- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Am I required to claim rental property depreciation on my Schedule E (line 18)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Your prompt reply and expertise advice are greatly appreciated.

Yes. I have a home office.

I have to fill Form 3115 for 2019 Tax refund. I have done all Tax refund myself . Can I fill it myself or must have a CPA to do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

While you technically could do it yourself, it is NOT an easy form, and I would highly recommend having a tax professional do it. Make sure the tax professional knows how to 'catch up' on the depreciation with Form 3115, because many tax professionals don't even know how to fill out the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Do you have any recommendation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Personally, I would find an "Enrolled Agent". They tend to be among the best at taxes, but often lower cost than a CPA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Yes. I will look for a CPA help in your link. But I am finishing 2019 TAX refund myself.

One more question.

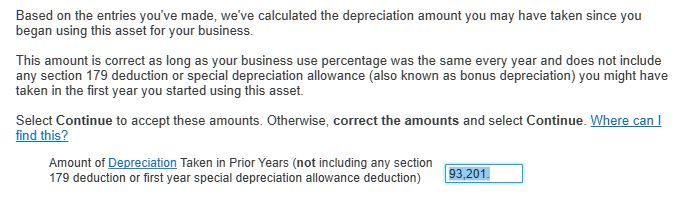

I started to report depreciation for my rental house for 2019 return. I didn't have any depreciation on house itself since 2014 (I don't know a house has depreciation). But I did report 179 depreciation for other assert (like car). For 2019, all these old 179 depreciation have nothing left (ended five depreciated period). I start new asserts (new appliances and house) depreciation in 2019. Turbo tax gave me this result (below snapshot). I think I should change "93201" to 0. Am I right?

Many thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Form 3115 needs to be filed WITH your tax return. You can't file your tax return separately from Form 3115. You should probably have the tax professional do the entire tax return.

In answer to your question, no, that seems to be asking for the depreciation on the HOUSE, and you need to enter what you SHOULD have claimed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Purchased primary residence December 2005. Lived in it until January 2019. Made it a rental in January 2019. Sold it September 2019. I was told you don't have depreciation if you sell the property the same year you put in service. To establish my basis in the property for the sale, do I use the date I purchased the property, and calculate depreciation I never claimed or use the fair market value of the property at the time I made it a rental? Bottom line is; does the recapture rule apply to a property put into service for a rental and sold the same year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Correct, in your case there is no depreciation and you don't need to consider it at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

It is actually a very good deal for you. You defer paying taxes on the depreciation amount. You can invest that (certainly during normal times) and make money. Then when you sell you pay it back. It's like an interest free loan from the government.

Furthermore for straight-line depreciation you get a deduction against ordinary income, but the recapture is taxed a much better capital-gain rates. So you probably get to keep some of it.

For an explanation of that see https://www.taxcpe.com/blogs/news/recaptured-and-unrecaptured-real-estate-rental-section-1250-gain

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Hello, is there a way I can find out if I’ve claimed deprecation before . I left my tax preparer and figuring this out on my own and I realized one of my rental properties didn’t have deprecation claimed. I didn’t know my tax preparer didn’t depreciate it. But I’ve own the property for 6 years now . Can I just begin claiming deprecation now for 2019 tax yr or should I amend to fix the previous yr? Or should I request for my previous tax returns . in the year that rental property was Purchased and placed into service ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

@Toon99 If you have not claimed depreciation for 6 years, you really need to go to a good tax professional that knows how to 'catch up' on the depreciation with Form 3115.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Here is an extended discussion of this same situation from last year. It might be helpful to explain why this is complicated. I'd suggest your old CPA should do this for free. Seems like malpractice to me.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Hi,

I use TurboTax primer for my 2019 tax and it is my first year for renting my property.

My rental property depreciation shows zero. Is it because my net income is zero? How the depreciation works in this case?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

@2385364 Unless the property goes back and forth between personal and rental use, enter ZERO personal days when it asks you about that. It is asking for the number of personal days AFTER it became a rental.

Entering zero personal days will most likely fix your problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I required to claim rental property depreciation on my Schedule E (line 18)?

Thanks. That helps.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

scatkins

Level 2

SB2013

Level 2

Idealsol

New Member

djpmarconi

Level 1