- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Does this answer still work? I see that it is 2 years ol...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

I purchased the house in March of 2006 for 171,500. It was my primary residence from March of '06 until I converted it to a rental in October of 2013. Since the FMV at the time of conversion of 114,000, I was required to take the lesser of FMV or purchase price for depreciation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

You are correct, there is no gain or loss. However, TurboTax is not set up very well to report this.

In most cases, the sale of Rental Property is sold in the rental section and you sell the 'asset' of the house. However, if the property was originally a personal-use property and it converted to a rental property when the Fair Market Value was less then the Cost Basis (usually the purchase price plus cost of improvements before it was a rental), it is reported in the "Sale of Business Property" section.

Go into the "asset" for the property in the Rental section, and indicate that you sold it. When you get to the screen that asks about "Special Handling", say YES. Then it will ask you to enter the date of the sale (do NOT enter the sales price).

Now figure out how much depreciation you took on the property, including the current year. It may be helpful to print out the 'Depreciation and Amortization' worksheet (you will need to pay before you print it). It is the side-ways worksheet.

Then go to "Sale of Business Property". If it was sold for less than the 'Fair Market Value when converted to a rental', you would say No, it was not sold at a gain, then on the next screen, yes it was sold at a loss.

However, in this situation there is not a gain or a loss. To property report this, we sort-of need to 'make up' the "basis". For your 'basis' you enter the total of (1) Sales Price plus (2) total depreciation plus (3) $1. Then enter the actual Sales Price and the Depreciation where it asks for them. That should give you a $1 gain and put it on the proper form (that section won't allow a $0 gain/loss).

EDIT:

Edited to add the $1 because the "Sale of Business Property" section will not allow a $0 gain/loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

Now, as to how to get TurboTax to report it correctly....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

Gain. If you have a gain on the sale, you generally must recognize the full amount of the gain. You figure the gain by subtracting your "adjusted basis" (price you paid plus improvements) from your amount realized (sale price), as described earlier.

What this means is that you only pay a gain if your sale price is more than the price you paid (not FMV at the time of conversion).

But in order to take an ordinary loss on your return, you may be excluded from doing this if the FMV was less than your adjusted basis at the time of converting your rental.

I hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

You are correct, there is no gain or loss. However, TurboTax is not set up very well to report this.

In most cases, the sale of Rental Property is sold in the rental section and you sell the 'asset' of the house. However, if the property was originally a personal-use property and it converted to a rental property when the Fair Market Value was less then the Cost Basis (usually the purchase price plus cost of improvements before it was a rental), it is reported in the "Sale of Business Property" section.

Go into the "asset" for the property in the Rental section, and indicate that you sold it. When you get to the screen that asks about "Special Handling", say YES. Then it will ask you to enter the date of the sale (do NOT enter the sales price).

Now figure out how much depreciation you took on the property, including the current year. It may be helpful to print out the 'Depreciation and Amortization' worksheet (you will need to pay before you print it). It is the side-ways worksheet.

Then go to "Sale of Business Property". If it was sold for less than the 'Fair Market Value when converted to a rental', you would say No, it was not sold at a gain, then on the next screen, yes it was sold at a loss.

However, in this situation there is not a gain or a loss. To property report this, we sort-of need to 'make up' the "basis". For your 'basis' you enter the total of (1) Sales Price plus (2) total depreciation plus (3) $1. Then enter the actual Sales Price and the Depreciation where it asks for them. That should give you a $1 gain and put it on the proper form (that section won't allow a $0 gain/loss).

EDIT:

Edited to add the $1 because the "Sale of Business Property" section will not allow a $0 gain/loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property that used to be primary residence

- Shouldn't the basis be original cost + selling expenses? Or is the goal here just to 'somehow' get a 0 value for the sale of the business property?

- And how does depreciation recapture occur under this scenario?

I'm in a similar situation where I bought a house and lived in it for awhile, started renting it out when it had gone down in value, then sold it when it had recovered to slightly under what I paid. Having deducted over 15,000 in depreciation, I was expecting to have to pay ~25% of that back because of recapture.

Am I the only one who would like TT to better handle the Sale of a Rental Property?

- shouldn't we have been asked for info on our settlement sheet, which could have flowed to deductions and basis adjustment

- there should be just 1 place to deal with sale of a rental property instead of 2

- gain, loss, or no gain/loss could all be sorted with a few simple questions

Edit: I had about 1 minute left to e-file so I did it your way. TT did allow a zero amount:

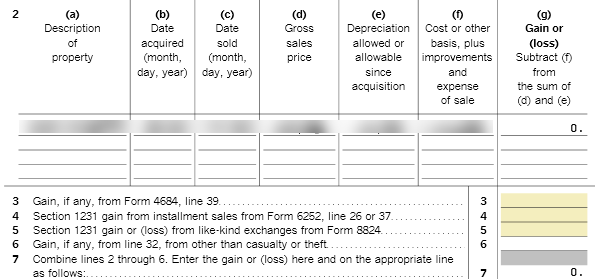

And it shows up on form 4797:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mikefranco014

New Member

hannahcastellano15

New Member

Lukas1994

Level 2

tianwaifeixian

Level 4

keriswan58

New Member