in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: 1098-T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

My son's 1098-T for 2018 states a 1098-T won't be submitted to the IRS because Box 5's value is greater than Box 1's value. The 2019 1098-T states it will be submitted to the IRS. I came upon this change when filling out a FASFA for 2021-22. So, I would think the 1098-T would be submitted with his tax returns. The reason Box 5 is greater than Box 1 is because for 2 school years (2018-19 and 2019-20), he was a RA for on campus housing and his room and board were paid for by the University. So I haven't gone through all of the forms but would the amounts I paid out still have the potential for a tax credit? Also, what changed from 2018 to 2019 as the Box values are about the same? Thanks,

Dan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

You are correct that if the amount in Box 5 for Grants/Scholarships on your 1098-T is larger than the amount in Box 1 for Tuition, you would not qualify for an Education Credit and the 1098-T should be entered on the Student's tax return (if they are required to file a return) and reported as Taxable Scholarship Income.

When entering your 1098-T, you can indicate that part of the Scholarship amount is reported elsewhere as Income if they also received a W-2 or 1099-Misc reporting this amount.

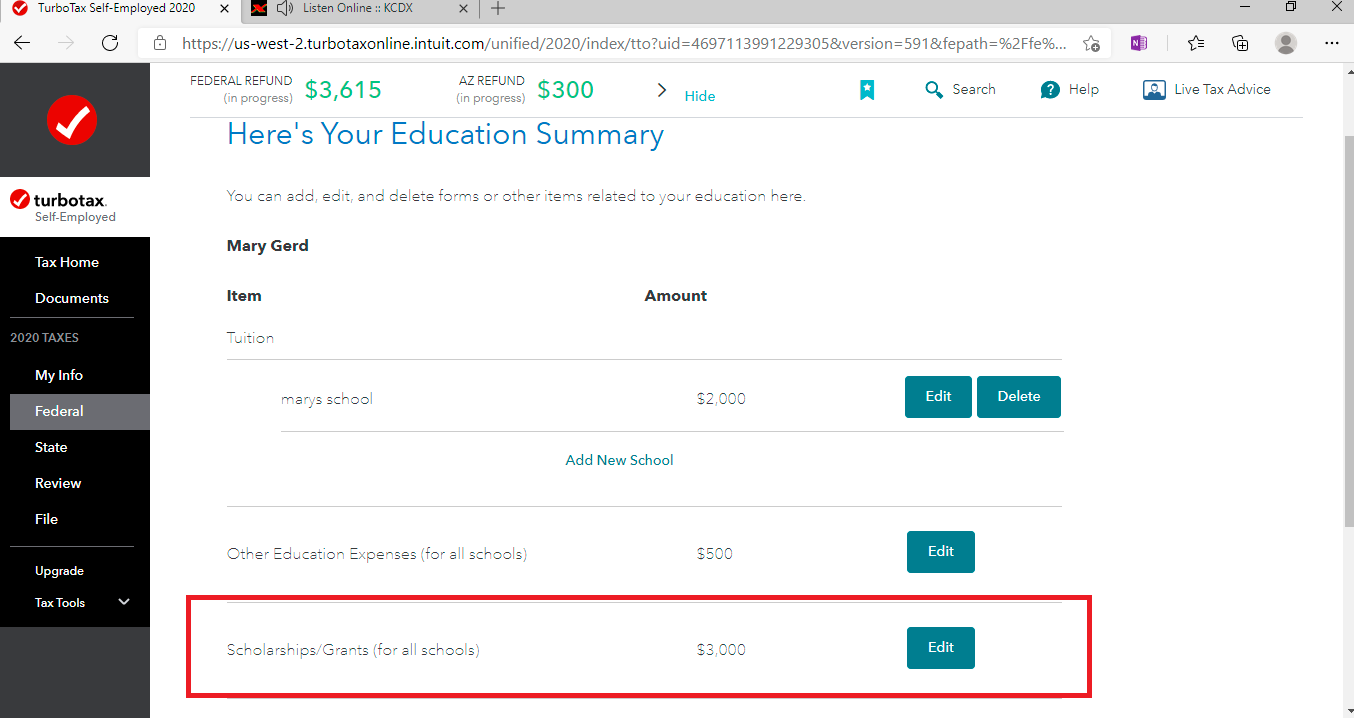

If this does not apply, you can indicate that part of the Scholarship was not used for Education Expenses. At the 'Here's Your Education Summary' page, EDIT the Scholarship item (screenshot).

