in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Lifetime Learning Credit, Reimbursed in Following Year, How to Report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit, Reimbursed in Following Year, How to Report?

Hi,

I've gotten mixed responses on this, including from the IRS. I took the Lifetime Learning Credit in 2018, then received tuition reimbursement in 2019 from my employer. Can you exclude the reimbursement under the $5250 non-taxable allowable assistance, or do I have to recapture the credit as additional tax this year? I'm just not sure about the term "refund" for recaptures, as it seems to apply to getting an actual refund from the school, whereas the $5250 allowable refers to employer "assistance", so I'm unsure which to go by for "reimbursement". Thank you.

-MD

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit, Reimbursed in Following Year, How to Report?

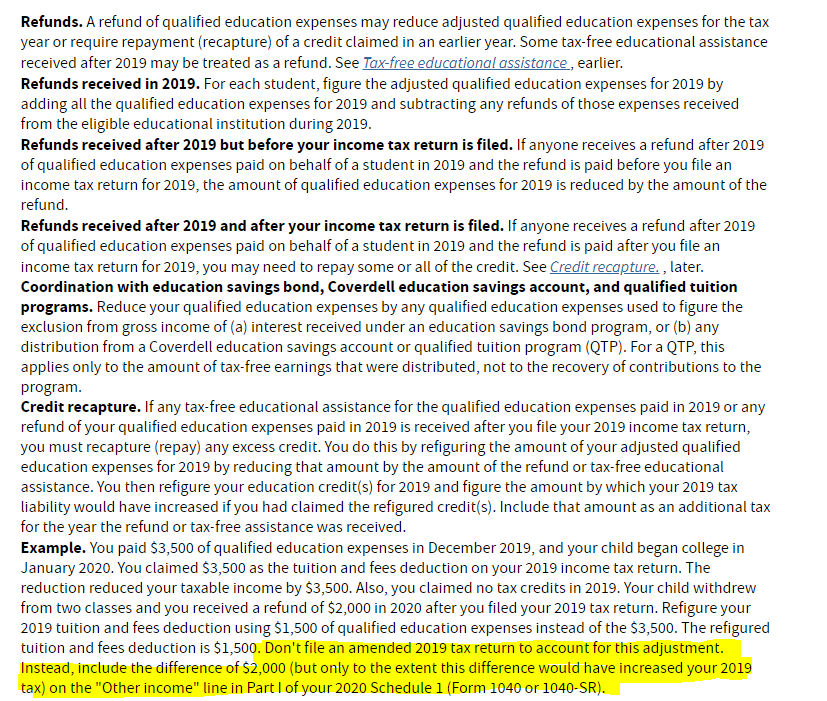

You will need to report this amount as "Other Income" on Schedule 1.

You will not file an amended return for 2018.

See the attached for additional information on how to compute the amount you would report.

Please see the "Example" as highlighted as your guide.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dave183

Level 2

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Thomasketcherside2

New Member

meenakshimishra

Level 2

Mary-Epperly

New Member