- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- CA NR tax return 2024

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA NR tax return 2024

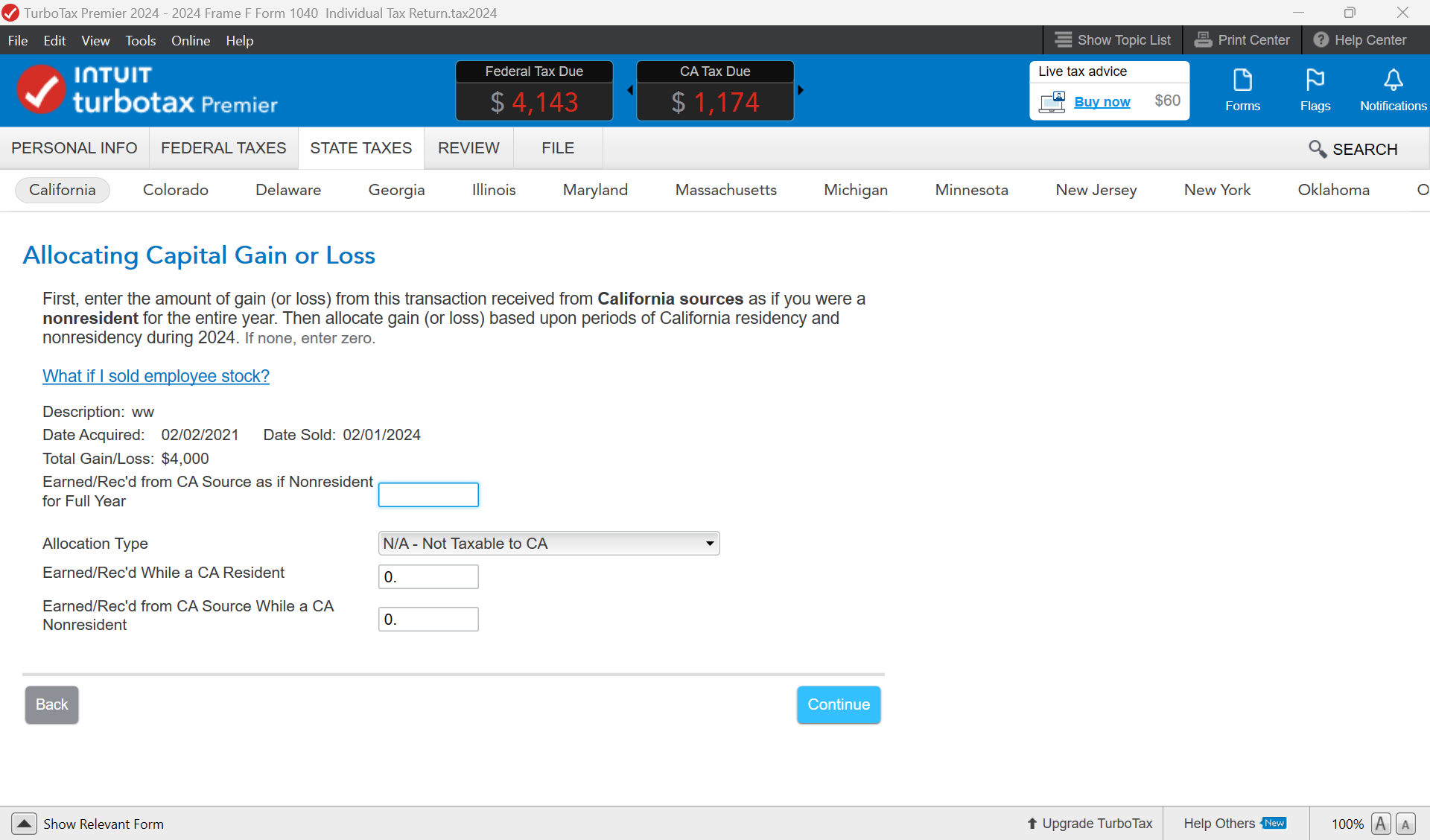

My son is non-dependent IL resident. He received some income from summer internship in CA reported on a W2. He also has income from Capital gains from sale of stocks (at that time he was not in CA, he was in IL). Will these capital gains still be taxed in CA? In turbotax there is this guidance (snapshot below)

The only option it gives is to divide the income between CA and other sources, either you check "sale by sale" OR "total amount". There is no option to say N/A or none of the income is from CA. With the Capital gains he owes taxes. What is the appropriate way to file this tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA NR tax return 2024

Here is how to report this.

- First of all, select sale by sale. Press Continue at the bottom of the page.

- Next screen, enter he was a part -year resident in California. Enter the dates of residency in Ca

- Indicate you will enter by resident and non-resident ratios

- Now you should see a summary of Capital Gain and Loss Summary

- Select Edit next to each

- In the dropdown for allocation types. Select NA-Non-taxable to California

- Now under-earned as a California resident, put in 0. See the first screenshot.

- Repeat this for all of your capital gains entries.

When done, the only income that should be taxed is the W2 wages and nothing else.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BaliAgnes

New Member

peteysue07

New Member

GaGirl55

Level 2

tidwell-monique74

New Member

Bruno_Mesquita

New Member