- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Capital Gains Entry Giving Smart Check Error for Cents

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Getting a similar error here as of 02/04, the 1099-B I uploaded from TD is rounding each individual transaction, creating an under-reported value relative to the 1099-B final gain/loss. I am hearing that this is a problem with TT 2020, that did not occur in TT 2019.

Anybody hear any other news on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

As of 2/8/2021 it is still not resolved by the latest update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

2/09/2020. Same problem "348 errors".

Please, when can we expect an update to fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

The 1099B rounding issue remains a problem in TT2020 Premier. I've even gone through the process of deleting my return completely and starting from scratch creating a new file.

When I import my transactions, they appear fine, but when reviewing the detail, each individual transaction is rounded so that the total does NOT match my 1099B. This results in extra tax due where it shouldn't be and this experience is DIFFERENT than how it was handled in TT2019 and earlier editions.

>> Intuit, could you please issue a response about this new "feature" in TT2020 and what you plan to do?

This is resulting in extra tax and prevents TurboTax from providing me with the "maximum refund, guaranteed" as stated on turbotax.com. I hope that the powers that be fix this soon as my patience is wearing thin and I'm about to switch to another service despite being a 20+ year customer of Intuit.

PLEASE HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

There is still an issue with the error check on Schedule-D worksheet for 1099-B on the special adjustments. It will not allow the customer to uncheck the box and continues to show error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Using Premier Desktop version, updated today (Feb 10) with latest fixes, I imported from Merrill Lynch/Merrill Edge & everything seemed to go fine until TT checked the federal & found 82 errors in cells that TT said needed to be blank. I used the advice from one of the posters above & went through those 82 cells one by one, rounding off the cents to dollars. What a pain! But it worked for me, since TT found zero errors after I rounded off the cents. This bug did not happen to me in previous years, using uploads from Merrill each year, so this is a bug that TT really needs to fix asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Another option, type in 4 lines manually. Each line is the total for that type of transaction. The IRS has the same brokerage statement and totals.

Enter the totals for each:

- short term covered

- short term non-covered

- long term covered

- long term non-covered

The IRS requires rounded numbers on the tax form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Updates were received and applied. No errors reported now. Thank you TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Click on “override” under edit to make changes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

So glad I saw your post. Its my first time having Capital Gains and I had this happen to me today. I'm not using the cd though, I'm using the web version. Do you know if I'm able to see the forms somewhere and correct them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

In reply to scorpslvr's question;

I'm sorry, I have never used web version and do not know how to navigate through it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

If you are unable to navigate through the web version, you might consider upgrading to TurboTax Live or Full Service.

See https://turbotax.intuit.com/personal-taxes/online/live/overview/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

Turbo tax was updated this morning but still as of today Feb 15 Feb. 2020 midnight ET, Turbo Tax home & Business 2020 gives error when wash sale adjustment amount is less than 50 cents and it rounds down to 0 dollar. Has any one got any solution so far?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

I'm also having this issue online. I have tried to clear the line item, rounding up, and re-loading the documents (Betterment) with no luck. The program will not let me file.

This was not an issue last year.

Turbotax??????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Entry Giving Smart Check Error for Cents

To correct the wash sale import,

...if you are in TurboTax Online, the way to adjust the error in TurboTax Online is to return to the original entry. There is no way to adjust the wash sale at the Review.

To return to the Investment Section, leave the Review by following these steps:

- Click Federal from the left menu.

- Scroll down to Stocks, Mutual Funds, Bonds, Other and Review.

- Click the Review button by the stocks that need correction.

- Click the pencil icon next to the stock transaction at Review your sales.

- Continue through the next screens until you again are at Review your sales and reach Now we'll walk you through entering your sale details. Scroll down and check the box for I have more info to enter that I don't see here.

- When testing this, I was able to enter amounts less than $1 in this area.

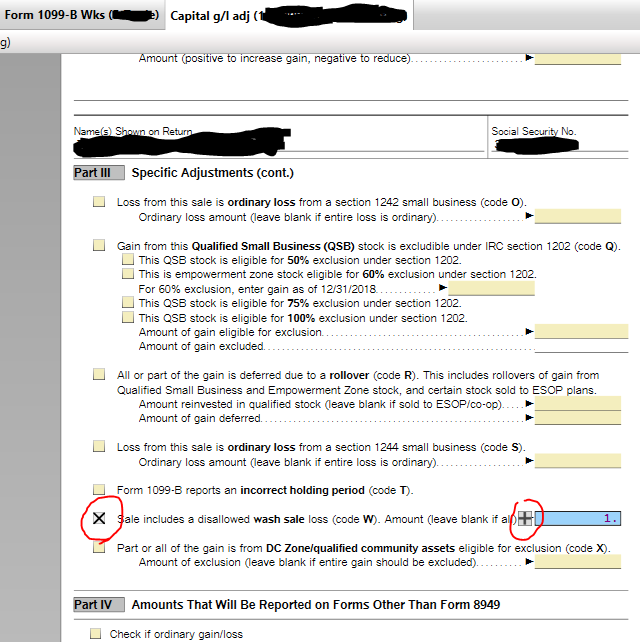

...if you are in TurboTax CD/Download, before correcting the Wash Sale, try using the "Capital g/l adj" page. instead.

To find this form, follow these steps:

- From the Forms Mode, click Open Form.

- In the Search box, enter Capital gn.

- Under Form 1099-B Worksheet, select Capital gn(ls) adjustments/other info and Open Form.

- A new window will open: Step 1: Add Capital gn (ls) adjustments/other info. Scroll to find the sheet for Capital g/l adj and select Next and Finish.

- In Part III Specific Adjustments, scroll down and check the box next to Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

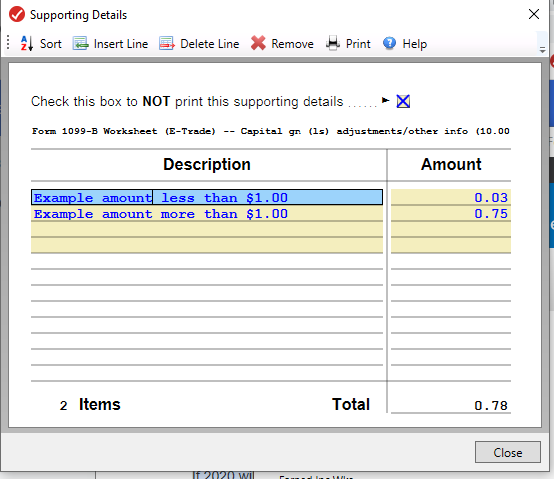

- Click on the box where an amount should be. Then, a + will occur to the left.

- Click on the + Icon to open up the Description and Amount Worksheet and list your amounts here with the pennies.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxgirlmo

Returning Member

jaykayjay

Level 1

awolfgang0519

Level 2

alexjtapia

New Member

Britania

Level 2