- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How can I change the cost basis entered incorrectly for a rental property sold? I know the correct value, but cannot find a way to change what is there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change the cost basis entered incorrectly for a rental property sold? I know the correct value, but cannot find a way to change what is there.

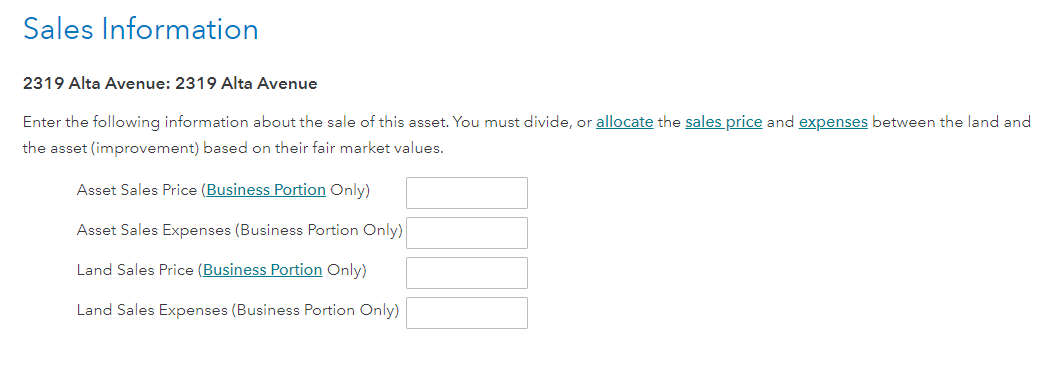

The question I made was about recording the rental property section not business equipment. I owned my house for 14 years but lived in it the first 4 yrs and rented it out til sold. So am I breaking that into a percentage when it asks for business portion only under asset price expenses and land and land expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change the cost basis entered incorrectly for a rental property sold? I know the correct value, but cannot find a way to change what is there.

You lived in the rental property for four years and then converted the property to rental property. The property remained rental property until it was sold.

When the property was converted to rental property, you converted the property from 100% personal use to 100% rental property use. Is that correct?

If 100% of the property was used as rental property, then ignore the statements in parentheses on the screen Sales Information.

Enter the Asset Sales Price, Asset Sales Expense, Land Sales Price and Land Sales Expense without reducing the numbers by some percentage.

In some cases, real property may have a business component and a personal use component. This might happen if you own a duplex where you live in one side and rent out the other side. If you paid $100,000 for the duplex and 75% of the square footage was rental property, the business portion of the property would be $100,000 X 75% equals $75,000.

Also click on the hyperlinks Business Portion on the screen Sales Information for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change the cost basis entered incorrectly for a rental property sold? I know the correct value, but cannot find a way to change what is there.

Hi thank you that’s very helpful.Also is that the only place that the sale is recorded in? I read some posts that said you had to enter as a business property sale? Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I change the cost basis entered incorrectly for a rental property sold? I know the correct value, but cannot find a way to change what is there.

Yes. A rental house sale will generate the business property sales information from the screen above that JamesG shows. There is no extra place to enter the form. Be sure to review your tax return and locate 4797 to be sure your entries are coming out as expected.

See About Form 4797, Sales of Business Property

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eric6688

Level 2

sbsvwa

Level 3

dpa500

Level 2

SB2013

Level 2

dibbeena1

Level 2