- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

If this is not your business, then it is investment income property.

To enter royalty income so it is not self-employed income, follow these instructions:

1. With your return open in TurboTax, type royalty income in the search bar and click search.

2. Click on Jump to royalty income.

3. On the Income from Rentals or Royalty Property You Own, answer Yes

4. On the next screen, check None of the above.

5. On the Is This a Rental Property or Royalty? screen, check Royalty property or payment. Enter the information.

6. On the next screen, answer Yes.

7. On the What Type of Royalty Income? screen, click on Other Intangible (Patents, copyrights) or other applicable category.

8. Continue answering the onscreen interview until complete.

See the screenshots below.

- Investment income from property you own is for natural resources extracted from your property by a third party who leases your property. It also includes royalties from intellectual property if you didn't create the intellectual property yourself. This will go on Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

If this is not your business, then it is investment income property.

To enter royalty income so it is not self-employed income, follow these instructions:

1. With your return open in TurboTax, type royalty income in the search bar and click search.

2. Click on Jump to royalty income.

3. On the Income from Rentals or Royalty Property You Own, answer Yes

4. On the next screen, check None of the above.

5. On the Is This a Rental Property or Royalty? screen, check Royalty property or payment. Enter the information.

6. On the next screen, answer Yes.

7. On the What Type of Royalty Income? screen, click on Other Intangible (Patents, copyrights) or other applicable category.

8. Continue answering the onscreen interview until complete.

See the screenshots below.

- Investment income from property you own is for natural resources extracted from your property by a third party who leases your property. It also includes royalties from intellectual property if you didn't create the intellectual property yourself. This will go on Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

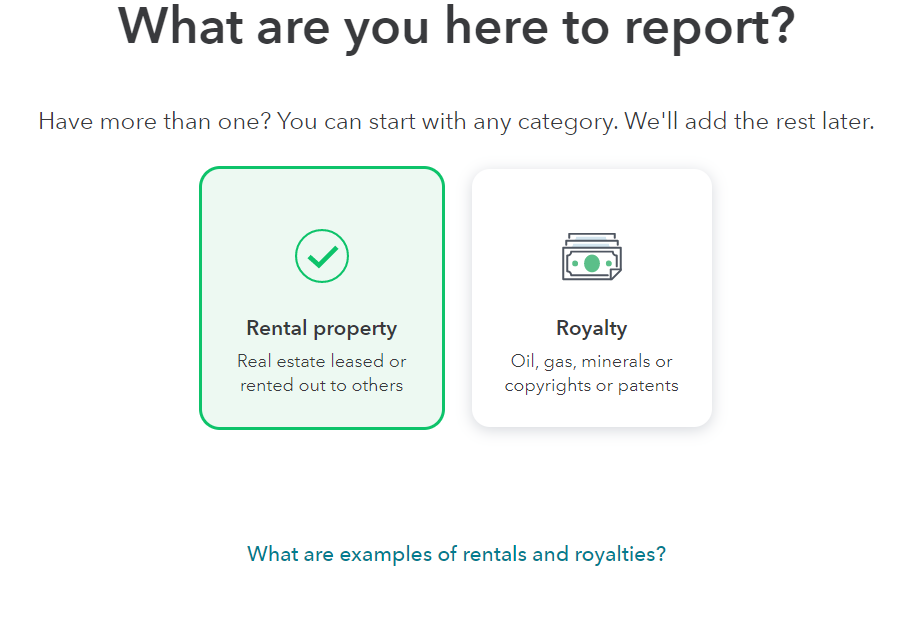

I can't find the option in No. 4, there are only 2 options below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Have misc. income from a royalty trust and it is asking if this is income from a property or from a business I own. Don't own either. What to do?

If you are trying to report Royalty income, then select the Royalty option shown in your screenshot.

Also see the following information for additional guidance:

Your royalty income will be reported in the Rental Properties and Royalties section of TurboTax and then will be shown on Schedule E as part of your return.

Use the following steps to go directly to that section of your return:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “royalties” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to royalties”

- Click on the blue “Jump to royalties” link

Answer Yes that you need to report rental or royalty income and then skip the first question or so because they will pertain to rental properties and not royalties. You will come to a screen titled, “Is This a Rental Property or Royalty?” where you can choose Royalty. You will need to enter a short description for the type of royalty and include an address for the royalty. Use your own address or the address of the property generating the royalty (such as when a property is generating a royalty). Continue moving forward until you get to a summary page for the royalty. Here you can select Start or Update beside Royalty Income to enter the income amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gborn

Level 2

andredreed50

New Member

justine626

Level 1

dibbeena1

Level 2

NYtoFL

Returning Member