- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

Let's assume this is the first year someone is using Turbo Tax Home and Business after years of doing taxes on paper. The person has a rental property that was fully depreciated that got a stepped up basis after the death of a spouse 5 years ago. Now, the surviving spouse sells the house. What is the correct way to enter the Original Asset and New Asset with Stepped Up Basis for sale in the Rental section of Turbo Tax Home and Business (desktop version). What is the correct way to enter it all in for the first time in Turbo Tax in the rental asset section such that the program correctly calculates the gains and recaptures 1/2 of the full depreciation of the original asset and the depreciation taken on the new asset the last 5 years?

Also, how is land cost handled when entering these assets?

I understand exactly what the gain and depreciation recapture should be here. The question is simply how to enter it properly in the software so that it calculates correctly assuming one had never used turbo tax previously.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

You can enter it just once.

Pease go to

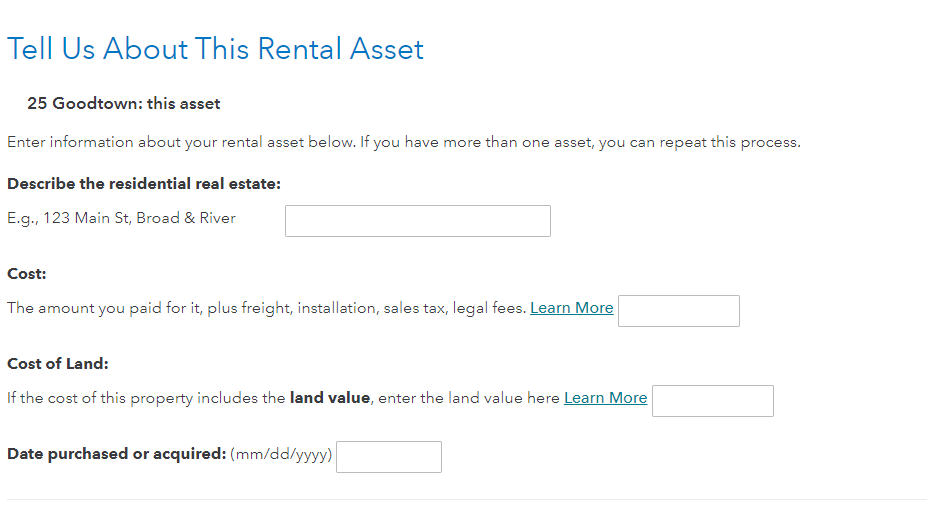

Business

Rental Properties and Royalties

Enter the property with the stepped-up basis for land and building.

If you know the proper amount to list as the basis, there is no need to select that it was inherited. If you would prefer the program calculates the basis, you can go through that interview.

Use the start dates of ownership and business use as the date it was inherited.

Report that it was sold and the sales date.

The 2021 depreciation will be calculated.

Continue through with any income and expenses.

Click Done.

Return to the Rental Section and continue through the interview until you get to the Summary screen

Click Edit next to the property

Scroll down to Sale of Property/ Depreciation and click Start or Update

Select YES to go to summary

Click Edit next to the property

Continue through the interview reporting the basis of property and land, the prior years depreciation (your calculation) and the sale proceeds.

The program will add the 2021 depreciation if applicable.

Depreciation recapture will be listed on Schedule 1 and capital gain or loss on Schedule D.

TurboTax will handle the land sale by the numbers you enter. Either gain or loss depending on how you allocate the sales proceeds to the land portion of the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

Hi, I follow the first half of this with no problem. I don't follow the second half at all. I entered in the "Asset" with the new basis, land cost and dates for in service, and "sold" and date sold. I proceeded to put in the sale price, land cost (no gain/loss on the land) and the expenses related to sale. It did calculate the prior depreciation for the 5 years or so for me and it matches.

What is the 2nd half of your response exactly? I tried to follow what you mentioned, but it basically just takes you back to the same questions. Maybe I'm not following something right here? I'm also using the desktop software version of TT 2021 - Home and Business.

I'm really struggling with the gains this software is calculating as they just do not make sense and are way higher than it should be. With no support from turbo tax for desktop software users, I'm very stuck here. Is there any way for you to reach out or help me figure this one task out? It's the only thing holding up these taxes and I'm at my wit's end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

I should clarify my first response. When you add the rental in, it never asks for a basis or anything. It is all just generic questions. The only place I can enter any kind of "basis" or cost and date of sale and sale price is in the asset section under "sale of property/depreciation". So I guess the second part of the response on how to do this is really where the first part happens in terms of entering all the info... hence my confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter the sale of a fully depreciated rental property that has a stepped up basis from death of spouse years prior to sale?

This is exactly where you enter the information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

user17550205713

Returning Member

Kenn

Level 3

Farmgirl123

Level 4

syounie

Returning Member