- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- When will the issue with form 1098t be fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I can't even input the data for the 1098T.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

When I search "Where to add 1098T", the link takes me to the

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Here are the steps to enter your Form 1098-T information:

In TurboTax online,

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "1098t" and Enter

- Select Jump to 1098t

- On the screen, Now Let's gather XYZ's Additional Education Expenses

- Follow prompts

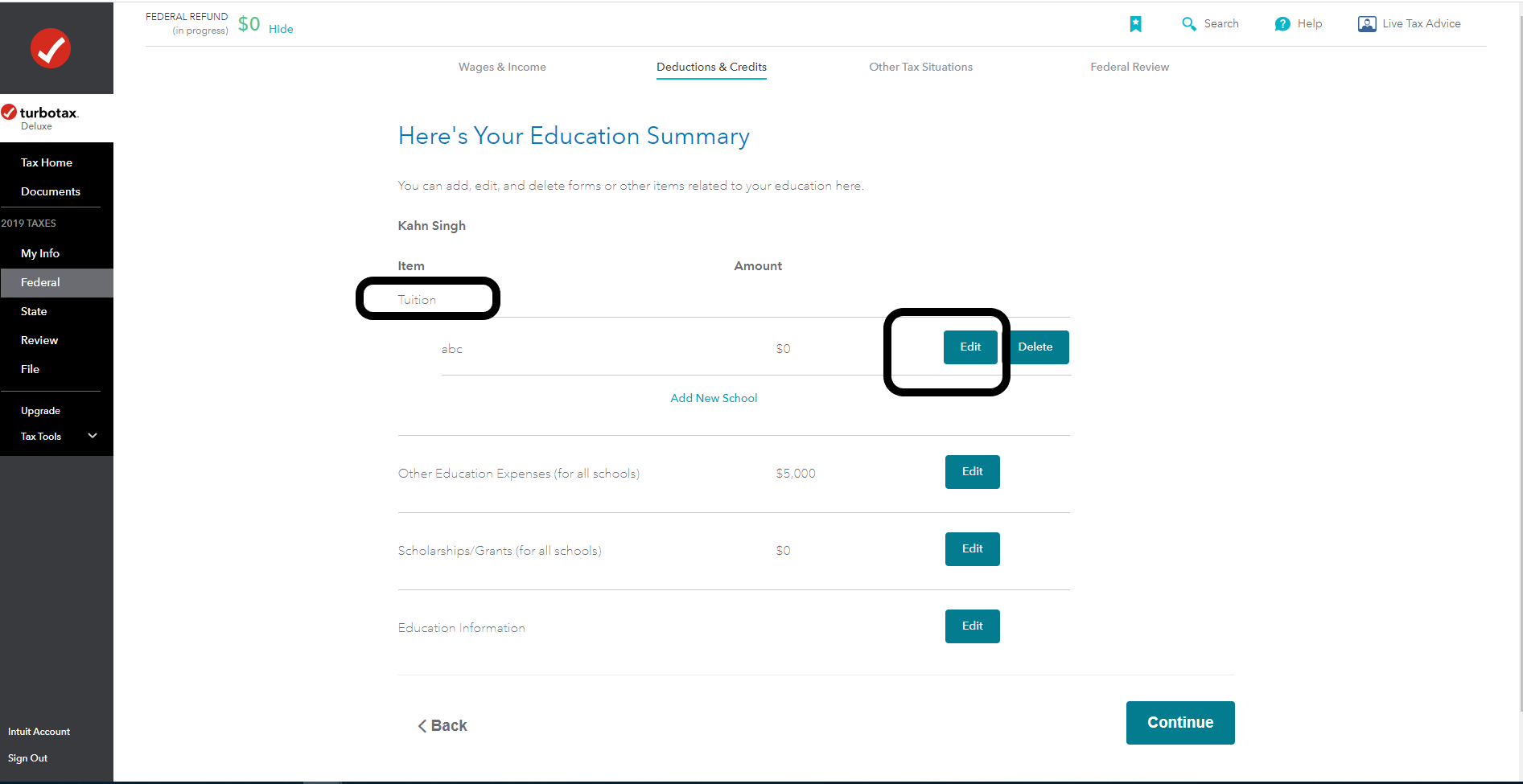

- Next screen, Your Education Expenses Summary, select Edit

- Next screen Here's Your Education Summary, under Tuition, select Edit to enter tuition information

- See the images below.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Yes I am having almost the same problem - program says my son does not qualify and Numbers don add up, if i fill out form 8663 it says my son does qualify for education credit. can't get any information on this issue also other forms are messed up with bad information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Try this and see if this helps. I understand some steps may be repetitive but it should fix whatever is going on and let you update your return.

- Go to the input section for the 1098-T.

- You will probably skip to the section titled books and supplies. Just continue as you probably will not be able to enter any information here. Just continue through the screen.

- Do Not enter any scholarship amounts when it asks if the scholarship is listed in Box 5 of the 1098-T. We want to avoid potentially doubling up any input already made. Hit continue instead.

- Continue through all the screens.

- You may get a message which says you can't maximize because there are no expenses. Just select continue until it takes you back to the Wages & Income screen.

- Now, Go back into the Education Credit section.

- Select Edit next to the student.

- It will ask you if you had an education credit and show you the summary.

- Select Edit to the right of Tuition.

- It will ask you if you received a 1098-T. Select Yes and continue.

- The next page should show you your input on the 1098-T.

- Continue through the screens

This should eventually take you to the screen showing which deduction you can take.

After you pass this screen, run a review. The issue should resolve itself allowing you to continue with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I am having a problem with the 1098T in that when the amount carries forward the system is not reducing the Scholarship amount by the scholarship amount paid out to the university. Consequently the full scholarship amount is adding into taxable income on the 1040 and other forms. Which of course increases taxes.

I can get around it by just entering the net on the 1098T but I shouldn't have to do that!!!

It worked fine last year!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Use the Chrome browser, not the app

Click the three dots in the upper right corner

Select Settings

Privacy and Security

Clear browser data for all time

Then sign in to TurboTax on the Chrome browser

Go to Tax Tools, Tools, Delete a Form and delete Form 1098-T for the school and delete the Education and Fees Summary

Go to the program

Federal

Deductions and Credits

Education

1098-T

Delete the student

Then enter the 1098-T again for the student

Sometimes computer browsers will retrain old data and overwrite the updates.

To qualify for the American Opportunity Credit, your 2020 modified adjusted income or MAGI can't exceed $90,000 ($180,000 if filing jointly).

For the Lifetime Learning Credit, your 2020 MAGI can't exceed $69,000 ($138,000 if filing jointly).

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17699999108

New Member

bill29

Level 2

daddyohood

New Member

Ashsa

New Member

County_Mayo

Returning Member