- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Who files 1098-T?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

Background: I am preparing to file my and my children's 2020 taxes.

My son is required to file because he received $14,000 in UI benefits. ($14,000-$10,200=$3,800 Taxable Income)

He received a 1098-T that did not have any Scholarships or Grants.

Since I paid all of his educational expenses, can I report the 1098-T on my return?

Thanks!

Q

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

if the student is a dependent, then the parent(s) always file the 1098-T and collect the education credits.

If it is first year (fall semester) you might not want to use the credit because you get only one half the tuition. File for the AOC in the next year, you still get four usages, as long as the year of graduation runs Jan-May or longer (five months).

you report "Tuitions actually paid in calendar year" with 1098-T.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

As fanfare, stated, since the student is dependent, you get to claim the educational credits.

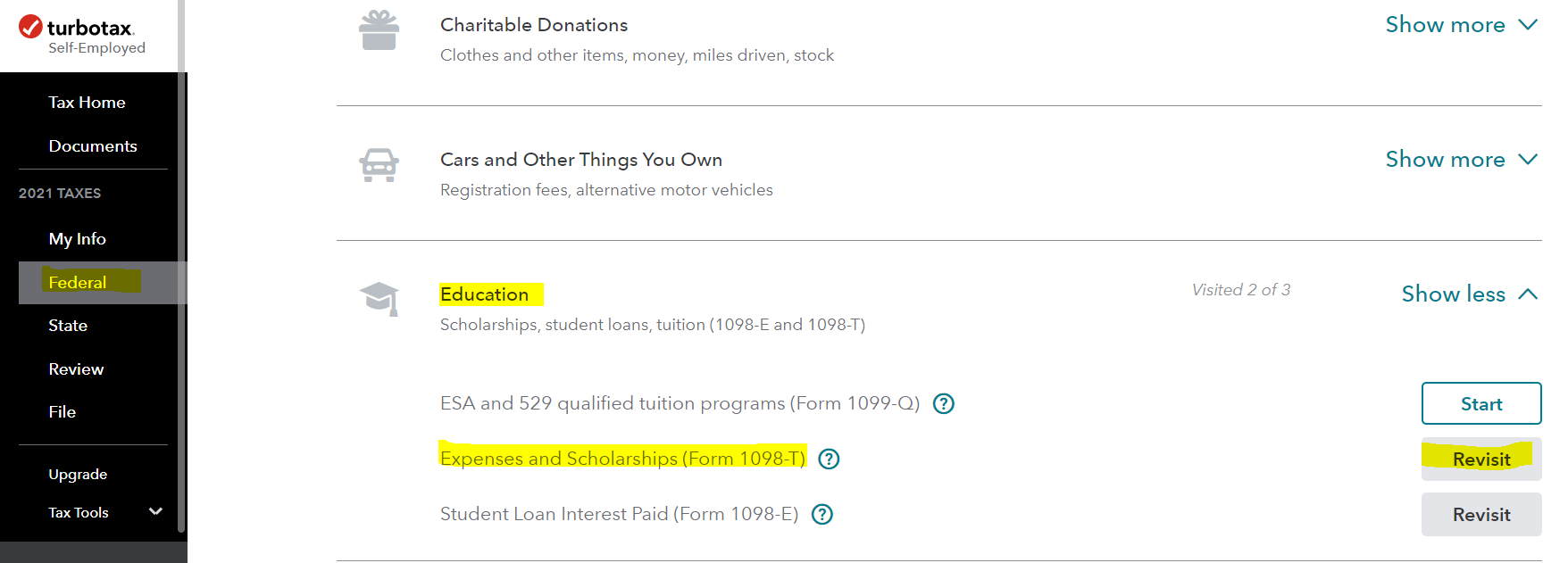

Additionally, please follow the steps below on how to input the 1098-T in TurboTax:

- Click on Tax Home from the Left Menu.

- Click on Deductions & Credits from the Main Screen.

- Scroll Down to the Education Section. There will be an option Titled "Expenses and Scholarships". Click on Start/Revisit on that and enter the information accordingly.

Additionally, please refer to the image below for further reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

The $10,200 Unemployment Compensation deduction was for 2020 only and does not apply for 2021.

