- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You lived in the rental property for four years and then converted the property to rental property. The property remained rental property until it was sold.

When the property was converted to rental property, you converted the property from 100% personal use to 100% rental property use. Is that correct?

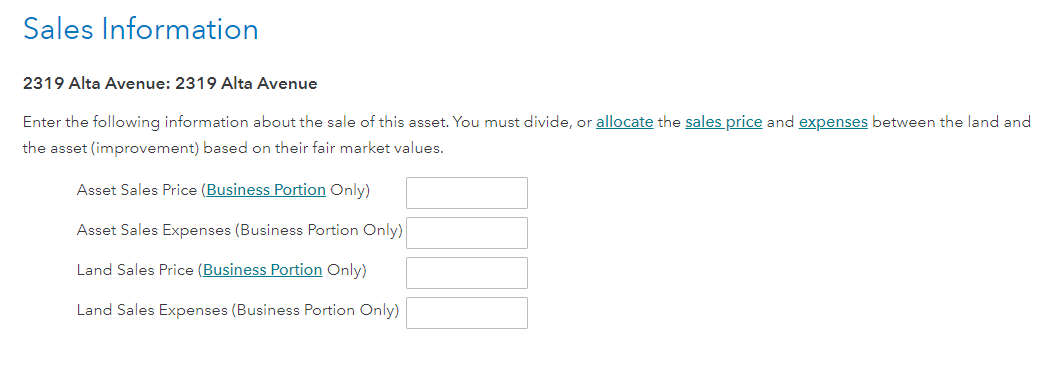

If 100% of the property was used as rental property, then ignore the statements in parentheses on the screen Sales Information.

Enter the Asset Sales Price, Asset Sales Expense, Land Sales Price and Land Sales Expense without reducing the numbers by some percentage.

In some cases, real property may have a business component and a personal use component. This might happen if you own a duplex where you live in one side and rent out the other side. If you paid $100,000 for the duplex and 75% of the square footage was rental property, the business portion of the property would be $100,000 X 75% equals $75,000.

Also click on the hyperlinks Business Portion on the screen Sales Information for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"