- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

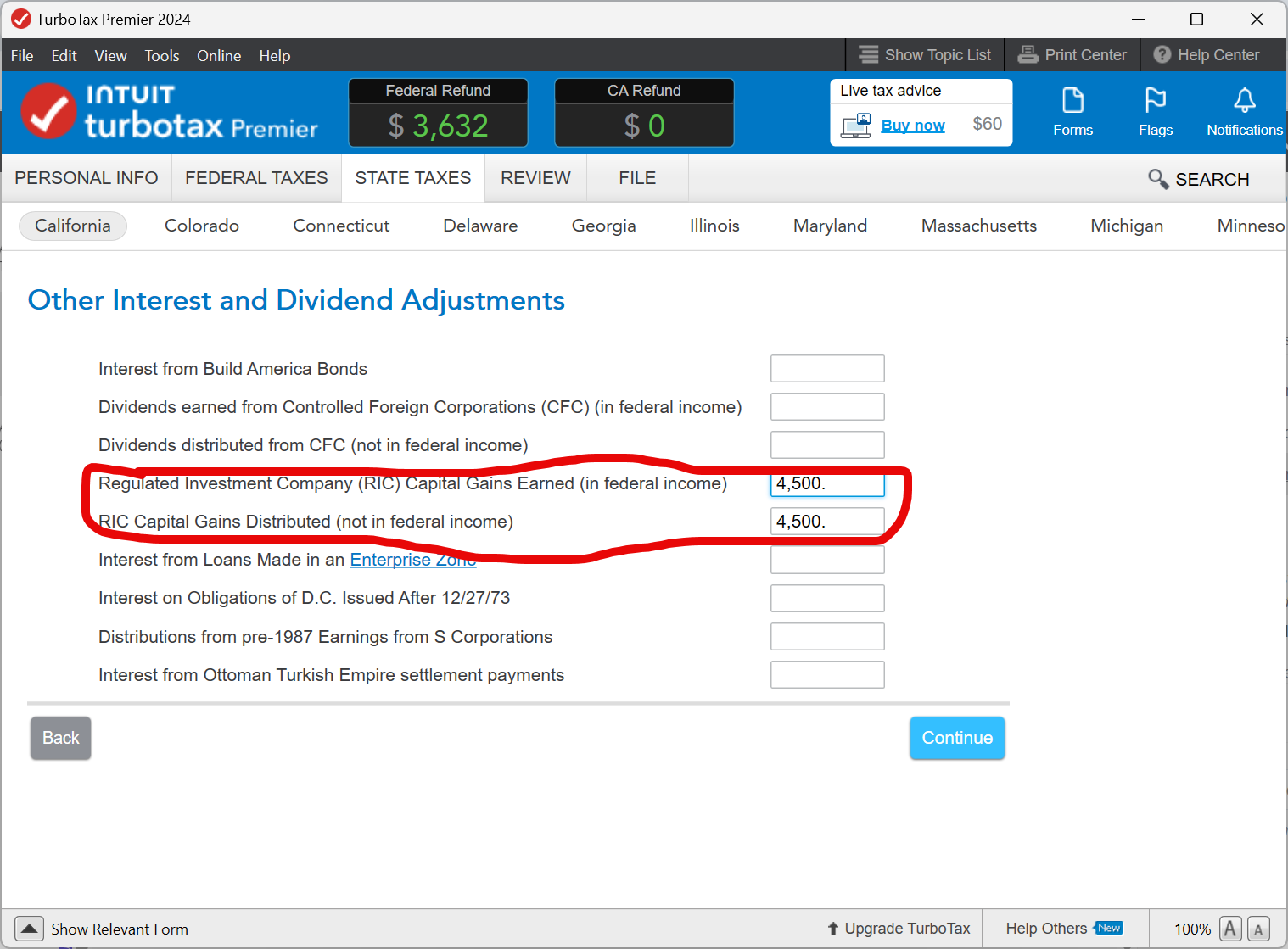

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

The types of Regulated Investment Companies are as follows:

ETF(Exchange Traded Fund), REIT(Real Estate Investment Trust, or UIT(Unit Investment Trust)

You would only enter capital gains reported for these specific types of investments in this field in CA.

If you want to ask about a specific investment, let me know in the comments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

I don't even know if my capital gains are earned in one year and distributed in a later year. Is that common?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

Did you ever get an answer to this? I can't believe we are the only three people dealing with this. And yet, TT has no one who knows how.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

You would not report the amount from Form 1099-B Box 2a under RIC Capital Gains on your California return unless you received additional information that specified the dividends were from an RIC.

