- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- J1 student since July 2017. Am I a resident for tax purposes this year when i file tax for 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J1 student since July 2017. Am I a resident for tax purposes this year when i file tax for 2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J1 student since July 2017. Am I a resident for tax purposes this year when i file tax for 2020?

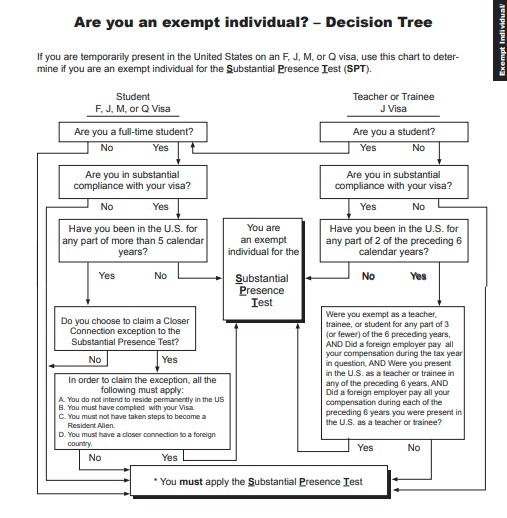

Generally, as a J-1 visa holder (teacher and trainee) you are considered a nonresident for two years from the first year you enter the US.

But a J-1 alien can exclude U.S. days of presence as a “student” for purposes of the Substantial Presence Test for up to five calendar years. The five-year limit is a lifetime limit that can’t be renewed but may be extended if certain conditions are met. For detail information, see Exempt Individual - Who is a Student.

Please see Taxation of Alien Individuals by Immigration Status – J-1 for additional information.

If you meet the student qualification then you would be considered a nonresident and would have to attach a statement and paper file your return to file married filing jointly. Please see IRS Nonresident Alien Spouse for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J1 student since July 2017. Am I a resident for tax purposes this year when i file tax for 2020?

Hi I am not sure if i get this right as I am not sure about the substantial compliance meaning in the flow chart. I thought I am qualified to be treated as a resident as I am here for more than 3years and paid taxes so i pass the substantial presence test. Am I qualified? I just want to avoid the fuss with writing a letter with my spouse and paper filing the tax as we are approaching the deadline. We would like to use Turbotax once we sure of what we need to do. Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J1 student since July 2017. Am I a resident for tax purposes this year when i file tax for 2020?

You are considered to have substantially complied with the visa requirements if you have not engaged in activities that are prohibited by U.S. immigration laws and could result in the loss of your nonimmigrant status.

It will depend if you were a full-time student or not (please see my answer above for details) if you met the Substantial Presence Test.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IndependentContractor

New Member

gman98

Level 2

shil3971

New Member

captmdismail

Returning Member

joycehong1978

New Member