- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

No, the broker commission is not deductible as a rental expense.

When you enter the sale of your rental unit, you can enter the broker commission as a selling expense. This will reduce the capital gain you may have on the sale of your rental home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Turbo tax didn't have a place for me to put the commission or other expenses for the selling of my rental property. Where do I put those?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

It depends. Instead of listing these as expenses of rental property, it is handled a little differently. Here is the menu path you will follow:

- Wages and income

- Other Business information

- Sales of Business Property>Start

- Next screen, indicate this is Sales of Business Property>yes

- Next screen will read Sales of Business or Rental Property

- In this screen, you will report real estate commissions as a Cost of Property plus expenses of sales.

In addition to reporting real estate commissions as expenses, you may also deduct other selling expenses such as::

- Advertising Expenses

- Legal Fees

- Broker Fees

- Transfer taxes

[Edited 01-24-2021|02:55 PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Am I adding this "Cost of Property plus expenses of sales" because that isn't an option. I'm surprised Turbotax didn't take me through this because that is a big expense I would be missing, along with the other expenses from selling that it isn't asking me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Sounds to me like you may not have reported the sale correctly, or more likely you simply missed it on one of the screens when working through the program to report the sale.

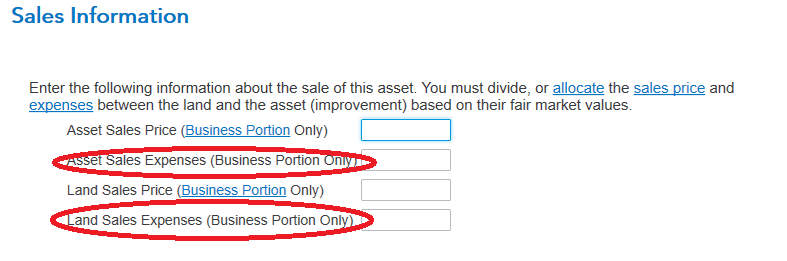

As shown in the below screenshot, you include your commissions in the sales expenses boxes. Simply divide the sales expense by the same percentages you divided the sale price between the structure and the land.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Ok I remember the boxes from your screenshot but I can't get back to them again to change them. How do I do that? I've been using Turbotax for years and this sale and entering the info is not easy and the questions do not do a very good job of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Just start from the beginning of the Rental section, select to start/update the Sale of Assets/Depreciation section and work through the asset again just as you did originally. All the selections you made originally will be there already. Just "next" through it until you get to that screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

I am using Turbotax Home and Business. I have posted the sale price and depreciation for the sale of my rental property, but nowhere does it ask for expenses such as Real Estate Commissions, Property Taxes, etc. Please advise where in the Step-by-Step does it appear?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

You add real estate commission and any other expenses relating to sales paid by you to the cost of your property

under the sale of a business or rental property.

Click on the link for more information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

Thank you for the response!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the sale of my rental property I paid a broker commission. Is it deductible as a rental property expense in the area of "commission paid to a sales person?"

No, you can not deduct the real estate commission for the sale of a rental property as a rental expense on Schedule E. You may deduct the commission as a selling expense.

Generally, these expenses can also be deducted when selling a rental house:

- Appraisal fees.

- Inspections.

- Loan origination fees.

- Title fees.

- Transfer fees.

- Mortgage interest.

- Mortgage points.

- Real estate property taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mbdarkhorse

New Member

ripepi

New Member

ir63

Level 2

mgc6288

Level 4

Donald-Palmadessa11

New Member