- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Depreciation - Converting rental to personal use (+ home office depreciation)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

I am self-employed and have had a home office for over 8 years. Every year, I take the depreciation deduction for my home office. Between August 2021 and June 2022 we lived abroad so I rented our home, at fair market value, 100% of the time Aug 2021-June 2022. In tax year 2021, I took a depreciation deduction for renting my home (Aug-Dec). I did not take any home office deduction (incl. depreciation). For 2022, I need to stop depreciation for my rental (I returned to live in it in July 2022), and possibly re-start depreciation for my home office (July-December 2022). How can I do this correctly in TurboTax?

My rental income In 2022 after expenses is ~10,000. If I try to convert it to personal use in TT, it brings my rental net down to ~3400. Could this be right? Here is what I am doing:

-State that I converted rental to personal use on July 1, 2022

-State that I have previously used this property for personal use, that I started renting it in August 2021, and that I rented it 100% of the time during the months it was rented (should I actually say that I rented it 50% of the time since it is a Jan-June rental?)

-Checked that the prior year’s depreciation amount is correct (it is).

-Check that I need special handling due to the conversion to personal use. Right after this question, TT gives me a deduction of over $6000. This doesn't sound right to me.

After the above is corrected, I would like to resume claiming home office deduction (including depreciation) for the months of July-December 2022.What would be the best way to do this correctly in TT? Alternatively, could I wait until 2023 to start claiming home office (and depreciation) deductions? I want to make sure I do this right. Thank you very much for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Let's go back to basics. Depreciation for a rental is 27.5 year on the house, not the land.

For example: A $200,000 property with $20,000 land value leaves $180,000 to depreciate. So, $180,000 divided by 27.5 = $6545 for a year of depreciation. You would then multiply that by the percentage of days actually rented (or multiply by the number of days and divide by 365). Your math for your house should match your program.

It is zero personal days while rented. It was 100% business while rented for 50% of the year. You marked the number of rental days. For my program to give me the correct answer, I used 100 percent business under the start date.

Also, look at the actual tax forms in your return. You can look at form 4562 and see the depreciation amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Converting to personal use for 6 months could lower your rental expense. I would expect your rental income/loss to go down about 50%. Otherwise, you answered correctly, and your depreciation will stop. If you didn't allocate your Rental Expenses, you may need to do so, if your TurboTax deduction seems too high. It should probably be about the same as 2021, since you rented for half the year for that year also.