Even though the student has more than $4300 of income*, he may still be your dependent for 2021 if he was full time student for parts of 5 months.

There are two types of dependents, "Qualifying Children"(QC) and standard ("Qualifying Relative" in IRS parlance even though they don't have to actually be related). There is no income limit for a QC but there is an age limit, student status, a relationship test and residence test.

A child of a taxpayer can still be a “Qualifying Child” (QC) dependent, regardless of his/her income, if:

- He is under age 19, or under 24 if a full time student for at least 5 months of the year, or is totally & permanently disabled

- He did not provide more than 1/2 his own support. Scholarships are excluded from the support calculation

- He lived with the parent (including temporary absences such as away at school) for more than half the year

So, it doesn't matter how much he earned. What matters is how much he spent on support. Money he put into savings does not count as support he spent on him self.

The support value of the home, provided by the parent, is the fair market rental value of the home plus utilities & other expenses divided by the number of occupants.

The IRS has a worksheet that can be used to help with the support calculation. See: http://apps.irs.gov/app/vita/content/globalmedia/teacher/worksheet_for_determining_support_4012.pdf

It only takes $4000 of qualified expenses to claim the maximum ($2500) American Opportunity Credit (AOC).

*Even in 2020, his gross income, for purposes of the $4300 dependent test, would have been $14,000, nor $3800.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

if the student is a dependent, then the parent(s) always file the 1098-T and collect the education credits.

If it is first year (fall semester) you might not want to use the credit because you get only one half the tuition. File for the AOC in the next year, you still get four usages, as long as the year of graduation runs Jan-May or longer (five months).

you report "Tuitions actually paid in calendar year" with 1098-T.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

If you're paying top school tuitions up front it probably makes no difference.

For my niece, going to community college for two years, and paying out of pocket as she goes, it was a better choice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

As fanfare, stated, since the student is dependent, you get to claim the educational credits.

Additionally, please follow the steps below on how to input the 1098-T in TurboTax:

- Click on Tax Home from the Left Menu.

- Click on Deductions & Credits from the Main Screen.

- Scroll Down to the Education Section. There will be an option Titled "Expenses and Scholarships". Click on Start/Revisit on that and enter the information accordingly.

Additionally, please refer to the image below for further reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

The $10,200 Unemployment Compensation deduction was for 2020 only and does not apply for 2021.

Even though the student has more than $4300 of income*, he may still be your dependent for 2021 if he was full time student for parts of 5 months.

There are two types of dependents, "Qualifying Children"(QC) and standard ("Qualifying Relative" in IRS parlance even though they don't have to actually be related). There is no income limit for a QC but there is an age limit, student status, a relationship test and residence test.

A child of a taxpayer can still be a “Qualifying Child” (QC) dependent, regardless of his/her income, if:

- He is under age 19, or under 24 if a full time student for at least 5 months of the year, or is totally & permanently disabled

- He did not provide more than 1/2 his own support. Scholarships are excluded from the support calculation

- He lived with the parent (including temporary absences such as away at school) for more than half the year

So, it doesn't matter how much he earned. What matters is how much he spent on support. Money he put into savings does not count as support he spent on him self.

The support value of the home, provided by the parent, is the fair market rental value of the home plus utilities & other expenses divided by the number of occupants.

The IRS has a worksheet that can be used to help with the support calculation. See: http://apps.irs.gov/app/vita/content/globalmedia/teacher/worksheet_for_determining_support_4012.pdf

It only takes $4000 of qualified expenses to claim the maximum ($2500) American Opportunity Credit (AOC).

*Even in 2020, his gross income, for purposes of the $4300 dependent test, would have been $14,000, nor $3800.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

Thank you very much for your assistance.

I used the information you shared with me that week and should have thanked you then.

Best regards,

Q

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who files 1098-T?

Thank you very much for your assistance.

I should have mentioned that my question was for completing my very, very late 2020 return.

I did use the information you shared with me that week and should have thanked you then.

Best regards,

Q

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jamiependleton

New Member

mstsuzanne

New Member

Listonash

New Member

sambadiagne01

New Member

blundell

New Member