- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Questions about scholarships and taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about scholarships and taxes

I have some questions about my son's scholarships for college. He will be a freshman this fall. So far, he has received approx $25K in private scholarships and most have no restrictions on use...that is, they can be used for tuition, fees, room and board, books, supplies and equipment. Only 2 do not allow room and board expenses. Also, the University does not charge his student account for books and must be paid for out of pocket. Also, his tuition and fees is covered by my post 9/11 GI bill benefits that I have transferred to him, so the scholarship money he has received will not be used for tuition and fees, but only used for room and board, books, supplies, and equipment. His room and board expenses will be approx $12K. His books, supplies, and equipment we're guessing to be approx $5K. His room and board will be payable out of his student account. We were able to charge approx $2.5K of equipment expenses to his student account, however his books and supplies will not be able to be charged to his account. On that note, we're guessing he will probably receive a refund of his scholarship money of approx $10K. He will not have access to that approx $10K of money until well after the semester starts, therefore we will have to pay for his books and supplies out of pocket up front. Here are my questions:

Will the refund of approx $10K automatically be taxable because it's a "refund"? Let's say out of that approx $10K refund, we use $3K for books and supplies, he uses $2K for travel expenses and saves the extra $5K for next year. I'm pretty sure the $2K in travel expenses would be considered taxable, however what about the $3K that was refunded and then used to reimburse the out of pocket expenses paid for books and supplies as well as the extra $5K that was refunded and not spent for any expenses and saved for next year....would that $3K and $5K be taxable? Also, lastly, with any of this money being taxable, would it be considered income for my son and would he need to file the tax forms and pay the taxes, or would it be considered income for myself and I would have to pay the taxes or is it optional who files...that is can we decide to consider it income for either ourselves or our son depending on which is more beneficial?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about scholarships and taxes

I will not try to answer every question but instead give you some general guidelines. You can find more detail in IRS Pub. 970: https://www.irs.gov/pub/irs-pdf/p970.pdf

Scholarship income used for anything other than qualified education expenses is taxable on the student's tax return. What can be included in qualified education expenses can vary with the circumstances. They include tuition and certain fees. They can include books, supplies, and course related equipment if the student qualifies for the American Opportunity Credit. Qualified expenses paid in calendar year 2019 for both the fall 2019 term and spring 2020 term can be claimed on the 2019 tax return for the credit or to offset scholarship income. The student will receive a 1098-T from the school with qualified tuition and fees and scholarship received by the school shown.

If the student is claimed as a dependent and qualifies for the American Opportunity Credit, the parent can claim up to $4000 of qualified expenses not paid by scholarships but paid out of pocket or with loans for up to $2500 of credit. Any scholarship income in excess of what was used to pay for qualified education expenses, is taxable on the student's tax return. This would include income refunded by the school for unused scholarship income and all scholarship income that paid for non qualified expenses such as room and board, travel, and any other non qualified expenses. The taxable amount of the scholarships is reported on the student's tax return and not the parent's tax return. The student should be eligible for up to $12,200 of standard deduction on his 2019 tax return to reduce the amount of total income that tax must be paid on.

A worksheet 1-1 on p. 7 of Pub. 970 can be used to calculate how much of the scholarship income is taxable. The discussion of the American Opportunity Credit in Chapter 2 describes what expenses can be included in qualified expenses for a student who qualifies for the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about scholarships and taxes

So far, he has received approx $25K in private scholarships and most have no restrictions on use...that is, they can be used for tuition, fees, room and board, books, supplies and equipment.

Actually, the IRS restrictions still apply. That is, those scholarships can only be used for the qualified education expenses of tuition, books and lab fees *unless specifically and explicitly stated otherwise* in the award. This rule applies to both scholarships and grants. Generally with a scholarship, there are no exceptions beyond tuition, books and lab fees. But with grants, there can be exceptions beyond those three *if* specifically stated in the grant.

Basically, weather it's a scholarship or a grant depends on two factors.

1) Who or what entity gives the student the money.

2) What the money is intended for, or designated to be used for.

For what I think is an easy to understand explanation of the difference between the two, see https://www.unigo.com/pay-for-college/scholarships/grants-vs-scholarships

Also, the University does not charge his student account for books and must be paid for out of pocket.