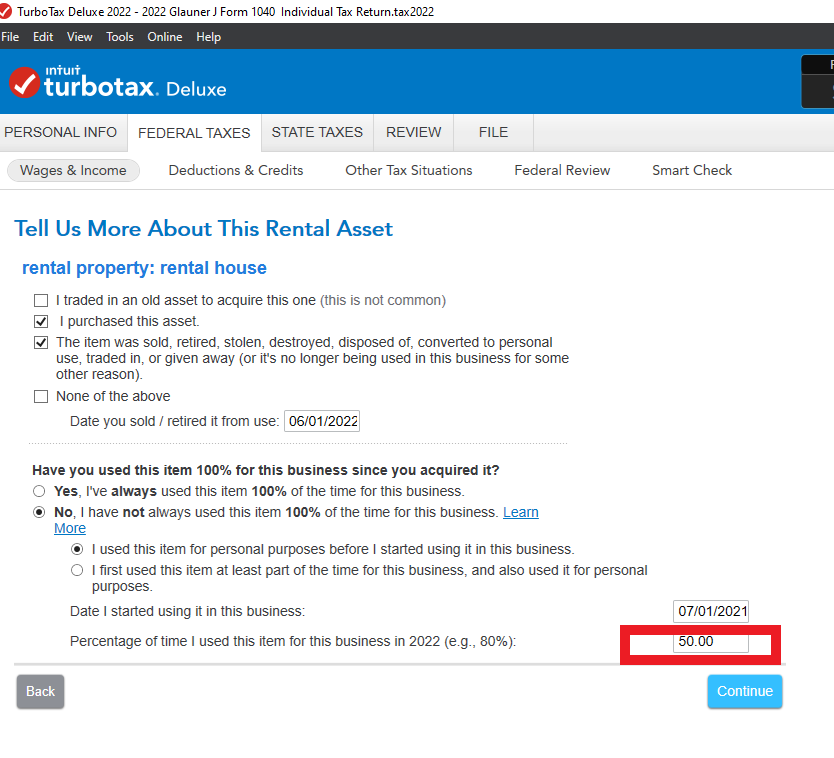

Be sure you indicated % of Business Use in 2022 (screenshot).

Since we can't see your return in this forum, I would suggest reviewing your Schedule E closely.

Yes, you could claim your Home Office Expenses for 6 months in 2022. Be sure to indicate that 100% of your Business Income for 2022 was earned from your Home Office, even if it was only used 6 months.

Here's How to Enter a Home Office Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Thank you very much for your response @MarilynG1 . I did allocate my rental expenses already. And things are making more sense.

I’d only like to double check with you on the percentage of time I rented my condo in 2022. During the 6 months I rented it, I did so 100% of the time, with no personal days. So would the percentage of time I used my rental as a business be 100% (because while renting there were no personal days) or 50% (because it was 6 months of the year)?

Thank you very much, again!

Susanna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

I think you are looking at this screen where it asked during the time you rented the property enter the rental and personal use days. You should not enter anything for your personal days if you didn't use it personally during the time it was rented.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Thank you @ThomasM125 .

No. In the description of the rental property, I did include the number of rental days (181) and the number of personal days (0) during the rental time.

I am referring to the "percentage of time I used this item for this business in 2022." (image attached) I was under the impression that the business use was 100% of the time during those 6 months of rental. Is this so?

Thank you again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Let's go back to basics. Depreciation for a rental is 27.5 year on the house, not the land.

For example: A $200,000 property with $20,000 land value leaves $180,000 to depreciate. So, $180,000 divided by 27.5 = $6545 for a year of depreciation. You would then multiply that by the percentage of days actually rented (or multiply by the number of days and divide by 365). Your math for your house should match your program.

It is zero personal days while rented. It was 100% business while rented for 50% of the year. You marked the number of rental days. For my program to give me the correct answer, I used 100 percent business under the start date.

Also, look at the actual tax forms in your return. You can look at form 4562 and see the depreciation amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Thank you for your detailed response @AmyC .

I entered that my home was dedicated 100% for the rental business, while rented 50% of the year. I am doing the math manually to double check: multiply the price of the home by 181 (days rented) and then divide by 365. The depreciation number I get is $525 more than what TurboTax gives me and shows on form 4562. Seems on the right track but a bit worried that it is not the exact same amount. Could the depreciation amount change a bit due to the date placed in/out of service or the date purchased? Can Turbotax still have this right?

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation - Converting rental to personal use (+ home office depreciation)

Yes, the convention should be the difference. Depreciation is guided by the type of property and date placed in service. The conventions are mid-month, mid-quarter, half-year so it probably won't be an exact match of your date in service. If you like details, let me give you more.

Your rental will use MACRS.

Reference:

About Publication 527, Residential Rental Property Including Rental of Vacation Homes states:

MACRS Depreciation

Most business and investment property placed in service after 1986 is depreciated using MACRS.

This section explains how to determine which MACRS depreciation system applies to your property. It also discusses other information you need to know before you can figure depreciation under MACRS. This information includes the property's:

Recovery class,

Applicable recovery period,

Convention,

Placed-in-service date,

Basis for depreciation, and

Depreciation method.

From there:

information you need to know before you can figure depreciation under MACRS. This information includes the property's:

Recovery class,

Applicable recovery period,

Convention,

Placed-in-service date,

Basis for depreciation, and

Depreciation method.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

alvin4

New Member

jack

New Member

melillojf65

New Member

iqayyum68

New Member