Regulated Investment Companies (RIC) include ETF (Exchange Traded Fund), REIT (Real Estate Investment Trust, and UIT (Unit Investment Trust). This list does not include regular capital gains reported on Form 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

So, to be clear, only capital gains which the investment company explicitly states are from a "RIC" should be entered at this point in the California adjustments section. I have several mutual funds in my portfolio, and the 1099 doesn't mark any as ETFs, REITs or UITs. Up til now, I thought any mutual fund was considered a Regulated Investment Company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

California Publication 1001 includes an explanation of the differences between California and Federal law for Dividend Income.

You would only make an entry in the California Adjustments section in the box for "RIC Capital Gains Distributed (not in federal income)" if you identified that you had a RIC Capital Gains distribution that was not reported on the Federal return but should be on the California return.

According to Pub 1001, California taxes the undistributed capital gain from a Regulated Investment Company (RIC) in the year distributed rather than in the year earned:

If capital gain from a RIC is earned in one year and distributed in a later year, enter the capital gain included in federal income for the year earned on Schedule CA (540), Part I or Schedule CA (540NR), Part II, Section A, line 3, column B and enter the capital gain for the year distributed on Schedule CA (540), Part I or Schedule CA (540NR), Part II, Section A, line 3, column C.

If RIC gains were earned and distributed in the same year, and they were reported on the Federal return, then you would not have a California adjustment to enter in the box for "RIC Capital Gains Distributed (not in federal income)" on the Other Interest and Dividend Adjustments screen in the California interview.

If your Dividend Income included a capital gain distribution for qualified small business stock—RICs, a portion of the gain may be excluded from the Federal return under certain circumstances. See the IRS instructions for Form 1099-DIV for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

Dear MonikaK1,

You have answered this before but you fail to tell us what goes onto the line BEFORE that, namely:

"Regulated Investment Company (RIC) Capital Gains Earned (in federal income)"

If the capital gains distributions ARE included in Federal income, AND they ARE distributed the SAME YEAR, why does that line exist? I do have some 2024 RICs which show capital gains distributions on my 1099. Do I just enter those on that line? When I try that experimentally, I see a bigger refund from the state of California.

Seems good to me, but if I shouldn't do it, please let me know! Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

It depends. You would only make these adjustments if you identified that you had a RIC Capital Gains distributions that weren't reported on the federal return but should be on the California return. This is rare but sometimes may happen.

In this case, if these dividends were earned and distributed in the same year, no adjustment is necessary.

[Edited 04/04/25|4:15 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

Thanks, Dave F1006!

With regard to :

Regulated Investment Company (RIC) Capital Gains Earned (in federal income) - Is this the "Line 36" you are referring to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

I should also point out these notes:

My 2024 1099 shows a detail of the individual funds which paid capital gains distributions, under "Total Capital Gains Distributions Detail" (for 1099 line 2A). When I went down that list of funds, I saw that 4 or 5 of them were also RICs, which are listed in a different detail of my 1099 concerned with foreign income, under "Foreign Income and Taxes Summary".

Nowhere in the Cap. gains detail page does it say that any of the funds listed are undistributed capital gains. The only column with an entry is "Capital Gain Distributions Subject to Applicable Rate".

There are "qualified and non-qualified" columns on the RICs list, however. Not sure what that means.

So this is why I thought that Turbo line pertains to me, and that California treats those capital gains differently. I tried to find this in my CA state publication, but I couldn't.

Therefore, in your opinion, can I still list them on that Turbo line - Regulated Investment Company (RIC) Capital Gains Earned (in federal income) ? Or am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are regular capital gains entered on California state taxes under "Regulated Investment Company (IRC) Capital Gains Earned (in federal income)"?

This is addressed in FTB Publication 1001 on page 10. It says not to report the amount of undistributed capital gains. Since you mention you do not have undistributed capital gains, no adjustment is necessary. So in my unfettered opinion, this would be listed in your Ca return.

Earlier I mentioned Line 36 but I was looking at an old publication. This is reported in a CA int/div adj worksheet on Line 14.

To report in the California state return.

- Go to the section of the return labelled "Here is the Income California Handles Differently"

- Go to Investments

- Investment and dividends adjustment

- Now you can see two choices.

- RIC Capital Gains Earned in federal income. This is where you would enter undistributed Income that shouldn't be reported on a Ca return.

- RIC Gains distributed (not in federal Income) This is rare.

- If the capital gains were distributed and reported, you wouldn't enter anything.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jcohen8317

Returning Member

banganr

New Member

JQ6

Level 3

naokoktax

Level 1

starkyfubbs

Level 4