- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Yes. I will look for a CPA help in your link. But I am finishing 2019 TAX refund myself.

One more question.

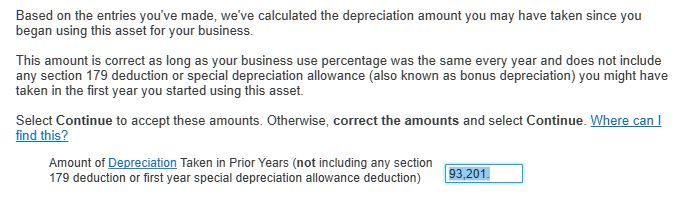

I started to report depreciation for my rental house for 2019 return. I didn't have any depreciation on house itself since 2014 (I don't know a house has depreciation). But I did report 179 depreciation for other assert (like car). For 2019, all these old 179 depreciation have nothing left (ended five depreciated period). I start new asserts (new appliances and house) depreciation in 2019. Turbo tax gave me this result (below snapshot). I think I should change "93201" to 0. Am I right?

Many thanks again!

April 3, 2020

11:50 AM