- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do i add depreciation to a rental property on schedule E I do not see any button for this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i add depreciation to a rental property on schedule E I do not see any button for this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i add depreciation to a rental property on schedule E I do not see any button for this?

You must enter it as an asset using the information from the prior year depreciation worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i add depreciation to a rental property on schedule E I do not see any button for this?

You will need a specific IRS Form 4562 from your 2019 tax return. There are two 4562's for the property and both print in landscape format. The one you will definitely need is titled, "Depreciation and Amortization Report". The other one you may or may not need is titled "Alternative Minimum Tax Depreication".

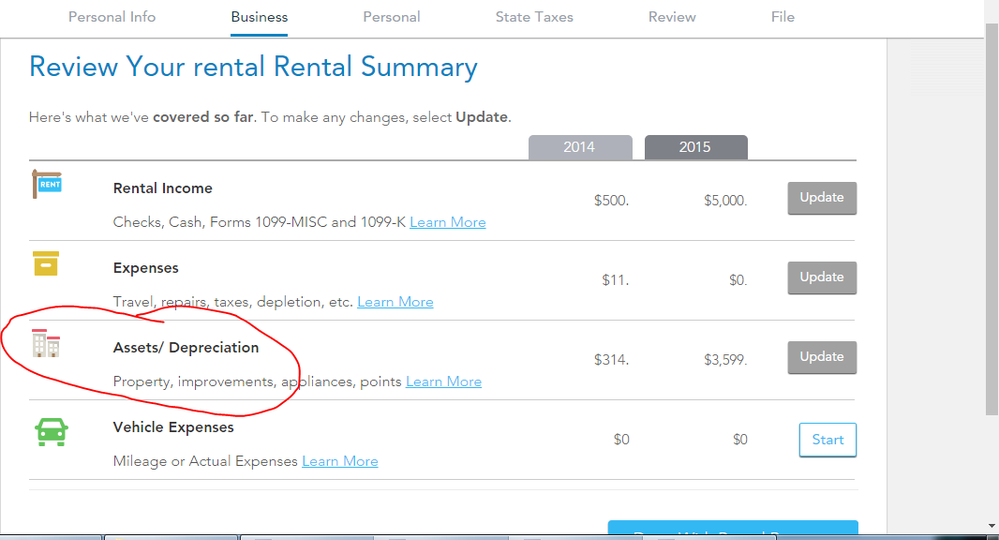

As you work this through the Assets/Depreciation section of the SCH E, make absolutely certain that everything matches up exactly when it comes to the in service dates, percentage of business use, etc.

For 2020, the total of all prior year's depreciation should equal the sum of the amounts in the "prior year depr" column and "current year depr" column on the 2019 form 4562. All other columns on the 2019 4562 should match exactly the same columns on the 2020 form 4562. This is assuming you did not have any changes, additions or dispositions in 2020 of any of the assets listed on the 2019 form 4562.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alincicum

New Member

mbin

New Member

Shawn B1

Returning Member

s d l

Level 2

bradnasis

New Member