- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Here is how to report this.

- First of all, select sale by sale. Press Continue at the bottom of the page.

- Next screen, enter he was a part -year resident in California. Enter the dates of residency in Ca

- Indicate you will enter by resident and non-resident ratios

- Now you should see a summary of Capital Gain and Loss Summary

- Select Edit next to each

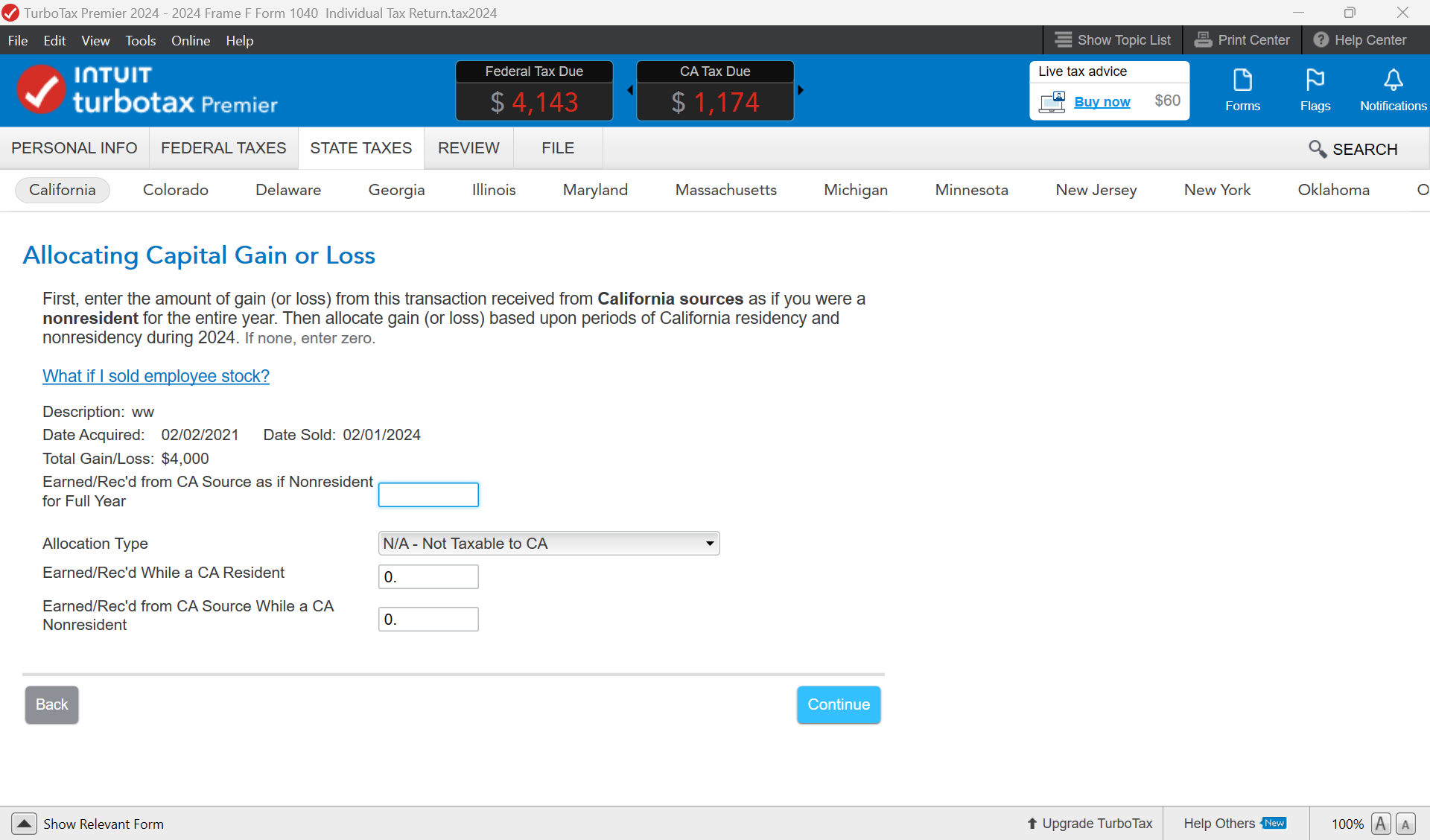

- In the dropdown for allocation types. Select NA-Non-taxable to California

- Now under-earned as a California resident, put in 0. See the first screenshot.

- Repeat this for all of your capital gains entries.

When done, the only income that should be taxed is the W2 wages and nothing else.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 2, 2025

4:04 PM