- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Converting to personal use for 6 months could lower your rental expense. I would expect your rental income/loss to go down about 50%. Otherwise, you answered correctly, and your depreciation will stop. If you didn't allocate your Rental Expenses, you may need to do so, if your TurboTax deduction seems too high. It should probably be about the same as 2021, since you rented for half the year for that year also.

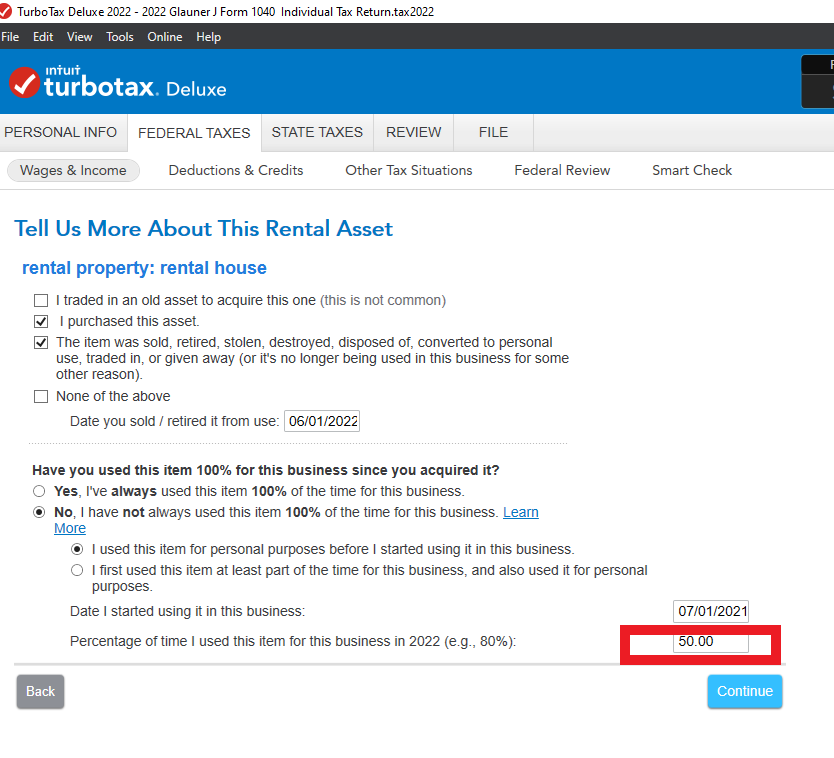

Be sure you indicated % of Business Use in 2022 (screenshot).

Since we can't see your return in this forum, I would suggest reviewing your Schedule E closely.

Yes, you could claim your Home Office Expenses for 6 months in 2022. Be sure to indicate that 100% of your Business Income for 2022 was earned from your Home Office, even if it was only used 6 months.

Here's How to Enter a Home Office Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"