Then 'Talk to a person'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

starkyfubbs

Level 4

di-b-keller

New Member

Steph2024

Level 1

katie46

New Member

corinne-tomczak

New Member