- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- How do I enter the amount of the scholarship?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

I withdrew from a 529 the exact amount of a tuition scholarship - the student was the recipient. The Tuition and other qualified expenses were already paid by the 529 (to me, and I made the payments) This should be very clean - no 10% penalty to her, and the earnings on the 28K distribution amounted to $9996. Where do I enter the $9996? I entered the 1099Q entirely, but nowhere does it ask if she received a scholarship. Can I delete the 1099Q entries and enter the earnings portion directly in any other section? TT is not great with college exps and 529s, sadly. TIA.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Q. Can I delete the 1099Q entries and enter the earnings portion directly in any other section?

A. No. Yes, you can get the taxable income on your return that way, but technically you have to also submit form 5329 to claim the scholarship exception to the penalty.

It's not clear if you are the recipient of the 1099-Q or the student is. I'm going to assume your name and SS# are on the 1099-Q. I'm going to further assume you not eligible for a tuition credit, because you income is too high.

You are right: "TT is not great with college exps and 529s, sadly". Here's quick workaround in TurboTax:

Enter the 1099-Q. When asked who the student is answer: someone else not listed here (lying to TurboTax to get it to do what you want does not constitute lying to the IRS). Enter the student's name when asked. A few screens later, you'll get one simple screen to enter expenses. Also enter the amount of the scholarship in the box "Tax-free assistance". This reports the earnings as taxable and claims the scholarship exception. You do not have to deal with the complicated Educational expenses and Scholarships (1098-T) section later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Thanks for your reply!

To your comment: It's not clear if you are the recipient of the 1099-Q or the student is. I'm going to assume your name and SS# are on the 1099-Q. I'm going to further assume you not eligible for a tuition credit, because you income is too high.

The student/my daughter was the recipient of the withdrawn funds - which were ONLY the amount of the scholarship. (I withdrew funds, payable to me, in the amount of the tuition and expenses and nothing extra.) Her name and social are on the 1099-Q. She is my dependent and I am not eligible for a tuition credit (all tuition was paid by the 529 anyway which I believe would preclude me from taking the credit?).

So I have answered to 'Who's shown as the Recipient on your 1099-Q' = "someone else not listed here" - then on the next screen it asks: 'Who's the student?" and I've selected the first bullet, which is the name of my daughter. Then it says "you don't need to enter this 1099Q info". and there is the button to add education expenses. I go there....

When I enter the expenses - I'm entering only the scholarship amount (because she did not pay any tuition, I did). Then the Federal tax due increases by about $3400. There's no way she's in a 30% tax bracket. Am I supposed to also enter the tuition paid? IF I do that, then the tuition paid will exceed the amount of the 529 withdrawal in her name. I'm also anticipating that I will have a question on how to enter the earnings portion of this withdrawal. Am I on the right track?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Q. " I am not eligible for a tuition credit (all tuition was paid by the 529 anyway which I believe would preclude me from taking the credit?"

A. No. That's not true. "All tuition was paid by the 529 only means you can not claim the same tuition expenses for both the credit and the tax free earnings of the 529. But you may select which ever works best for you, and that is almost always the tuition credit.

Q. Am I on the right track?

A. No. You are not locked to using the certain funds for certain expense. You may allocate them for your best advantage.

Let's start over. The quick workaround previously described doesn't work because you don't meet the assumptions. Provide the following info for more specific help:

- Are you the student or parent.

- Is the student the parent's dependent.

- Box 1 of the 1098-T

- box 5 of the 1098-T

- Any other scholarships not shown in box 5

- Does box 5 include any of the 529/ESA plan payments (it should not)

- Is any of the Scholarship restricted; i.e. it must be used for tuition

- Box 1 of the 1099-Q

- Box 2 of the 1099-Q

- Who’s name and SS# are on the 1099-Q, parent or student (who’s the “recipient”)?

- Room & board paid. If student lives off campus, what is school's R&B charge.

- Other qualified expenses not included in box 1 of the 1098-T, e.g. books & computers

- How much taxable income does the student have, from what sources

- Are you trying to claim the tuition credit (Is your income less than $90K ($180K Married jointly))

- Is the student an undergrad or grad student?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Q. " I am not eligible for a tuition credit (all tuition was paid by the 529 anyway which I believe would preclude me from taking the credit?"

