- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

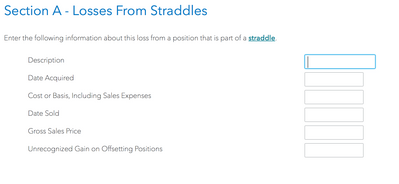

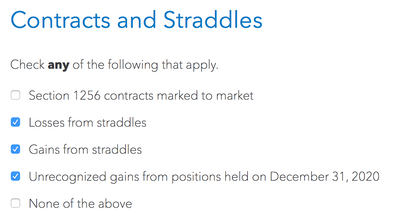

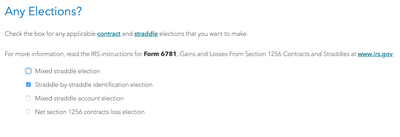

Thanks Fanfare, but should i select Straddles on turbo tax? and what i need to elect after that? See my possible elections in attached pictures. See following Qs:

1. As per IRS form 6781, the selections i make this year will be permanent (can only be changed after contacting IRS). So i need to be sure what i am electing based on my trading style.

2. If i have imported my 1099-B in the tax software here, which includes all trades, why i should go and fill out the straddles again?

3. N what if i may have some missing or unaccounted trades in my form 1099-B. I bought and sold Puts as well, but the form 1099-B only marks trades as Calls (difficult to decipher, trying to figure this out with broker)

4. For year 2021 I am currently trading Cash Covered Puts and Covered Calls. How the elections i will make today will affect my tax filing next year?

Please let me know as much as possible.