- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

I'm using 2024 Turbo Tax Premier desktop version. I've entered my vacation rental property income and expenses and the result is a loss. Schedule E has the following information:

Sch. E line 21: - $14,928 this is a loss

Sch. E line 22: $0 (this is correct since the income is greater than $150,000)

Sch, E line 25: $0 (the decription for this line specfies that lines 21 & 22 are added together.

2 questions:

(1) Why is line 25 $0 when it should be -$14,928, the sum of lines 21 & 22?

(2) On the Federal carry over sheet the carry over from 2023 is not increased by $14,928 in the 2024 column. I would expect the 2024 column to show an increase of $14,928 from 2023. Why isn't the carry over increased?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

I'm adding more info in the event it provides additional insight. From what I have been able to find on my own, when a taxpayer's (married filing joint) income exceeds $150,000, losses from a rental property can not be claimed in that year. Instead they are carried forward to next year's taxes. And they never expire until the property is sold, applying them against any gains at that time. I am not seeing this loss being added to the previous year's losses. I say this because the carry over worksheet is showing the same carry over figure for both the prior year column (in my case 2023) and the current year carry over column (in my case 2024).

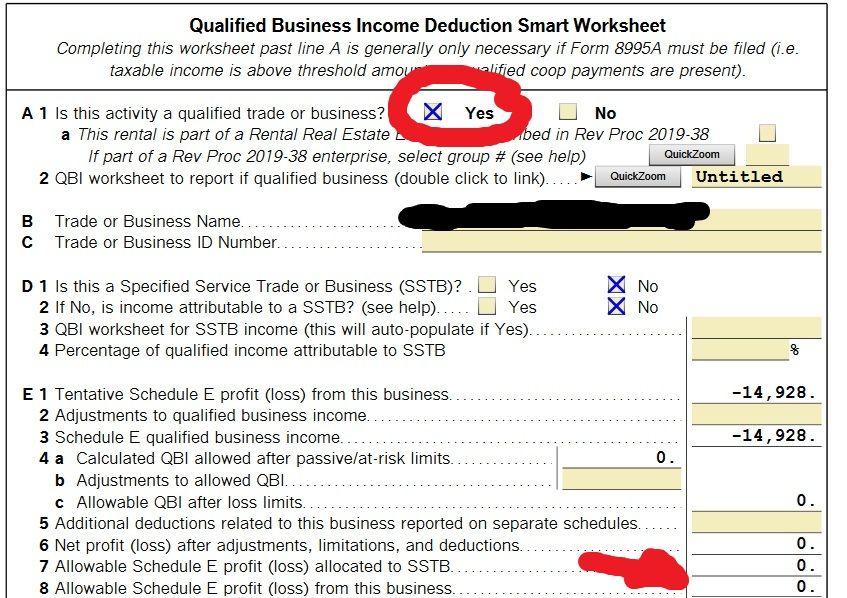

I've tried sever things, most I can not recall. I did go back through the rental income section going through all the questions again and still no change in the loss showing up in the carry over worksheet. One thing I did do that worked, but I'm not sure it is the correct way to address this, is I overroad line E8 in the QBI Income Smart Worksheet putting in the loss figure from schedule E. This is a qualified business since it is a short term vaction rental and I am interacting regularly with all our guests. With this override, the carry over worksheet is now adding to the carry over the loss for this year.

It seem very odd to me that TT would not automatically add the loss to the carry over worksheet. Or perhaps I've done something else incorrectly? Any insight on this and the correct way to address this would be greatly appreciated.

The figure in red in the images below is the override I added. Prior to me adding the override line E8 was blank as well as E1 and E3 were also blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

Go back to the information that you entered for the property and make certain that you checked the box for 'actively participating' so that the loss is carried forward properly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

Thank you for the reply!

Yes, the active participant box was already checked. But still not seeing this year's loss added to the prior year losses in the carry over worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

In the rental property section, did you go through the entire section and answer the QBI questions at the end? Overriding entries prevents e-file and voids the accuracy guarantee, so you should undo the override. Go back through the rental property income and expense - all the way to the end and review your entries along the way. Do you have any personal use days entered?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

Appreciate your response DawnC. I'm still perplexed on this. I have gone thru the question in the rental prop section to the end several times. I have even started over and reentered all the property info so to see if creating a 'new' would have any affect on seeing the carry over is increased by the passive loss. But no luck the carry over from 2023 stays the same for 2024.

I think the images below will show you the responses I have entered to the questions asked in the Rental section of TT. In the first image you will see personal days equal zero, 'active participation selected. In the next 2 images I show the difference I see in the Sch E worksheet when I answer yes or no to the QBI question. No matter how I respond to the active participation or the QBI question, the carry over is not changing.

I'm not able to think of a reason why my passive loss for this year is not being added to carry over. Appreciate your continued review of the difficulty I am having.

RENTAL PROP QUESTION RESPONSES

QBI RESPONSE - YES note: line E8 is zero, should this be the same as the value on E3?

QBI RESPONSE - NO I would think Line E1 would be the loss from Schedule E, and line E3 to be zero since QBI response is NO. Could this be indication of the problem I'm having?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

@dom416 wrote:

Sch, E line 25: $0 (the decription for this line specfies that lines 21 & 22 are added together.

(1) Why is line 25 $0 when it should be -$14,928, the sum of lines 21 & 22?

(2) On the Federal carry over sheet the carry over from 2023 is not increased by $14,928 in the 2024 column. I would expect the 2024 column to show an increase of $14,928 from 2023. Why isn't the carry over increased?

Re-read the description for line 25.

Is the loss showing up on Form 8582? Does 8582 show the 2023 loss?

In 2023, did you enter any personal days?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

Hello AmeliesUncle. Thank you for reviewing my use of TurboTax and carry over of passive loss. To answer your questions. I put my responses in all caps.

Is the loss showing up on Form 8582? YES, I SEE THE 2024 LOSS ON FORM 8582 PART 1 LINE 1B

Does 8582 show the 2023 loss? YES, FORM 8582 PART 1 LINE 1C SHOWS THE LOSS FROM 2023

In 2023, did you enter any personal days? 2023 PERSONAL DAYS ARE ZERO (0)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

It sounds like it is showing up correctly on the tax return.

As for why it isn't showing up on the carryover worksheet you are looking at, I don't know. Because it seems to be showing it up correctly on the 8582, I would just forget about the worksheet for now, but make yourself a note for next year to check if the correct carryover is going to your 2025 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

Thank you for the reply. Although, something still does not seem correct to me. In years past and as recent as tax year 2023, form 8995 would also show the loss on line 1i column c. It would also show the same loss on form 8995 line 2. But for 2024 tax year form 8995 line 1i column c is zero (0) and line 2 is zero (0). This seems incorrect to me. The rental is considered QBI because it is a vacation rental where I have interaction with many tenants who rent short term.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Current year (2024) vacation rental loss not being added to prior year (2023) loss carry over

I wonder if that worksheet you are looking at might be showing carryover of QBI, rather than the actual loss itself (passive loss).

As for why your 8995, zero might be correct. I always need to look it up, but if I remember correctly, the 8995 losses are suspended if the loss itself (the passive loss) is suspended. The carryover would be on some other worksheet. But as I said, it has been a while since I've looked that up, so I may be misremembering part of it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

erwinturner

New Member

profgg

New Member

Amelia60

New Member

mike-koontz

New Member

mikerob4

New Member