Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report currency realized losses?

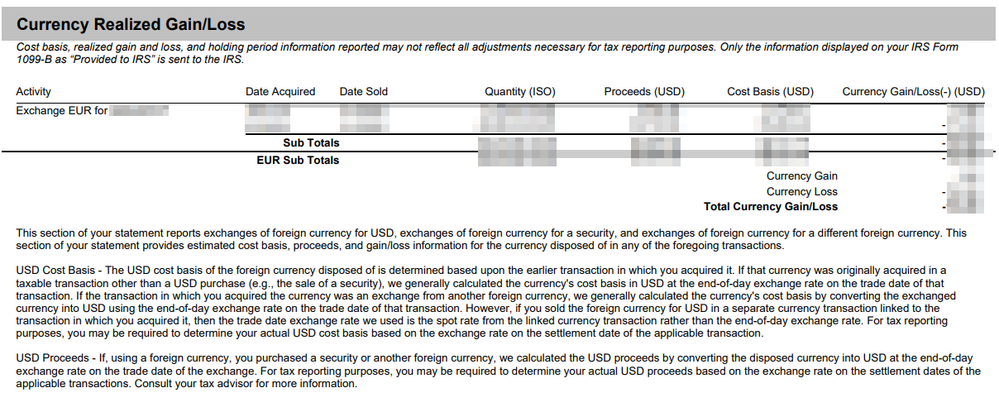

In 2020, I wired euros into my US brokerage account with Fidelity (which resulted in the conversion of the euros into US dollars) and bought a security that is traded in euros. On my 2020 tax statement from Fidelity, there is a section entitled, "currency realized gain/loss" (see screenshot below) which shows a loss due to the cost basis being higher than the proceeds. I assume this difference between the cost basis and proceeds was the result of the exchange rate deteriorating between the time I deposited the funds into my account and the time I used the funds to make a purchase of the security. How do I report this loss in TurboTax?

Topics:

January 26, 2021

5:05 PM