- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

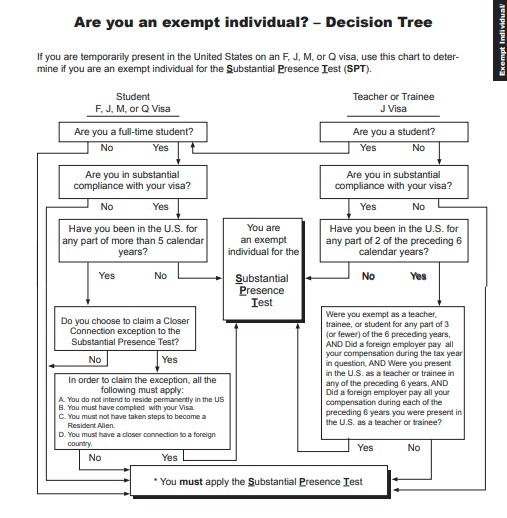

Generally, as a J-1 visa holder (teacher and trainee) you are considered a nonresident for two years from the first year you enter the US.

But a J-1 alien can exclude U.S. days of presence as a “student” for purposes of the Substantial Presence Test for up to five calendar years. The five-year limit is a lifetime limit that can’t be renewed but may be extended if certain conditions are met. For detail information, see Exempt Individual - Who is a Student.

Please see Taxation of Alien Individuals by Immigration Status – J-1 for additional information.

If you meet the student qualification then you would be considered a nonresident and would have to attach a statement and paper file your return to file married filing jointly. Please see IRS Nonresident Alien Spouse for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"