- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Connecticut tax return form on Education Trust Fund Distributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Connecticut tax return form on Education Trust Fund Distributions

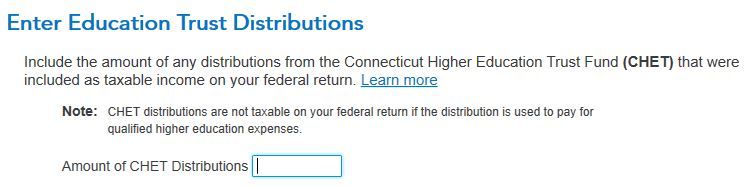

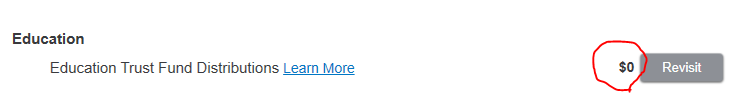

Hi, I'm confused by the above questions. I had a distribution of $21000 from CHET directly paid to a college. According to the Note under the question, CHET distributions are not taxable for qualified higher education expenses (I also like to know how to check it in the federal tax return form). So I entered zero on the box above. However, once clicking continue, I got the following screen with my zero entry circled. It looks like not right now on the screen. Did I enter the number wrong? Please help, and thanks,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Connecticut tax return form on Education Trust Fund Distributions

Where any of your Connecticut High Education Trust (CHET) distributions included as federal taxable income?

In the CHET distribution box, enter the amount that taxable on your federal return, if any. You will see this amount on Schedule 1, line 8. If the amount is $0, don't enter anything.;

I don't know why you are getting a red circle by entering a $0. I am not seeing that on my return. Someone would have to look at your return to figure that out.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Connecticut tax return form on Education Trust Fund Distributions

ErnieS0, thank you very much for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

newt45

Level 2

jkcmlandis

New Member

in Education

menomineefan

Level 2

Luna_Tax

Level 3

in Education

eohiri

New Member