in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: How to I add the MD student loan debt relief tax credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

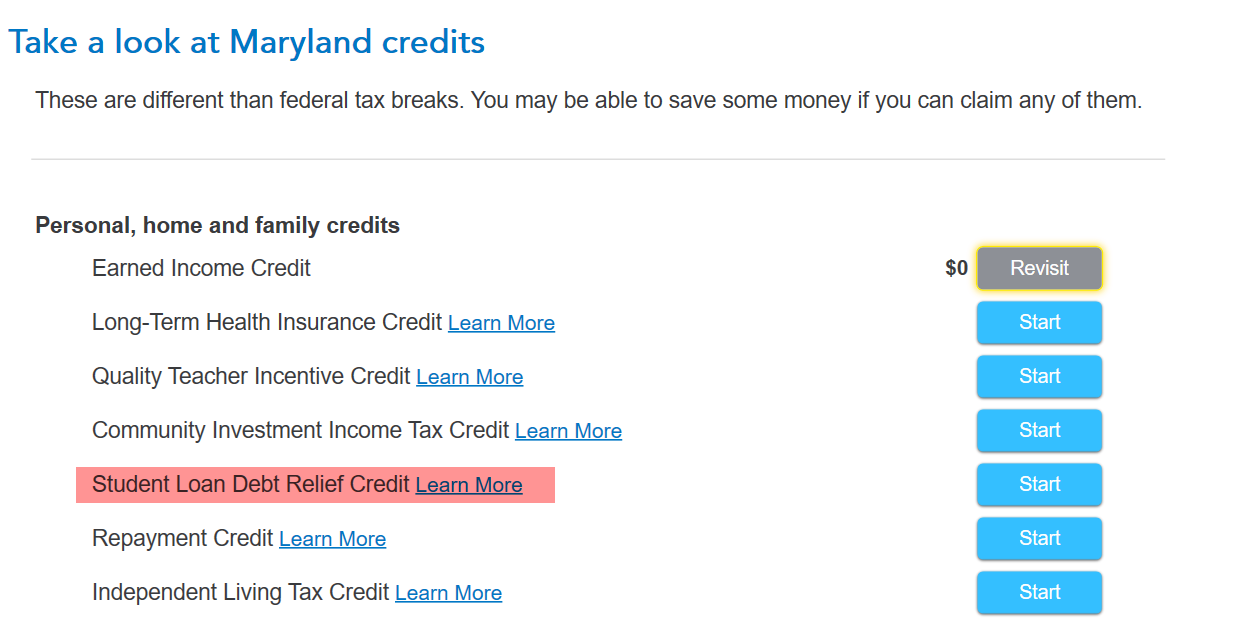

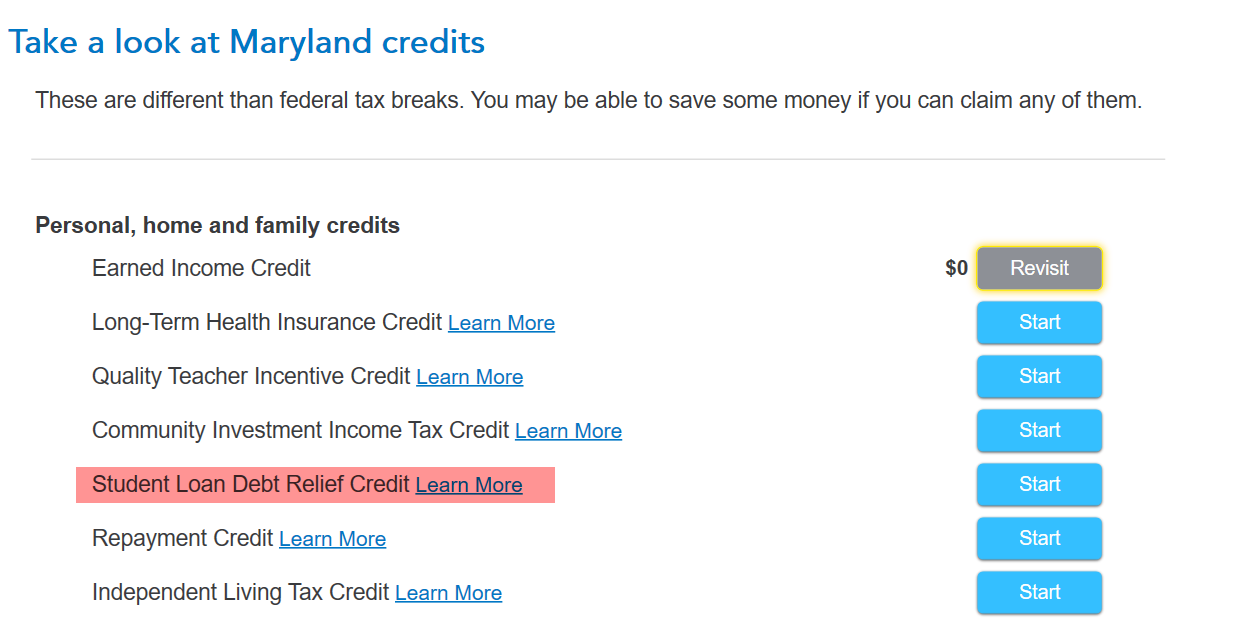

When you go through the Maryland program in TurboTax, you will come to the following screen Take a look at Maryland credits and you will see an option for the Student Loan Debt Relief Credit. Just complete that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

TurboTax Online allows you to enter your discharged student loan indebtedness for the Maryland state tax return.

As you go through your Maryland return, look for the screen titled, 'Here's the income that Maryland handles differently'.

On that page, look for Education > Discharged Student Loan Indebtedness and click Start or Update beside that line to enter your information.

Be aware that you will need to provide a copy of the notice stating the loans have been discharged as an attachment to your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

When you go through the Maryland program in TurboTax, you will come to the following screen Take a look at Maryland credits and you will see an option for the Student Loan Debt Relief Credit. Just complete that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

thank you so much! It worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

I updated all of my info for the MD student loan debt relief tax credit and uploaded the certification. However, my estimated state refund still shows $0. Is there something else I need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

You uploaded everything but did you go through the program and make the entries as shown above?

Are you seeing the credit showing in the program but not on your return or is it not showing in the program either?

If it is showing in the program, please view your forms so you can see what happened to your credit. If you had liabilities, the credit could be used.

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

Yes, I did add in the amount, and it shows on the page. How do I determine if my liabilities outweigh my credit? And how do I do what you suggested below:

- In desktop, switch to Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

If you are using one of the CD/downloaded versions of TurboTax, that is what we call a 'desktop' version. There is a button in the upper right corner of the screen labeled Forms (or in the upper left corner if you are using a Mac). Click that button to see your actual tax forms. Then, look at Maryland Form 502 line 21. This shows your total Maryland tax before credits.

Then, take a look at Maryland Form 502CR. The Student Loan Debt Relief Tax Credit is in Section CC on line 1. Be sure that there is an amount on that line to show that you are claiming the credit. This amount will also carry to Form 502 line 46 (but it may be a different number if other credits are claimed too).

