- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

Hi,

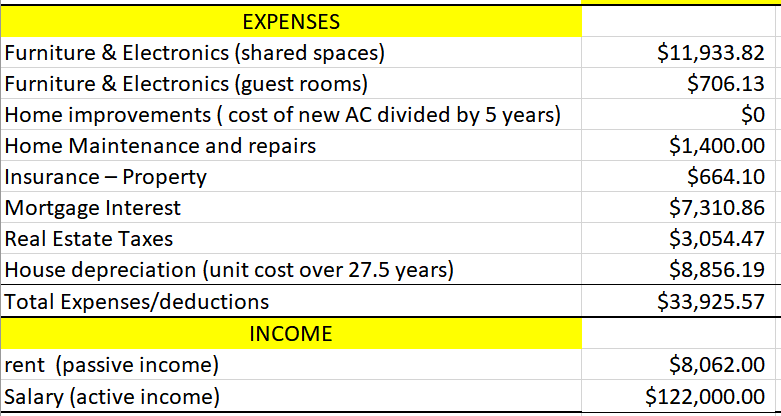

I am running super late with my 2018 tax return (yes 2018, I was too busy for it). I bought a house in Florida, and I rent part of it while living on the other part. I have my active income, rental income, and expenses. I was thinking to use the De minimis Safe Harbor so I can offset all the rental income and not have to pay anything to IRS (plus 2 years of interest + fees for being late). I would not go for Section 179 cause I do not know if I will rent in the next years, so I am afraid I will have to pay recapture. Since my furniture expenses+repairs are ~14k (each item is less than $2500), the De minimis have a 10k maximum requirement. I read the IRS guidelines but I am not sure I understand. My questions are:

1) Can I still deduct the remaining 4k? And how?

2) Please also confirm De minimis is a better choice than Section 179, and that bonus depreciation is not the way to go here in Florida. And that there is no other option (standard deduction for everything?)

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

There is no standard deduction for rental expenses, so that does not apply here.

For your other expenses, you can only deduct the costs for the areas that are for the exclusive use of the tenant(s) (e.g. bedrooms & bathrooms). You only depreciate the percentage of the house that is used exclusively by the tenant(s). Same for insurance, taxes, interest, etc. Based on your spreadsheet it looks like you may be wanting to deduct 100% of these costs. You cannot deduct furniture and electronics for shared spaces.

As for taking Section 179, if you don't have net income from your rental, you won't be able to take the expense, and it will carry forward.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

Yes I am aware that I am renting part of the house. The non-shared (exclusive) part of the house is 75% of the total footage. I am still confused. Questions:

1) i found online that "you are eligible for Safe Harbor only if the total amount paid during the year for repairs, maintenance, improvements, and similar expenses for a building does not exceed the lesser of $10,000 and 2% of the unadjusted basis of the building". The basis of my home is about 240k, so my expenses etc goes over $4800 (2% of 240k). Does it mean I can deduct $4800 of expenses, furniture etc, or that I cannot take advantage of the De minimis at all?

2) If I can deduct $4800 as I just said above, I see online that I can offset my active income if I claim active participation in the rental activity (I am active, and I can offset up to the minimum between 25k and 50% of 150k-MAGI, which in my case is about 15k). Can I offset my income in any way once I claim the de-minimis for 4.8k? Or is the rest just carried over?

3) Can i deduct 75% of the furniture expensive in the shared part of the house, or can I deduct only 100% of the furniture in the exclusive guest rooms?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

The de minimis election allows you to expense certain items that would normally be capitalized. Here are the responses to the questions you pose in your first and second postings:

Can I still deduct the remaining 4k? And how?

- For the items that are above the $10,000 total you can treat as depreciable assets.

De minimis is a better choice than Section 179

- Using the De minimis election you are taking a one-time expense for the item and that's it. You don't have to worry about recapture.

1) Does it mean I can deduct $4800 of expenses, furniture etc, or that I cannot take advantage of the De minimis at all?

- The total amount paid during the taxable year for repairs, maintenance, improvements, or similar activities performed on such building property doesn't exceed the lesser of --

--Two percent of the unadjusted basis of the eligible building property; or

--$10,000

2) I'm not sure what you mean by "I can offset my active income if I claim active participation in the rental activity"

- If you show a loss on the property, if you "actively participate" in the rental property you can deduct up to $25,000 of the loss.

3) Can i deduct 75% of the furniture expensive in the shared part of the house, or can I deduct only 100% of the furniture in the exclusive guest rooms?

- To stay on the good side of the IRS, deduct 100% of the furniture in the exclusively rented area.

A very good resource for the De Minimis election is the IRS Tangible Property Regulations - Frequently Asked Questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

Thank you,

as a last thing, do I need to itemize (provide a list with name and cost) of the items for the de Minimis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I mix De minimis Safe harbor with standard deduction (and not sure what standard deductions are)

You want to have a list of each item and the records to support that entry. For years before 2020, the IRS did not specify contemporaneous records. After 2020 the rule below applies: You always want to have records to prove that you are entitled to any deductions or safe harbor that you take.

IRS Real Estate Safe Harbor

- The taxpayer maintains contemporaneous records, including time reports, logs, or similar documents, regarding the following: hours of all services performed; description of all services performed; dates on which such services were performed; and who performed the services.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nickzhm

New Member

dalibella

Level 3

Vivieneab

New Member

teewilly1962

New Member

jwicklin

Level 1