- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099-B, Summarized sales category, No way to enter Box 1f

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B, Summarized sales category, No way to enter Box 1f

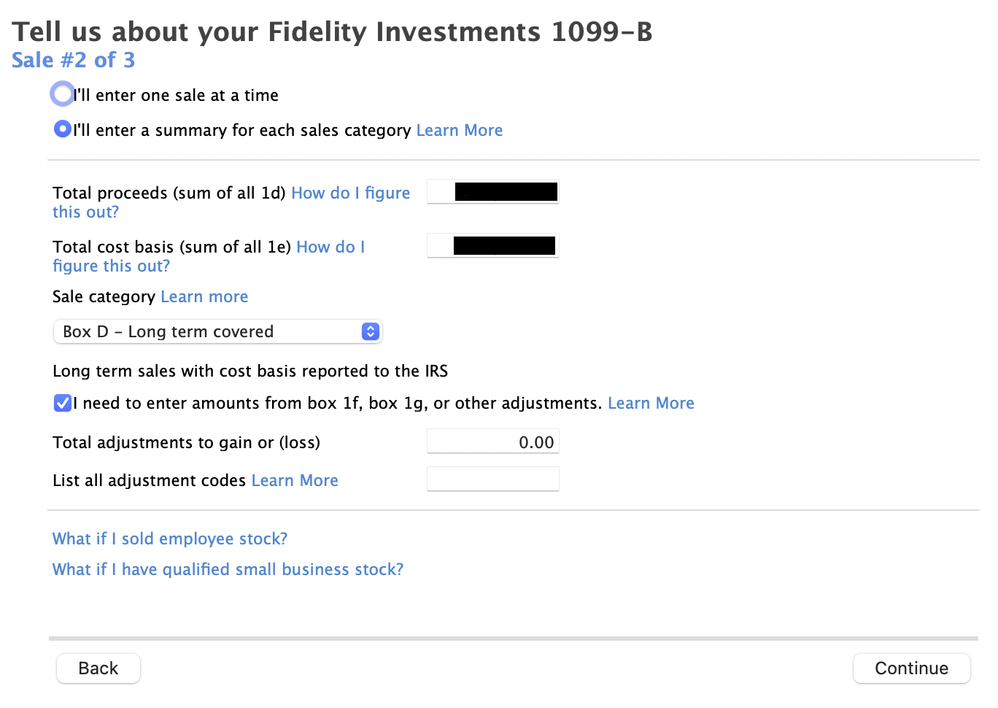

For 1099-B, TurboTax Mac Download (not online) I am entering the summary information for each sales category. One of the 1099-B entries to be summarized has a value for Box 1f. I click on the box saying, "I need to enter amounts from box 1f... or other adjustments".

The screen updates to ask about the "other adjustments" but no ways to enter box 1f or 1g data, as seen below. This is the entire screen, there is no more to scroll down to. And when you "Continue", I am taken back to the summary screen.

The "Total adjustments to gain or (loss)" seems tied to the adjustment codes, not to boxes 1f or 1g.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B, Summarized sales category, No way to enter Box 1f

Enter the amount from Box 1f as a negative number in the Total adjustments to gain (or loss) and Code D as the adjustment code.

Code D lets the IRS know the gain is being adjusted for an accrued market discount. The adjustment amount will be reported as interest income on your tax return. If it does not carry to Schedule B automatically, you will have to carry it over by entering the amount in the Capital Gains Adjustments Worksheet in Forms mode. The Accrued interest to schedule B in Part IV should be highlighted. Enter the adjustment amount here.

What is happening is that you are recognizing less of a gain on this sale because a portion of the gain is being reported as interest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B, Summarized sales category, No way to enter Box 1f

Enter the amount from Box 1f as a negative number in the Total adjustments to gain (or loss) and Code D as the adjustment code.

Code D lets the IRS know the gain is being adjusted for an accrued market discount. The adjustment amount will be reported as interest income on your tax return. If it does not carry to Schedule B automatically, you will have to carry it over by entering the amount in the Capital Gains Adjustments Worksheet in Forms mode. The Accrued interest to schedule B in Part IV should be highlighted. Enter the adjustment amount here.

What is happening is that you are recognizing less of a gain on this sale because a portion of the gain is being reported as interest.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RE-Semi-pro

New Member

davidcjonesvt

Level 3

inr618

New Member

DonNielson

New Member

Rayhne

New Member