- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Can i deduct NextGen 529 contributions on the Maine State income taxes? Everything I'm reading online says yes, however i can't get TurboTax online to get me there.

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i deduct NextGen 529 contributions on the Maine State income taxes? Everything I'm reading online says yes, however i can't get TurboTax online to get me there.

I realize that 529 contributions are not eligible for a Federal deduction but from what i understand they are deductible on State of Maine income tax return. However, TurboTax has never prompted me to input this information and i refuse to upgrade to the "Live" version to get this resolved, as it appears to be a glitch/error on their end. Anyone dealt with this or have a workaround? Thanks.

posted

March 2, 2025

3:30 AM

last updated

March 02, 2025

3:30 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i deduct NextGen 529 contributions on the Maine State income taxes? Everything I'm reading online says yes, however i can't get TurboTax online to get me there.

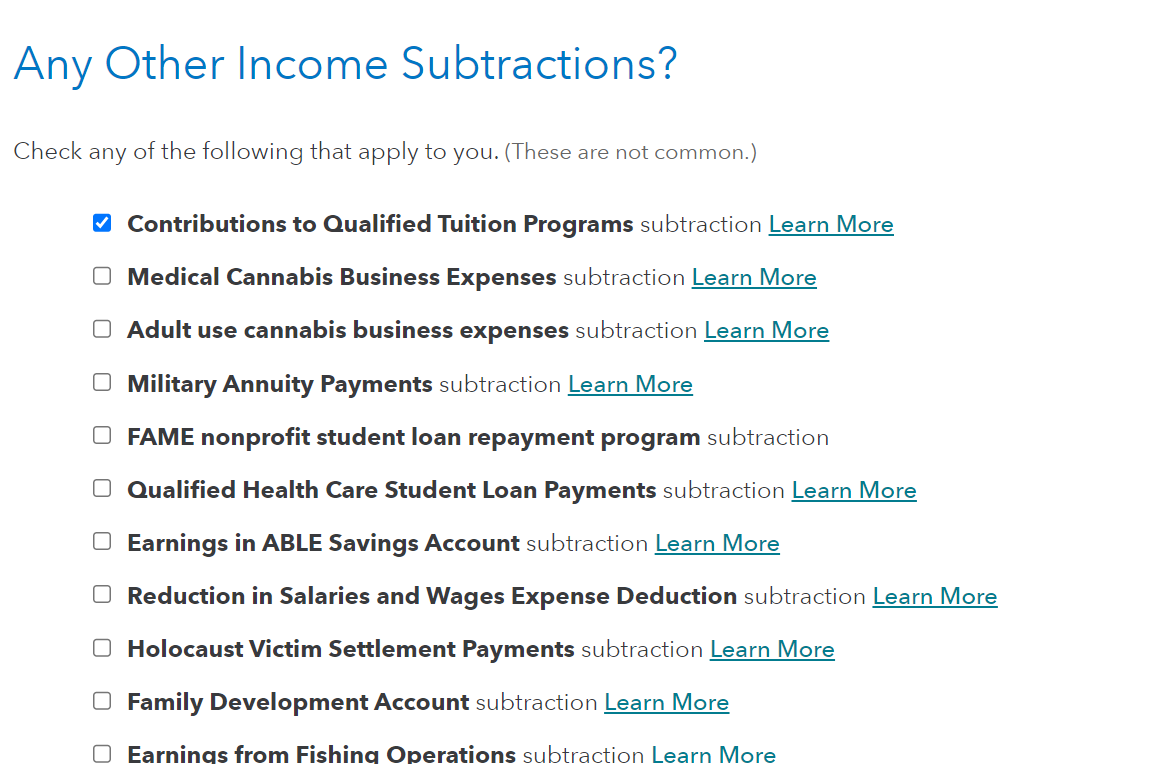

Your contributions to the Maine 529 plan comes up as you go through your Maine return. Look for the screen titled, Any Other Income Subtractions. Then, check the box beside Contributions to Qualified Tuition Programs. That will allow you to enter your information.

See the picture below for a visual reference:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 2, 2025

4:09 AM

1,768

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Returning Member

krockls1

New Member

Lukas1994

Level 2

jigga27

New Member

rawalls18

New Member