A. No. That's not true. "All tuition was paid by the 529 only means you can not claim the same tuition expenses for both the credit and the tax free earnings of the 529. But you may select which ever works best for you, and that is almost always the tuition credit.

Q. Am I on the right track?

A. No. You are not locked to using the certain funds for certain expense. You may allocate them for your best advantage.

Let's start over.

Provide the following info for more specific help:

- Are you the student or parent.

- Is the student the parent's dependent.

- Box 1 of the 1098-T

- box 5 of the 1098-T

- Any other scholarships not shown in box 5

- Does box 5 include any of the 529/ESA plan payments (it should not)

- Is any of the Scholarship restricted; i.e. it must be used for tuition

- Box 1 of the 1099-Q

- Box 2 of the 1099-Q

- Who’s name and SS# are on the 1099-Q, parent or student (who’s the “recipient”)?

- Room & board paid. If student lives off campus, what is school's R&B charge. If the student lives at home, only the school's board charge for on campus students.

- Other qualified expenses not included in box 1 of the 1098-T, e.g. books & computers

- How much taxable income does the student have, from what sources

- Are you trying to claim the tuition credit (Is your income less than $90K ($180K Married jointly))

- Is the student an undergrad or grad student?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Thanks - here goes:

- Are you the student or parent. - I am the parent but I'm preparing the student's tax return

- Is the student the parent's dependent. - yes she is

- Box 1 of the 1098-T - $56,404

- box 5 of the 1098-T - $28,500

- Any other scholarships not shown in box 5 - none

- Does box 5 include any of the 529/ESA plan payments (it should not) - no

- Is any of the Scholarship restricted; i.e. it must be used for tuition - no - scholarship was awarded by the school and applied directly to her account. she lived off campus so the only expenses on her account were tuition and fees.

- Box 1 of the 1099-Q - $28,500

- Box 2 of the 1099-Q $9996.46

- Who’s name and SS# are on the 1099-Q, parent or student (who’s the “recipient”)? my daughter, the student

- Room & board paid. If student lives off campus, what is school's R&B charge. about 18K/year (but I took separate withdrawals from a different 529 to me in order to pay for these expenses)

- Other qualified expenses not included in box 1 of the 1098-T, e.g. books & computers - none

- How much taxable income does the student have, from what sources - about 20K, from several jobs

- Are you trying to claim the tuition credit (Is your income less than $90K ($180K Married jointly)) - no my AGI was 102K.

- Is the student an undergrad or grad student? - undergrad

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

$56,404 Tuition expenses

- 28,500 Paid by Scholarship

= 27,904 Expenses that can be used for the 1099-Q

$28,500 1099-Q (529 Withdrawal)

- 27,904 Expenses

$ 596 of the distribution in non qualified

Surely, you can come up with $596 of books, computers or room & board not covered by the other 529. In which case, you can omit entering both the 1099-Q and 1098-T on either your or her return.

Otherwise, 596 / 28500 = 2% of the earnings are taxable. 0.02 x 9996 = $209 Is your reportable income. We could use a workaround to enter that, but as I said earlier, technically you have to also submit form 5329 to claim the scholarship exception to the penalty. Entering it correctly is going to be messy. "TT is not great with college exps and 529s, sadly. "

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

This is actually a lot simpler. Because there is excess $ in the 529, we are withdrawing the exact amount of the scholarship. I have already used all of the qualified expenses with other 529 withdrawals, to me. I withdraw the fund and pay all of the expenses. Since her tax rate is lower, and since she had scholarship, I'm generating withdrawals to her to avoid the penalty which would be assessed later in life if we withdraw the money. So, to recap - she paid no qualified expenses, therefore the $28,500 withdrawal equals the scholarship amount. $9996 is the earnings portion, which will not be penalized at 10%, but should be shown on her return as taxable income. I can't figure out what numbers to enter to a) get the income of $9996 to appear, and b) to generate the form 5329. Are you able to help? Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Sorry to come late to the party but if:

$56,404 Tuition expenses

- 28,500 Paid by Scholarship

= 27,904 Expenses that can be used for the 1099-Q

$28,500 1099-Q (529 Withdrawal)

- 27,904 Expenses

$ 596 of the distribution in non qualified

Why not

$56,404 Tuition expenses

- 28,500 1099-Q (529 Withdrawal)

= 27,904 Expenses that can be used for the Scholarship

$28,500 Paid by Scholarship

- 27,904 Expenses that can be used for the Scholarship

$ 596 of taxable scholarship

Just have the student claim 596 scholarship income, will that make any difference on her return? And Form 5329 is not needed.

