- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

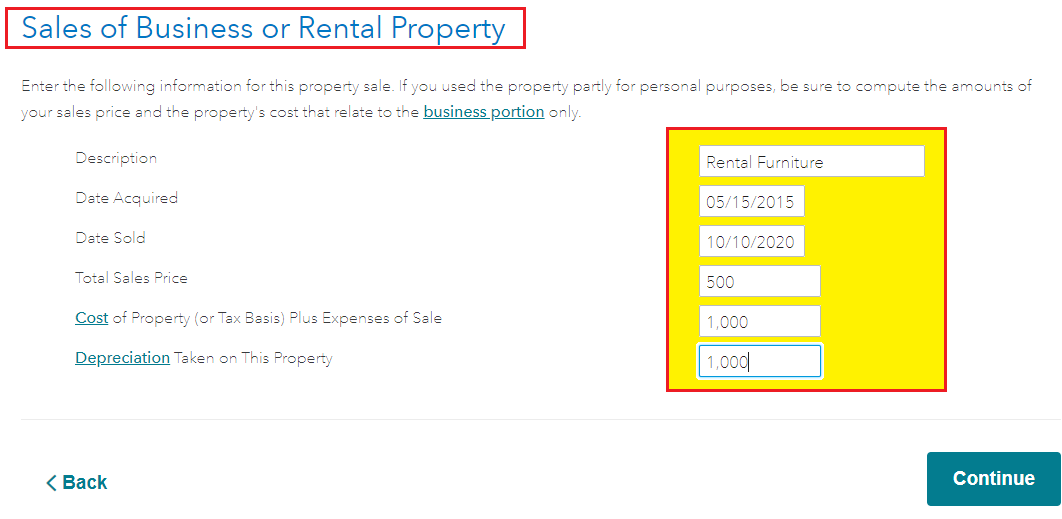

Yes, the furniture would be a separate asset that was sold and it is not part of the rental house asset it self. The sale of the furniture would be entered into your tax return by using the steps below if they are no longer listed as an asset due to the fact they have been fully expensed on your tax returns over time. The cost basis and depreciation would be the same number.

- Open or continue your return, search (upper right) type sale of business property (use this exact phrase; copy/paste if necessary), press Enter and then select the Jump to link at the top of your search results.

- On the Any Other Property Sales? screen, make sure the first checkbox is checked and Continue to the next screen.

- The next screen, Sale of Business or Rental Property, select Yes or, if the sale has already been started you should see display Edit and Delete buttons next to the property in question.

- Select the appropriate button and follow the onscreen instructions to either edit or add the sale information and the Form 4797.

- See the image below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2021

10:59 AM