- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How can I access IRS form 8949?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I access IRS form 8949?

Can I access IRS form 8949 through TurboTax, or do I have to mail in my return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I access IRS form 8949?

What do you mean by "access Form 8949?" Please explain more about what you need to do.

Are you asking how to navigate to the interview topic to report capital gains/losses and sales of stocks, bonds, mutual funds, etc.? When you enter those items, TurboTax fills out a Form 8949 and Schedule D in the background. Do you have a 1099-B you need to report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I access IRS form 8949?

Typically, you will answer questions from the interview about capital assets, like stocks, and Form 8949 will be automatically generated in the background.

But if you want to view or edit Form 8949 directly, switch from the interview mode to forms view. If Form 8949 has been generated, it will appear in the list. If not, you can use open form to show a new copy of Form 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I access IRS form 8949?

i got a 1099B with no cost basis or gain/loss due to a merger-- must I report that 1099b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I access IRS form 8949?

An IRS form 1099-B that has been generated has also been reported to the IRS. Include the IRS form 1099-B in your tax return or have the issuer correct the form that has been issued.

You are able to correct an IRS form 1099-B in TurboTax Desktop by following these steps.

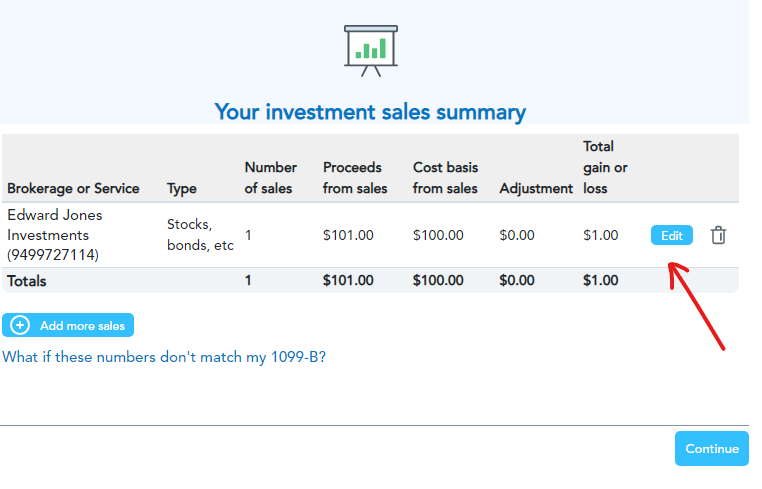

Select Edit at the screen Your investment sales summary.

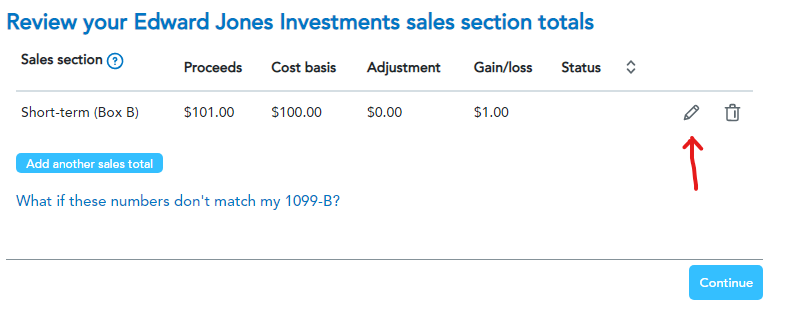

Click on the pencil to view the fields that may be corrected on the IRS form 1099-B.

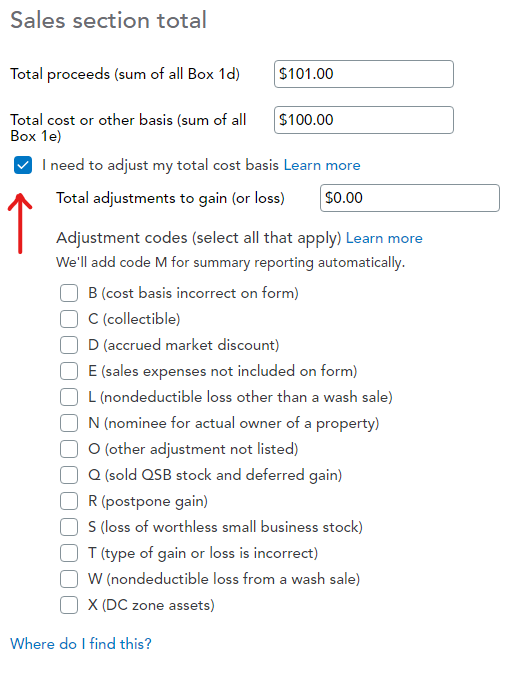

Review and select the Adjustment codes that apply.

@gjk1gjk1 [Edited 02/19/24 | 8:11 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17548719818

Level 2

Newby1116

Returning Member

user17524628611

New Member

MeeshkaDiane

Level 2

sebastiengrrr

New Member