Select UPDATE for the Rental Properties and Royalties section

Select YES to review

Select EDIT for the property on the list

Select UPDATE (or START) for the Property Profile

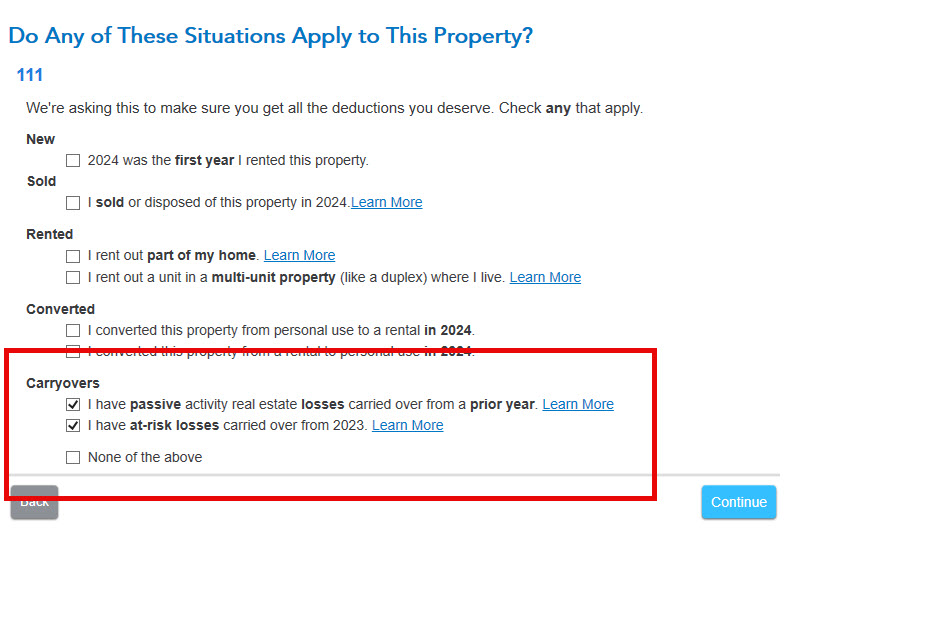

Continue through this interview until you get to the screen asking about CARRYOVERS on the "Do Any of These Situations Apply to This Property?" screen.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"