The student can enter that in the Education Section as Scholarship received.

You do need to go through screens that will say she is not eligible for credits that way

OR

Sign into TurboTax and continue through until you can start selecting "Wages & Income" located at the top of the screen

Click on Wages & Income

(If the program asks about your W2, select Skip for now )

Select answers to the following questions if necessary to move forward

Click Add more income

Scroll down to the VERY LAST option "Less Common Income" and click Show more

On this new drop-down list scroll down to the VERY LAST option "Miscellaneous Income" and click START

On this new drop-down list scroll to the VERY FIRST option "Other income not already reported on a Form W-2 or Form 1099"

Click START

Select YES to the page titled "Other Wages Received" and Continue

Select CONTINUE on the "Wages earned as a Household Employee" screen (enter nothing here)

Select CONTINUE on the "Sick or Disability Pay" screen (enter nothing here)

Select "Yes" on the "Any Other Earned Income" screen and continue

Select "Other" on the "Enter Source of Other Earned Income" and Continue

In Description Box type "SCH" and 529

Click Done

This will put the income on the 1040 line 1 where it needs to be.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Enter the 1099-Q on her return. Indicate that she is the recipient and the student. Then enter the 1098-T, at the education section. Enter $28,500 in both boxes 1 & 5. Enter no other numbers. That should do it (but frequently doesn't).

Review the Student information worksheet, (abbreviated Student Info Wk on the forms list), and the 1099-Q worksheet for the calculations. In particular look at Section VI, line 17 of the student worksheet, It should be blank or 0 (but frequently isn't)

One new wrinkle: The $9996 is unearned income, so the "kiddie tax" will kick in. Most of that will be taxed at the parent's marginal tax rate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

@KrisD15 You are correct. That would work too. And normally I would also recommend that method. Based on the numbers, here, it wouldn't make too much difference on actual tax.

But that's moot. Poster latest update indicated there was a 2nd 529 withdrawal that was used for the other $27904. Now she would have to declare all the scholarship taxable vs. $9996 of QTP earnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Actually, no - the other 529 withdrawal amounts match up exactly to the tuition and qualified expenses paid. No other withdrawals were taken against the scholarship. None of the other 529 withdrawal is taxable (none was withdrawn against the scholarship), and there are no excess expenses to go against the 28,500 529 withdrawal. This is why I did it this way: to make it simple.

The 529 withdrawal received by my daughter was the exact amount of her tuition scholarship: 28,500, of which 9996 was earnings. So, 9996 should be taxable to her, but not subject to a non-qualified withdrawal penalty.

I still cannot, and after 3 hours on the phone with TT, cannot figure out how to enter this. Sigh....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Will this work? I found that I could directly access form 5329:

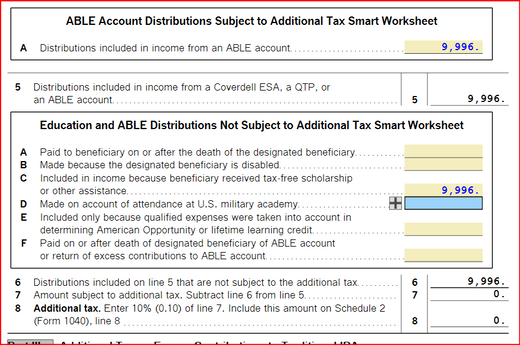

Reviewing Schedule 1 shows that the $9996 is listed as a taxable distribution (which is correct). Have I done this correctly? If so, my last question is:

Can I still file this return electronically? I thought I read somewhere that if you enter directly into the form then you have to file by paper mail, which I am not doing (my own 2020 return, filed by mail, still has not been processed due to the backlog).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

Do you see the $9,996 on your return? Look at Schedule 1, Line 8z, do you see the $9,996?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of the scholarship?

The $9996 shows on line 8p of Schedule 1 (Taxable distributions from an ABLE account) - is that the correct place to put it?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

RyanK

Level 2

RicsterX

Returning Member

anonymouse1

Level 5

in Education

freedom_111_07

New Member