If you are using TurboTax Online, you will not be able to see these actual tax forms until the TurboTax fee has been paid. Once that is done, you will be able to print or print preview any form included with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

How do you do this for 2023 taxes? There is no option for this.

@AmyC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

The desktop version shows the Student Loan Debt Relief under personal, home and family credits. The online version does not currently show the availability. The IRS will begin accepting returns Jan 29 and the state should be soon after that.

The MD website is vague with no information on when they will actually have their side finished and be ready to accept returns. You will need to either use the desktop version or wait and see if the online version will be able to support what MD decides. You have a good 3 week wait no matter what you decide.

Desktop version

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

Has there been any update on when MD will add Student Loan Debt Relief to the online version?

Where would this be at?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

TurboTax Online allows you to enter your discharged student loan indebtedness for the Maryland state tax return.

As you go through your Maryland return, look for the screen titled, 'Here's the income that Maryland handles differently'.

On that page, look for Education > Discharged Student Loan Indebtedness and click Start or Update beside that line to enter your information.

Be aware that you will need to provide a copy of the notice stating the loans have been discharged as an attachment to your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

This is something different. We are looking to enter the Maryland Student Loan Debt Relief Credit. There is no option for this on Turbotax this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

Here is the screen shot with an arrow pointing to the credit. Note that this screen shot is from the desktop product, so your experience may be a little different. If you are in the Online product, look for Maryland, credits, Personal Home and Family Credits, then Student Loan Debt Relief Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

How/where do you upload the letter to attach the information to your tax return?

I figured out where/how to add the information/numerically, but can't attach the letter(s) I've received, stating that my student loan has been discharged.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to I add the MD student loan debt relief tax credit?

You will need to paper file your return to Maryland along with the certification. @erinj1012 E-file your federal return and choose File by Mail for your MD state return. TurboTax will provide mailing instructions when you finalize the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dave183

Level 2

anonymouse1

Level 5

in Education

KELC

Level 1

Vermillionnnnn

Returning Member

in Education

zalmyT

Returning Member