- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: When will the issue with form 1098t be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

What is the issue? Are you not able to file Form 1098-T? What does the error message say?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I have filed three times and each time rejected. The error is associated with the 1098t form. TurboTax says there is an issue with the form that will be corrected by 2/1/2020 and to file after that date. I tried today twice and same error. I was on the phone with Turbotax to troubleshoot the issue. They had me delete the form and re-add the information. As I re-added by 1098t information, the form was all over the place. I added one school for one child and then I was asked to add it again. There is definitely an issue with the form. Now that everything is re-entered, the refund total is off, and there seems to be a glitch. Now it says I have to mail my taxes in. I have been using Turbotax for 20 years and for the first time, an issue. I will use another company this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Yes, it's now fixed; at least for those just starting.

For those who started earlier, trying to get back to the beginning of the education section may not work. If so, Go through the entire education interview until you reach a scree titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to the section you want to change

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I have done all this and now it says I have to mail my taxes in because I submitted too many times after they said the issue was fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Any one else having issues filing because of the 1098T form issues?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Yes, it won't let me enter the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I am sorry to hear that you are also having issues. Leg us know if you have issues once you file and it is returned because of the 1098t form. I have never had issues with Turbotax until this year. I hope they fix things soon. I dont want to mail my forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

We are having the same issue with the downloaded version. When I entered my son's 1098T it goes from asking the name and schools to putting in books and other fees. The screen that is supposed to be in between to enter the actual 1098T is missing. You can go to the forms view and enter the information on the worksheet which makes everything calculate properly, but we shouldn't have to do that. And I just did the taxes for the first time Tonight so you're situation fixed is wrong. Because when I opened the software it says there are no updates to download.

There is a major glitch in this system that needs fixed ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I agree. The issue needs to fixed ASAP. They also need to notify us prior to filing about the glitch and let us know when it is resolved. I have been waiting since last week. They say they fixed it on Feb 1st, but the problem still exists.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I am having the same issue. Turbo Tax completely skips past the entry of Form 1098T. It says I entered it earlier when I click on Tuition and enrollment fees. I just began this tax return within the last two hours.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Start by going to the Education section of your return using these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “education” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to education”

- Click on the blue “Jump to education” link

Then, if you are not prompted to enter your 1098-T, go through the entire education expenses section of your return until you reach the screen titled “Your Education Expenses Summary”, then follow these steps:

- Click Edit next to the student name.

- On the screen titled “Here’s your Education Summary”, click Edit beside Tuition.

- Enter the information from your Form 1098-T.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

You are just giving instructions on how to submit the information, which is not the issue. There is a glitch with the 1098T section of Turbotax. I wish everyone would stop trying to give instructions and address the glitch with the section of the software. The information has been entered and I have tried to transmit. My return was rejected with the notification that TurboTax has addressed and fixed the 1098T issue and I can resubmit again after 2/1/2020. I transmitted on 2/3 and received the same response after I submitted, i.e. they have resolved the 1098T issue and I can submit after 2/1/2020. The issue with 1098T has not been resolved by TurboTax. I tried a few of the other tax software programs and they are also having an issue with the 1098T form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

I do apologize for the repeated instructions.

Try this and see if this helps. I understand some steps may be repetitive but it should fix whatever is going on and let you file your return.

- Go to the input section for the 1098-T.

- You will probably skip to the section titled books and supplies. Just continue as you probably will not be able to enter any information here. Just continue through the screen.

- Do Not enter any scholarship amounts when it asks if the scholarship is listed in Box 5 of the 1098-T. We want to avoid potentially doubling up any input already made. Hit continue instead.

- Continue through all the screens.

- You may get a message which says you can't maximize because there are no expenses. Just select continue until it takes you back to the Wages & Income screen.

- Now, Go back into the "Education Credit" section.

- Select "Edit" next to the student.

- It will ask you if you had an education credit and show you the summary.

- Select "Edit" to the right of Tuition.

- It will ask you if you received a 1098-T. Select Yes and continue.

- The next page should show you your input on the 1098-T.

- Continue through the screens

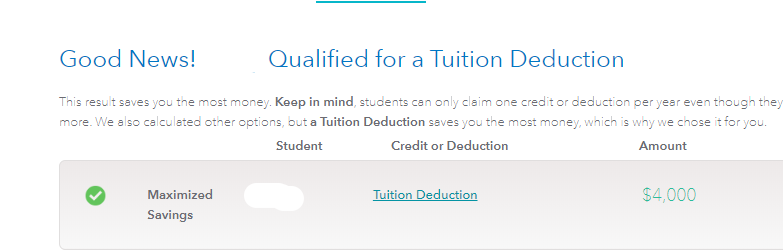

This should eventually take you to the screen showing which deduction you can take.

After you pass this screen, run a review. The issue should resolve itself allowing you to file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the issue with form 1098t be fixed?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Njhan92

New Member

plam8423

New Member

christoph-hammer

New Member

tk10935

Returning Member

ohyeahliz09

New Member