More than likely, that will be offset by excess scholarships/grants. Let me explain.

If you have a $10,000 scholarship awarded in 2019, and it's used to pay $9,000 of tution in 2019, that means the student will be receiving a check from the school for the $1000 difference. So if the books cost $1000, then that $1000 refunded by the school gets counted first, before anything is considered "out of pocket". It's important that you be aware that the "tuition and fees" deduction (what you pay out of your pocket) expired at the end of 2017 and thus far has not been renewed or extended by congress. So while valid and true out of pocket expenses will qualify you for some education credits, the "tuition and fees" deduction is no longer an available option unless congress changes things between now and the next tax filing season. I honestly don't see that happening. But I won't go so far as to say it definitely won't happen. It very well could.

Will the refund of approx $10K automatically be taxable because it's a "refund"?

Let me start by clarifying a few things here.

Colleges work in academic years which generally run from Sept thru Aug. The IRS works in calendar years Jan-Dec. So the reality is, it takes you five calendar years to get that four year degree. Now with that said:

- Scholarships, grants and 529/funds are reported as *taxable* income (initally) in the tax year they are received. It flat out does not matter what tax year that scholarship, grant or 529 distribution is *for*. The taxability of this money is offset by the qualified expenses they are used to pay for *in the same tax year the funds are received.*

- Qualified education expenses are deducted in the tax year they are actually paid. It flat out does not matter what tax year you pay *for*.

Now about the check the student will receive from the school for the excess scholarship/grant money. Yes, it will be taxable income *to the student* unless the student uses that money to pay for the qualified education expenses of books in the same tax year the money is received by the student.

On top of that, that specific money will be taxed at the higher, parent's tax rate. However, if the student goes ahead and uses that money received in 2019 to pay for 2020 qualified education expenses, then it won't be taxable at all.

"what about the $3K that was refunded and then used to reimburse the out of pocket expenses paid for books and supplies as well as the extra $5K that was refunded and not spent for any expenses and saved for next year....would that $3K and $5K be taxable?"

If not spent on qualified education expenses in the same tax year it is received, then it's taxable income. Period. But like I said above, there is no reason why you can't take a scholarship refund received in 2019 and go ahead and pre-paid the 2020 tuition before Dec 31 2019. That would make it a reportable qualified education expense on the 2019 return that would be reported as paid for with scholarship money.

Now if the excess scholarship money is returned to the student in 2020, then turn around and use it to pay the fall semester qualified expenses, as well as the 2021 spring semester if you still have any left over. (I doubt you will, but you could.)

Also, lastly, with any of this money being taxable, would it be considered income for my son and would he need to file the tax forms and pay the taxes

It is reportable on the tax return of whoever is named on the check issued by the school. Traditionally, that would be the student.

Now it's a good thing that you're trying to get a jump on this. It's rare I see that. I usually see things "after the fact" when the student is shocked to find they owe the IRS a few thousand in taxes because they nor their parents did their homework. Glad to see you're doing your homework and not waiting until the last minute.

Now this can get complicated if you let it. In fact, I'm a bit concerned about the questions you have not asked, than I am with the ones to have asked. So below I've included "the whole enchilada" for your reviewing pleasure. You'll need to read it through at least three times before things start to click for you. After that, if you have more questions then my all means, please ask.

College Education Expenses

Colleges work in academic years, while the IRS works in calendar years. So the reality is, it takes you 5 calendar years to get that 4 year degree. With that said:

- Scholarships and grants are claimed/reported as taxable income (initially) in the year they are received. It does not matter what year that scholarship or grant is *for*

- Tuition and other qualified education expenses are reported/claimed in the tax year they are paid. It does not matter what year they pay *for*.

