- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I now claim an old 2013 Capital loss carryover maximum of $3000? Turbo Tax takes me back to last year's 2023 tax info stating I have no losses to use in 2024?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I now claim an old 2013 Capital loss carryover maximum of $3000? Turbo Tax takes me back to last year's 2023 tax info stating I have no losses to use in 2024?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I now claim an old 2013 Capital loss carryover maximum of $3000? Turbo Tax takes me back to last year's 2023 tax info stating I have no losses to use in 2024?

First, you need to determine how much capital loss you have available. If you had no capital gains in any of the years since 2013, you must reduce the carryover by $3,000 for each year that has passed, since you were allowed to deduct that. If you had capital gains, you must reduce the carryover by the gains and $3,000 more. You can amend returns up to 3 years ago, but any years before that, the deduction is lost. Since you did not include the carryover on your return, you may be questioned by the IRS to prove you had a carryover, so keep your documentation handy.

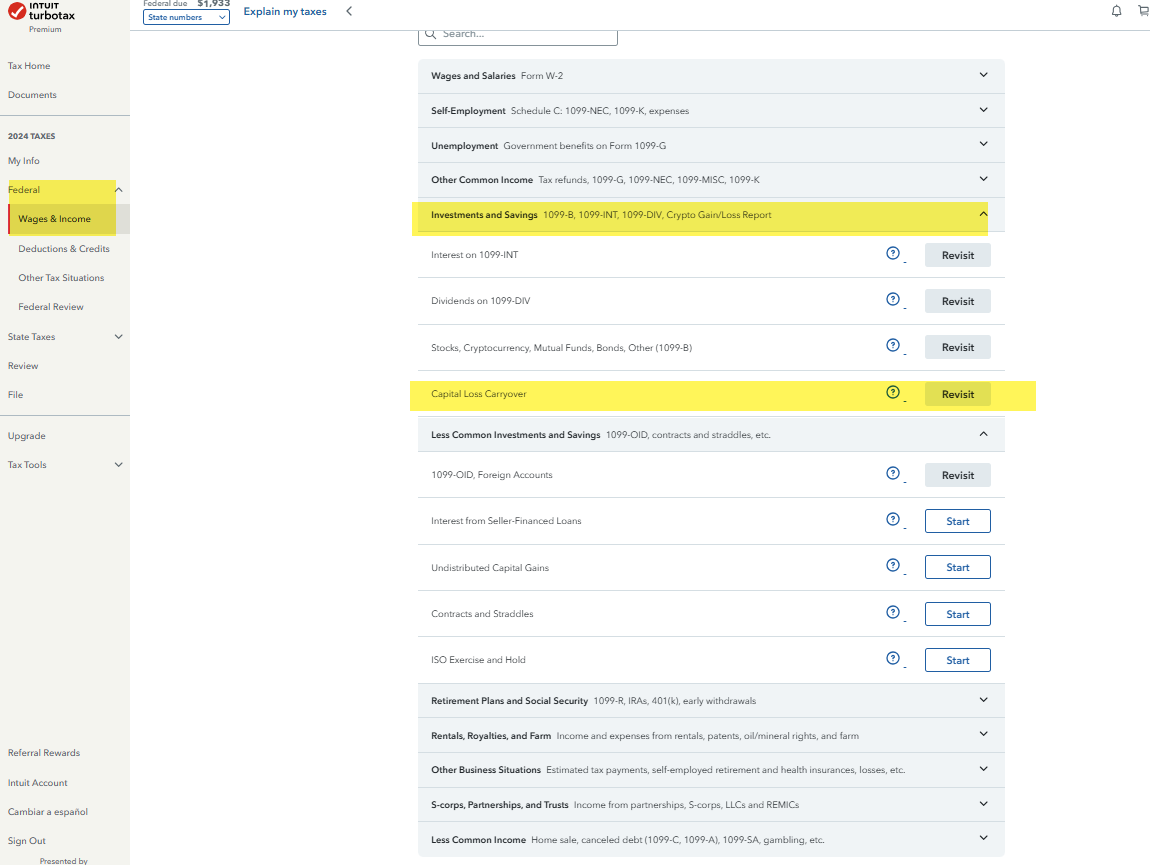

To manually enter the capital loss carryover, navigate to Federal > Wages & Income > Investments and Savings > Capital Loss Carryover > Start or Revisit. You see a summary from the 2023 tax return, choose edit to adjust.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jersian

New Member

JZiavras

New Member

MNYL

Level 3

twlincoln

New Member

EDalton

New Member