in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Savings bonds for education

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

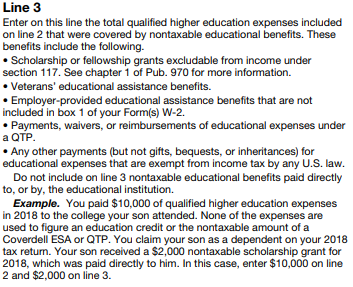

form 8815 line 3, should you enter a QTP distribution here? Tuition being paid for by a combination of QTP money and savings bonds. IRS instructions unclear.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

From the Form 8815 instructions, enter the total of nontaxable educational benefits including QTP distribution (payments) used for qualified education expenses on line 3. If your distribution was not used for education (in whole or part), then it is a taxable distribution and not included on line 3.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

From the Form 8815 instructions, enter the total of nontaxable educational benefits including QTP distribution (payments) used for qualified education expenses on line 3. If your distribution was not used for education (in whole or part), then it is a taxable distribution and not included on line 3.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

If the instructions said "from a QTP" instead of "under a QTP" it would be much clearer. Thanks for the quick response

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

You are welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Savings bonds for education

For future planning, if you still have uncashed savings bonds: Cash the bonds and roll the money over, within 60 days, to your QTP. Then remove the money to pay for college. That way, room ans board are qualified expenses for tax breaks (Savings bonds cannot be used to pay room and board, but QTP money can be).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

maxdanbull

New Member

cirithungol

Returning Member

patamelia

Level 2

patamelia

Level 2

sherod-1264

New Member