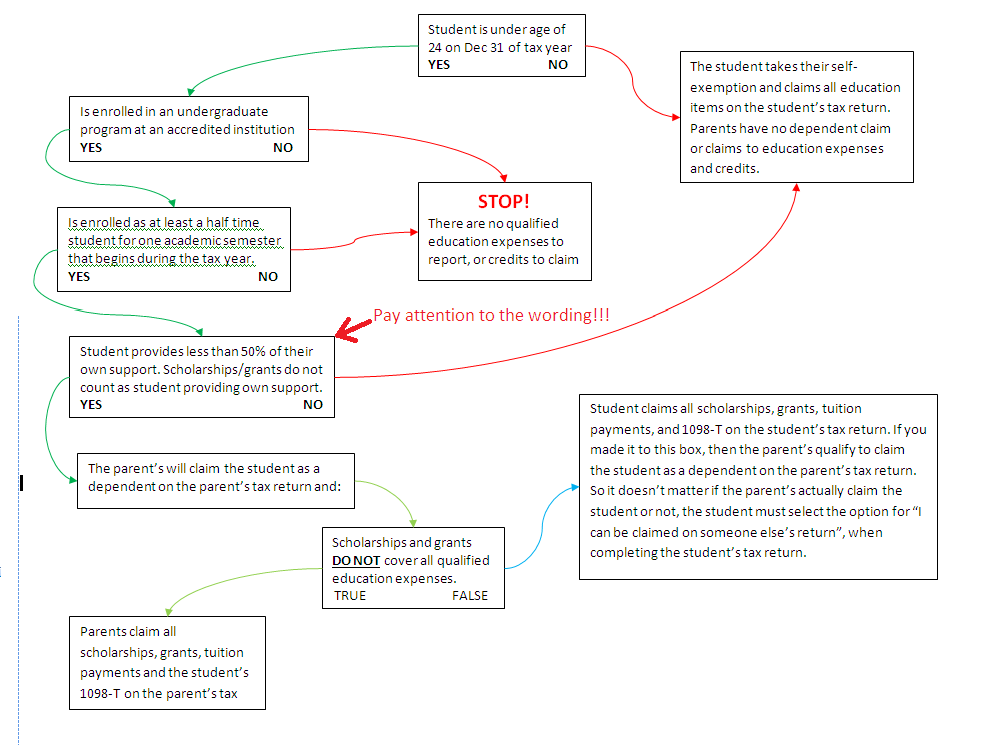

Understand that figuring out who claims the student as a dependent, and determining who claims the education expenses & credits, is two different determinations. It depends on the specific situation as outlined below. After you read it, I have also attached a chart at the bottom. You can click on the chart to enlarge it so you can read it. If it’s still to hard to read on your screen then right-click on the enlarged image and elect to save it to your computer. Then you can double-click the saved image file on your computer to open it, and it will be even easier to read.

Here’s the general rules gisted from IRS Publication 970 at http://www.irs.gov/pub/irs-pdf/p970.pdf Some words are in bold, italicized, or capitalized just for emphasis. This is because correct interpretation by the reader is everything. Take the below contents LITERALLY, and do not try to “read between the lines”. If you do, you’ll interpret it incorrectly and risk reporting things wrong on your taxes. For example, there is a vast difference between “can be claimed” and “must be claimed”. The first one indicates a choice. The second one provides no choice.

Now there are two separate determinations to be made here.

- Who claims the student as a dependent.

- Who reports all the education expenses and claims all the education credits.

First, who claims the student as a dependent?

If the student:

Is under the age of 24 on Dec 31 of the tax year and:

Is enrolled in an undergraduate program at an accredited institution and:

Is enrolled as a full time student for one academic semester that begins during the tax year, (each institution has their own definition of a full time student) and:

the STUDENT did NOT provide more that 50% of the STUDENT’S support (schollarships/grants received by the student ***do not count*** as the student providing their own support)

Then:

The parents qualify to claim the student as a dependent on the parent's tax return . Period, End of Story. But one thing I want to point out here. The parents *QUALIFY* to claim the student. The parents are *NOT* required to claim the student as a dependent. But even if they don’t, since they *qualify* to claim the student, then if the student will be filing their own tax return the student is *REQUIRED* to select the option for “I can be claimed on someone else’s return”. To reiterate:

If the student qualifies to be claimed on the parent’s tax return, then the student can not take the self-exemption on their own tax return, no …matter…what.

Who reports all the education expenses and claims all the credits?

If (and only if) the parents qualify to claim the student as a dependent, *and* the parents actually are claiming the student as a dependent, then:

The parents will claim all schollarships, grants, tuition payments, and the student's 1098-T on the parent's tax return and:

The parents will claim all educational tax credits that qualify.

