- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

Furniture and appliances were depreciated as was the rental property itself.

1) Would the depreciable cost basis of the furniture and appliances get added back into the calculation of adjusted cost basis as Improvements? (i.e. Purchase price/settlement costs - Depreciation + Improvements)?

2) Rental was sold for less than what it was purchased for and was sold fully furnished. Consulted with a CPA who said that "you include the cost of all that was in the rental property when sold...whatever was put in as depreciable valued gets added back in?" In reviewing my notes, I'm not entirely clear on that. Was he only referring to coming up with adjusted cost basis as in #1 above or would I ALSO add back in the depreciable cost basis of the furniture and appliances to the selling price of the property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

1) No. Furniture is not "a physical part of" the structure. Furniture is depreciated over 5 years.

Generally, I do not recommend including such items with rental property. That's because states or lower leve taxing authorities may impose a "tangible property tax" on the furniture assets for each and every year those assets are used in the business . But in your case you have to, since you provided a furnished rental. Your furniture is entered in the assets/depreciation section and gets depreciated over 5 years. If you haven't done that, then personally I would leave it alone and just report the sale of the property "as is" and press on with life.

If you want to include the furniture and you haven't been depreciating it at a business asset as required, then you need to file IRS Form 3115 with your 2020 tax return to "correct" your mistake if the furniture was placed "in service" prior to 2019. Then you "may" have to also deal with state taxes, as well as tangible property taxes you haven't paid on those assets in prior years. That's separate from the 3115. While the 3115 is included with the TTX program, there is no help or guidance provided. The 3115 is not simple by any stretch of the imagination and requires professional help.

Your cost of professional help combined with the penalties and potential back taxes you'll pay for not having depreciated and reported the furniture as required, is most likely not going to help your gain on the sale. So I'd just leave it alone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

The furniture was properly depreciated over the 5 years, so that is not an issue. Also, the property is located in a state without state taxes. I am confused because when the CPA and I were discussing the furniture, he said that "you include the cost of all that was in the rental property when sold...whatever was put in as depreciable value gets added back in?" The furniture was in the rental property when sold, so my question is: Where does it get added back in when sold?

I know that the adjusted cost basis is the purchase price plus settlement costs MINUS the total depreciable costs of everything claimed over the years to recapture all the depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

You had one purchase price that included everything, the building and all the appliances. Your appliances were fully depreciated, so they had no value. You have the choice of isolating each appliance, give it a zero basis and isolate a portion of the sales price to the appliance. I do not recommend this.

The issue of the appliances is already taken care of. They were included in the sales price. You don't need to do anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

Would the same hold true for the furniture that was included in the sale? Is it correct that you can't consider it an "improvement' to be added to the cost basis of the rental?

For future reference, what if the fully depreciated furniture were sold? How would that be accounted for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

Yes, the furniture would be a separate asset that was sold and it is not part of the rental house asset it self. The sale of the furniture would be entered into your tax return by using the steps below if they are no longer listed as an asset due to the fact they have been fully expensed on your tax returns over time. The cost basis and depreciation would be the same number.

- Open or continue your return, search (upper right) type sale of business property (use this exact phrase; copy/paste if necessary), press Enter and then select the Jump to link at the top of your search results.

- On the Any Other Property Sales? screen, make sure the first checkbox is checked and Continue to the next screen.

- The next screen, Sale of Business or Rental Property, select Yes or, if the sale has already been started you should see display Edit and Delete buttons next to the property in question.

- Select the appropriate button and follow the onscreen instructions to either edit or add the sale information and the Form 4797.

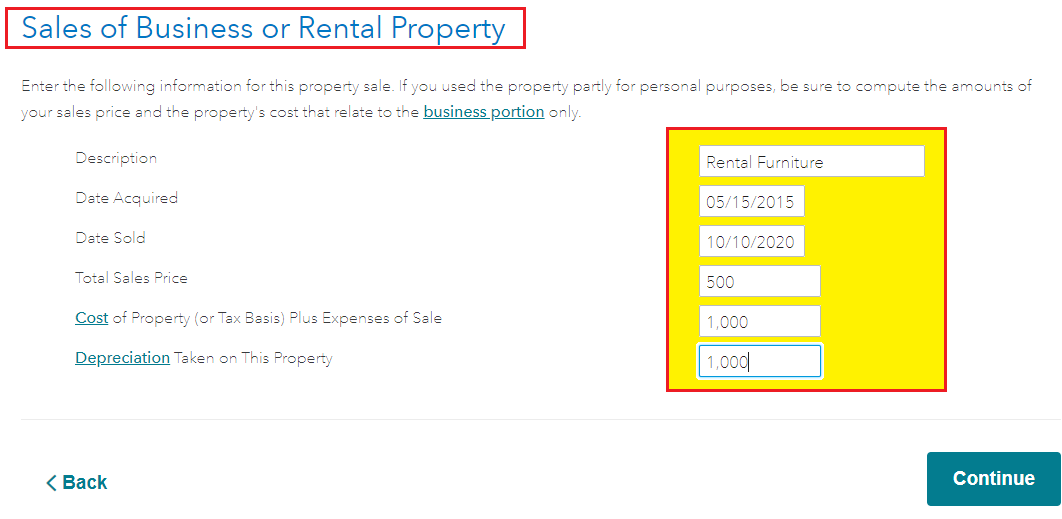

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fully furnished rental - Would furniture/appliances be considered an "improvement" for adjusted cost basis

If the furniture was sold separately from the rental, and that furniture is listed as an asset for the rental property in the SCH E section of the program, then on the SCH E you would indicate the furniture was removed for personal use.

Then the sale of the furniture would be reported separately in the "Sale of Business Property" section. Since that furniture is aleady fully depreciated, you just give it a cost basis of zero, and claim zero depreciation taken. This will result in the sale exact outcome, as if you put in the price you paid for that furniture, the amount of depreciation will be exactly the same as that price you paid for the furniture. So they basically cancel each other out giving you a cost basis of zero anyway.

On the "Any Other Property Sales?" screen select that it's the sale of Business or Rental Property.

On the "Sale of Business or Rental Property" Screen click YES

Then on the next screen also titled "Sales of Business or Rental Property" enter a description for the furniture, followed by the date you acquired the furniture. (Doesn't have to be exact)

next, the date you sold it, followed by the sales price.

For the cost of the furniture just enter a zero since it was already fully depreciated, and for depreciation taken you should enter a zero too.

On the next screen select "Property other than real estate that I took depreciation on" and continue working it through to the end.

That will take care of it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

raymond-leal60

New Member

feliciameowhiggins

New Member

marcmwall

New Member

wesaabs4

New Member