- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I report currency realized losses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report currency realized losses?

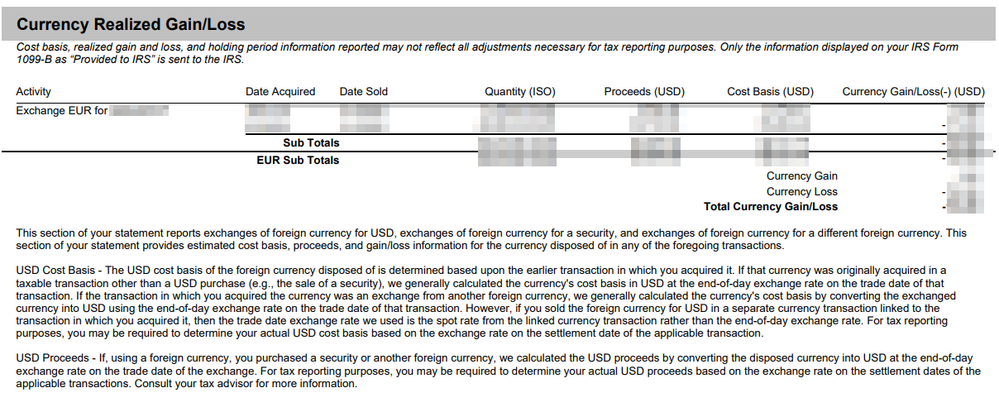

In 2020, I wired euros into my US brokerage account with Fidelity (which resulted in the conversion of the euros into US dollars) and bought a security that is traded in euros. On my 2020 tax statement from Fidelity, there is a section entitled, "currency realized gain/loss" (see screenshot below) which shows a loss due to the cost basis being higher than the proceeds. I assume this difference between the cost basis and proceeds was the result of the exchange rate deteriorating between the time I deposited the funds into my account and the time I used the funds to make a purchase of the security. How do I report this loss in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report currency realized losses?

You can report your loss on your foreign currency conversion by following the steps below:

- In the Wages & Income section, scroll to Less common income.

- Click the Start/Revisit box next to Miscellaneous Income, 1099-A, 1099-C

- On the next screen, click the Start/Edit box next to Other Reportable Income.

- If you have already made entries, you will see a screen, Other Miscellaneous Income Summary. Click the Add another income item link.

- If you haven't yet made entries, you'll see the screen Any Other Taxable Income? Click the Yes box.

- On the Other Taxable Income screen, enter the description "Loss on foreign currency transactions." and enter the loss as a negative amount.

You may use the Yearly Average Currency Exchange Rates on the IRS website or the exchange rate on the date you changed the money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report currency realized losses?

Thanks @Irene2805 , much appreciated!

One follow-up question. As you see from the screenshot I originally attached, the fine print of the Fidelity document states:

"USD Cost Basis - The USD cost basis of the foreign currency disposed of is determined based upon the earlier transaction in which you acquired it. ... For tax reporting purposes, you may be required to determine your actual USD cost basis based on the exchange rate on the settlement date of the applicable transaction.

USD Proceeds - If, using a foreign currency, you purchased a security or another foreign currency, we calculated the USD proceeds by converting the disposed currency into USD at the end-of-day exchange rate on the trade date of the exchange. ... For tax reporting purposes, you may be required to determine your actual USD proceeds based on the exchange rate on the settlement dates of the applicable transactions."

How do I know if I can use the USD cost basis and proceeds that Fidelity calculated and printed on my statement or if I have to recalculate the USD cost basis and/or proceeds based on the exchange rate on the day the trade settled, as the fine print suggests I may need to do? For what it's worth, the relevant dates are as follows:

- I deposited euros into my Fidelity account on 12/31/19 and 1/2/20.

- I bought a security that is traded in euros using the previously deposited funds on 1/3/20.

- The transaction was settled on 1/7/20.

Appreciate any insights you can share!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report currency realized losses?

Fidelity processes such transactions on a large scale. It's safe to assume that the USD listed on the Fidelity statement would be the correct exchange rate for the date of the transactions.

If you choose you can always compare the rates using the Yearly Average Currency Exchange Rates on the IRS website as noted by @Irene2805.

The date to use for purchase (and for sale) for tax law is the trade date, not the settlement date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

brian94709

Returning Member

MeeshkaDiane

Level 2

patamelia

Level 2

patamelia

Level 2