If the student will be filing a tax return and:

The parents qualify to claim the student as a dependent, then:

The student must select the option for "I can be claimed on someone else's return", on the student's tax return. The student must select this option even f the parent's qualify to claim the student as a dependent, and the parents do not claim them.

Here’s when the parents will claim the student as a dependent, but the parents will NOT claim any of the education expenses or report the 1098-T on the parent’s tax return.

.If the amount of scholarships/grants/529 funds exceeds the amount of qualified education expenses, then the student will report the education stuff on the student’s tax return. The parent will know this when reporting the education on their tax return, because the parent will not qualify for any of the tax credits. (They only qualify for tax credits based on out-of-pocket qualified expenses not covered by scholarships/grants.) Also, the parent’s will not qualify for the credits depending on their MAGI which is different for each credit, and depends on the marital status of the parent or parents.

In the case where scholarships/grants covers “all” qualified education expenses, the parent’s don’t need to report educational information on their dependent student at all – but they still claim the student as a dependent if they “qualify” to claim the student.

If the scholarships/grants exceed the qualified education expenses, then the student will report the 1098-T and all other educational expenses and scholarships/grants on the student’s tax return. The student will pay taxes on the amount of scholarships/grants that are not used for qualified education expenses. However, if the student’s earned income reported on a W-2, when added to the excess scholarships/grants does NOT exceed $12,000 (12,350 for the 2019 tax year), then the student doesn’t even need to file a tax return, and nothing has to be reported.

If the student has any other taxable income not reported on a W-2, and it exceeds $400, (not including taxable portion of scholarships/grants) then most likely it’s considered self-employment income. That will require a tax return to be filed and the student will have to pay the Self-Employment tax on that income.

Finally, regardless of the student’s W-2 earnings, if any taxes were withheld on those earnings and it was less than $12K, then the student should file a tax return so as to get those withheld taxes refunded.

- 1099-Q Funds

First, scholarships & grants are applied to qualified education expenses. The only qualified expenses for scholarships and grants are tuition, books, and lab fees. that's it. If there is any excess, then it's taxable income. It automatically gets transferred to and included in the total on line 7 of the 1040.

Next, 529/Coverdell funds reported on 1099-Q are applied to qualified education expenses. The qualified expenses for 1099-Q funds are tuition, books, lab fees, AND room & board. That's it. If there are any excess 1099-Q funds they are taxable. The amount is included in the total on line 7..

Finally, out of pocket money is applied to qualified education expenses. However, take ***SPECIAL*** ***NOTICE*** that the tuition and fees deduction expired at the end of the 2017 tax year and was not renewed for the 2018 tax year. It’s unknown if it will be renewed for the 2019 tax year. If it is renewed for the 2019 tax year, the only qualified expenses for out of pocket money is tuition, books, and lab fees. Room & board is NOT a qualified expense for out of pocket money. As of this writing, (3/26/2019) congress has not renewed the out of pocket expense deduction, which expired in 2017.

When you have a 1099-Q it is extremely important that you work through the education section of the program in the order it is designed and intended to be used. If you do not, then there is a high probability that you will not be asked for room & board expenses, and you could therefore be TAXED on your 1099-Q funds.

Finally, if "all" qualified expenses are covered by scholarships, grants, 1099-Q funds and there is ANY of those funds left over, the left over excess is taxable. While the parent can still claim the student as a dependent, it is the student who will report all the education stuff on the student's tax return. That's because the STUDENT pays the taxes on any excess scholarships, grants and 1099-Q funds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about scholarships and taxes

Q. Will the refund of approx $10K automatically be taxable because it's a "refund"?

A. No. Anything used for books and "course materials" (including computers and software) are qualified expenses and reduce the taxable portion of the scholarships.

If he receives $25K in scholarships and and only pays $3K for qualified expenses (tuition, fees and course materials), then he has $22K of taxable income. Room and board are not qualified educational expenses. But, he should actually claim the entire $25K as taxable income, so that the parents can claim the $3000 of qualified expenses for the American Opportunity Credit

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aashish98432

Returning Member

meltonyus

Level 1

jackkgan

Level 5

Itty211

New Member

jenniferbannon2

New Member