- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much information do I need to enter from my 1099-B?

First time filing my taxes after having started trading. I missed the auto-import time frame or else I'd just avoid this headache entirely. I made around 120 trades back in 2018, so it'll be a pain to enter them in one-by-one.

On the 1099-B I got from my broker, there's the "Form 1099-B Totals Summary" section, holding a summary of proceeds, cost basis, wash sale adjustments, and realized loss and gain.

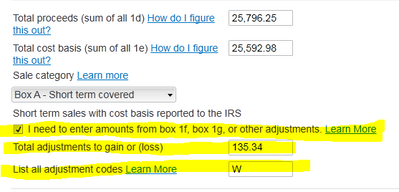

I see in TurboTax that I can either enter in every sale individually, or I can "enter a summary for each sales category". From what I understand, it says if there's any wash sale adjustments, I can't just use the summary field. However, there's still a box in that selection that allows me to enter in my total adjustments.

So this has me confused. Do I need to enter in every trade individually? Or can I simply just enter in the one Totals Summary field, with the included total adjustments and leave it at that? I only have wash sale adjustments, no others.