- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Does payment for room and board as part of being a resident assistant/community leader count in box 5 as scholarship/grant? But not count towards box 1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does payment for room and board as part of being a resident assistant/community leader count in box 5 as scholarship/grant? But not count towards box 1?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does payment for room and board as part of being a resident assistant/community leader count in box 5 as scholarship/grant? But not count towards box 1?

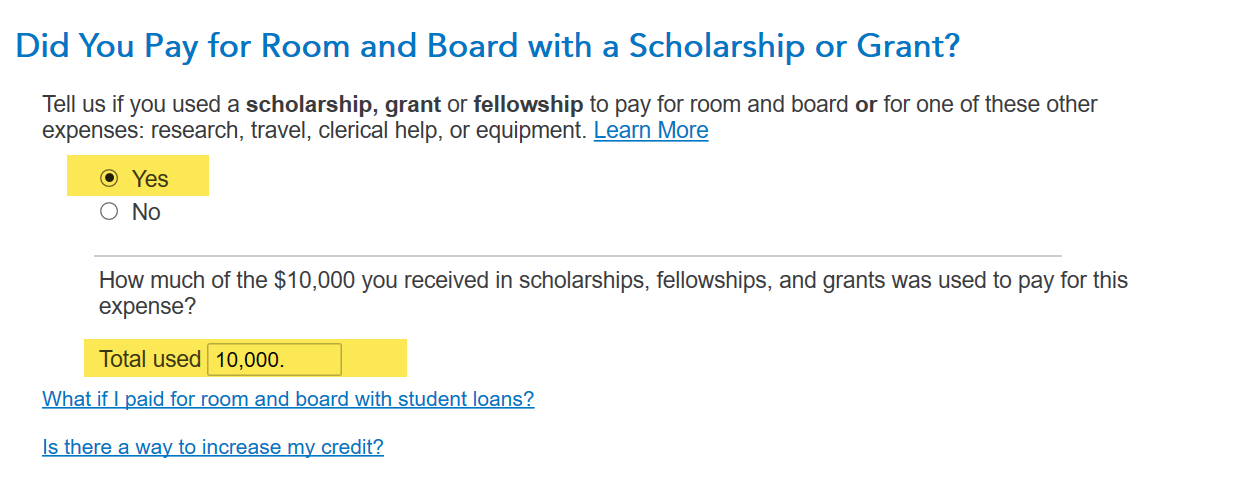

The amounts reported as scholarship income in box 5 should not be applied towards the education expenses reported in box 1, since they are for room and board. When you enter your Form 1098-T, you can indicate that on the screen that says Did You Pay for Room and Board with a Scholarship or Grant?:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does payment for room and board as part of being a resident assistant/community leader count in box 5 as scholarship/grant? But not count towards box 1?

Scholarships that pay for qualified educational expenses (QEE - tuition, fees, books and other course materials) is tax free. Scholarship amounts that exceed QEE is taxable income, on the student’s tax return. Room & board (R&B) are not QEE.

If box 5 of the 1098-T exceeds box 1, TurboTax (TT) will treat the difference as taxable income, unless you enter additional QEE at books and other expenses.

Since you know that some of the amount, in box 5, is taxable, because it was designated for R&B, you must tell TurboTax that. The way you do that is as ThomasM125 described. The good news is that that will free up some of the tuition so that you can use it to claim the Tuition credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

juahc

Level 2

yingmin

Level 1

Propeller2127

New Member

dc20222023

Level 3

RyanK

Level 2