- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

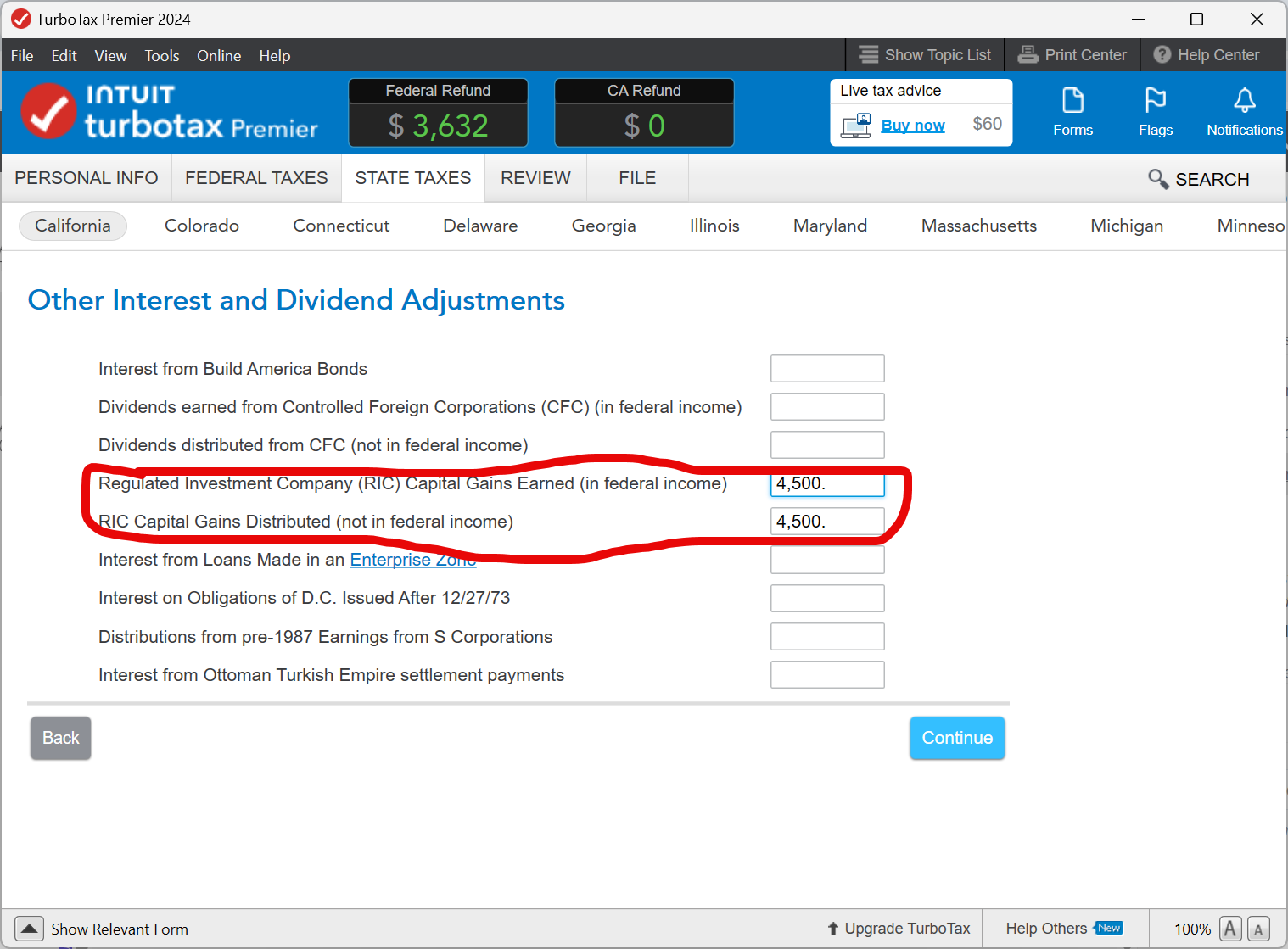

This is addressed in FTB Publication 1001 on page 10. It says not to report the amount of undistributed capital gains. Since you mention you do not have undistributed capital gains, no adjustment is necessary. So in my unfettered opinion, this would be listed in your Ca return.

Earlier I mentioned Line 36 but I was looking at an old publication. This is reported in a CA int/div adj worksheet on Line 14.

To report in the California state return.

- Go to the section of the return labelled "Here is the Income California Handles Differently"

- Go to Investments

- Investment and dividends adjustment

- Now you can see two choices.

- RIC Capital Gains Earned in federal income. This is where you would enter undistributed Income that shouldn't be reported on a Ca return.

- RIC Gains distributed (not in federal Income) This is rare.

- If the capital gains were distributed and reported, you wouldn't enter anything.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 4, 2025

4:02 PM