- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Use Form 6781 only for futures contracts, options on futures, or FOREX currency that you have elected to treat under section 1256. Even then you are not a Professional , so you would not check any boxes except perhaps D if that applies. You don't want that one to be applicable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

what tax document do you have?

consolidated 1099-B? or substitute 1099-B for Futures and FOREX?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

since you mentioned " no stock" I guess you are trading stock options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Its consolidated 1099.. doesn't say B, not for Futures or Forex.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Yes these were stock options trade using strangles, straddles and vertical spreads.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Sorry FanFare, it does say 1099-B. thx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

you are not a professional engaged in hedging operations.

your option trades are covered transactions.

I recommend the summary reporting option since covered transactions do not require Form 8949. No mailing is necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

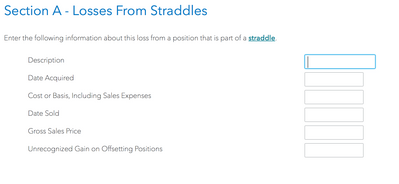

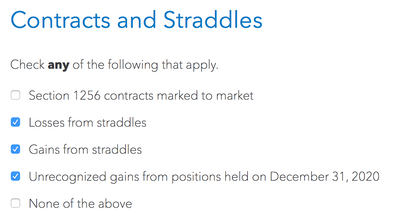

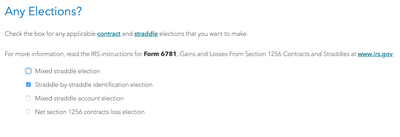

Thanks Fanfare, but should i select Straddles on turbo tax? and what i need to elect after that? See my possible elections in attached pictures. See following Qs:

1. As per IRS form 6781, the selections i make this year will be permanent (can only be changed after contacting IRS). So i need to be sure what i am electing based on my trading style.

2. If i have imported my 1099-B in the tax software here, which includes all trades, why i should go and fill out the straddles again?

3. N what if i may have some missing or unaccounted trades in my form 1099-B. I bought and sold Puts as well, but the form 1099-B only marks trades as Calls (difficult to decipher, trying to figure this out with broker)

4. For year 2021 I am currently trading Cash Covered Puts and Covered Calls. How the elections i will make today will affect my tax filing next year?

Please let me know as much as possible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Actually the 3rd election is 4th (last election to start entering data).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

As I tried to explain, perhaps not too clearly, you don't file Form 6781.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

Use Form 6781 only for futures contracts, options on futures, or FOREX currency that you have elected to treat under section 1256. Even then you are not a Professional , so you would not check any boxes except perhaps D if that applies. You don't want that one to be applicable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

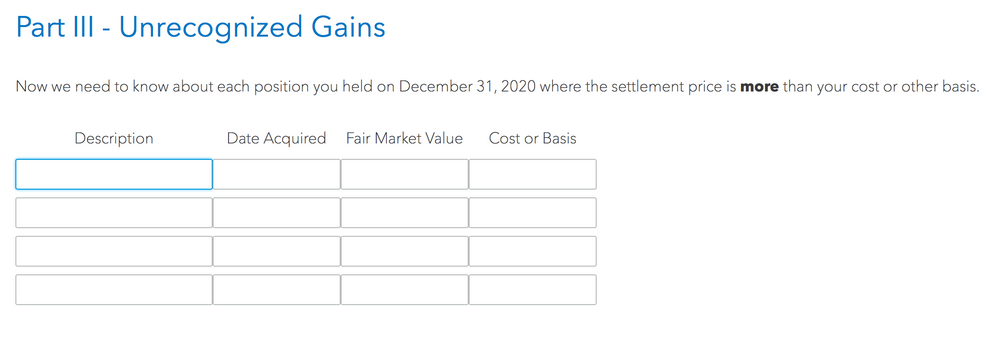

Hi Fanfare, you mean "Unrecognized gains from positions held on December 31st 2020"??, Yes i have 1 Vertical Call Spread on options, which i sold in 2021 (so i will need to fill in this table, see picture) and select no other elections?? basically skipping all the steps i mentioned earlier in pictures. Right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can some explain me how i can input my multi-leg options trading positions, which i bought and sold within short time? All trades were opened and closed within same time.

As I tried to explain, perhaps not at all clearly, you don't file Form 6781.

Instead, file Schedule D.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

faulknerj32

New Member

johntheretiree

Level 2

skenyonjr

New Member

user17524196967

Level 1

hornbergermichael555

New Member