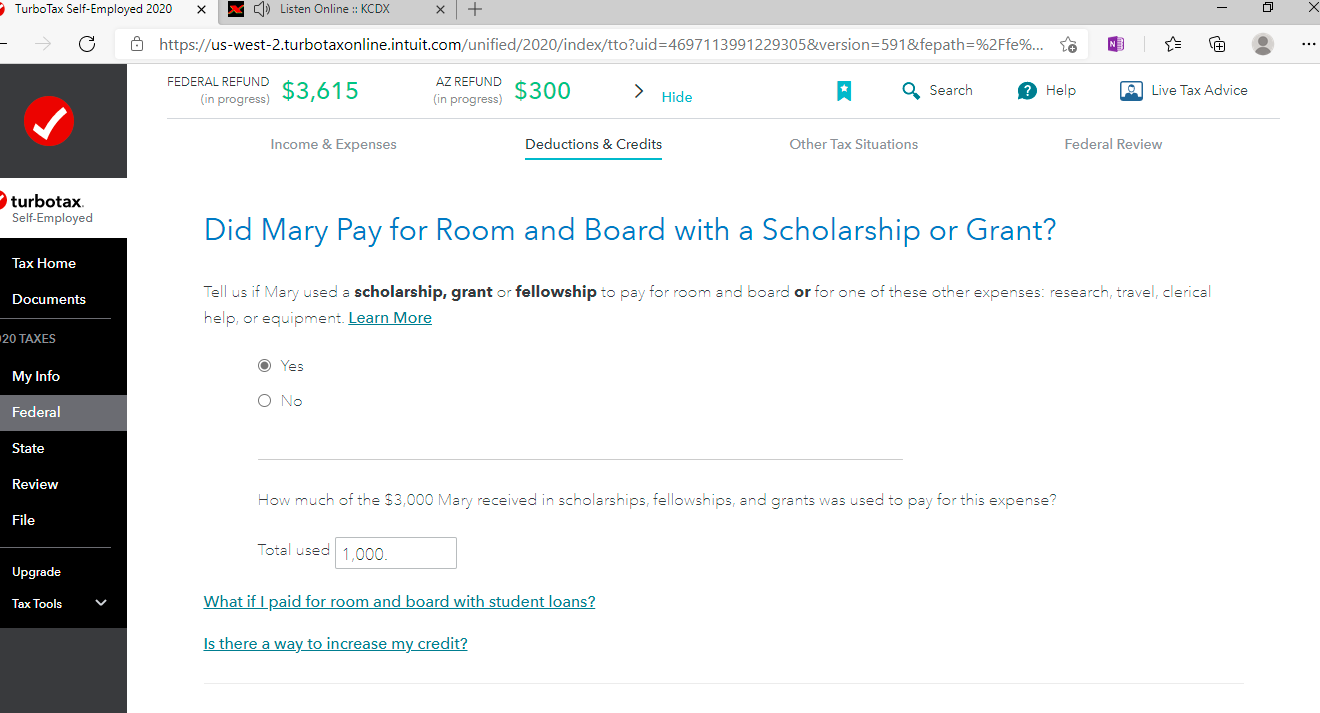

Continue and you will be able to enter the amount used for Room and Board as an RA (screenshot).

You would then still have the potential for an Education Credit. You may need to verify the amount of the total scholarship amount awarded for Room and Board with the school if you're not sure.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LB4

New Member

ChrisMHonoluIu

New Member

user17704880283

Returning Member

in Education

PhxSand

Level 3

in Education

bartzda67

Level 3

in Education