- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

- Shouldn't the basis be original cost + selling expenses? Or is the goal here just to 'somehow' get a 0 value for the sale of the business property?

- And how does depreciation recapture occur under this scenario?

I'm in a similar situation where I bought a house and lived in it for awhile, started renting it out when it had gone down in value, then sold it when it had recovered to slightly under what I paid. Having deducted over 15,000 in depreciation, I was expecting to have to pay ~25% of that back because of recapture.

Am I the only one who would like TT to better handle the Sale of a Rental Property?

- shouldn't we have been asked for info on our settlement sheet, which could have flowed to deductions and basis adjustment

- there should be just 1 place to deal with sale of a rental property instead of 2

- gain, loss, or no gain/loss could all be sorted with a few simple questions

Edit: I had about 1 minute left to e-file so I did it your way. TT did allow a zero amount:

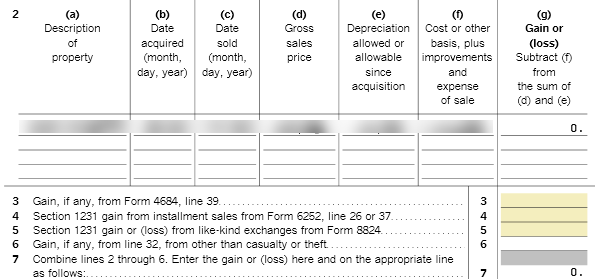

And it shows up on form 4797:

October 15, 2019

11:56 PM