- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 529 distribution being taxed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

I'm preparing for my daughter's 1040 return. For 2019, she has income of $7,000. She is a full-time college student. Her tuition last year was $49,000,scholarship $26,000, 529 distribution $23,000 (earnings $16,000 and basis $7,000). Since all 529 distributions were used for tuition only (not room and board), why does turbo tax show she has to pay $1,000 in taxes when she should be getting a refund?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

Are you saying that the $7,000 for your daughter's income is the same as the $7,000 basis in 529 funds?

Or is the $7,000 something entirely different? Have all qualifying expenses been correctly entered?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

$7,000 is from part time work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

That said, is she your dependent? If so, you should be claiming the tuition credit and she should be counting room and board toward the 529 plan distribution to keep it untaxed (or reduce the tax).

The "error" in TurboTax may be that it has assumed the credit was claimed, and has allocated some of the tuition to the credit.

Read on for more detail.

_____________________________________________________________________

Qualified Tuition Plans (QTP 529 Plans)

It’s complicated.

For 529 plans, there is an “owner” (usually the parent), and a “beneficiary” (usually the student dependent). The "recipient" of the distribution can be either the owner or the beneficiary depending on who the money was sent to. When the money goes directly from the Qualified Tuition Plan (QTP) to the school, the student is the "recipient". The distribution will be reported on IRS form 1099-Q.

The 1099-Q gets reported on the recipient's return.** The recipient's name & SS# will be on the 1099-Q.

Even though the 1099-Q is going on the student's return, the 1098-T should go on the parent's return, so you can claim the education credit. You can do this because he is your dependent.

You can and should claim the tuition credit before claiming the 529 plan earnings exclusion. The educational expenses he claims for the 1099-Q should be reduced by the amount of educational expenses you claim for the credit.

But be aware, you can not double dip. You cannot count the same tuition money, for the tuition credit, that gets him an exclusion from the taxability of the earnings (interest) on the 529 plan. Since the credit is more generous; use as much of the tuition as is needed for the credit and the rest for the interest exclusion. Another special rule allows you to claim the tuition credit even though it was "his" money that paid the tuition.

In addition, there is another rule that says the 10% penalty is waived if he was unable to cover the 529 plan withdrawal with educational expenses either because he got scholarships or the expenses were used (by him or the parents) to claim the credits. He'll have to pay tax on the earnings, at his lower tax rate (subject to the “kiddie tax”), but not the penalty.

Total qualified expenses (including room & board) less amounts paid by scholarship less amounts used to claim the Tuition credit equals the amount you can use to claim the earnings exclusion on the 1099-Q.

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $600

3000/5000=60% of the earnings are tax free

60%x600= $360

You have $240 of taxable income (600-360)

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

Read on, for details

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

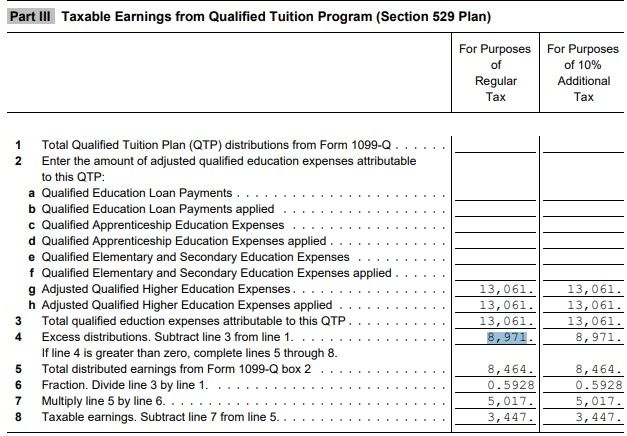

I just got a letter from the IRS saying that the taxed owed on the 529 distribution in 2020 was the amount prior to the 60% being applied. This was calculated on the PArt III Taxable Earnings from Qualified Tuition Program (Section 529). Please note that this worksheet is gone from TT2021.....seems like TT owes me $5017 when do I get the check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

TT stands by its calculations. If the program made an error, it will pay any interest and penalties, but not the additional taxes due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

If the IRS is saying "that tax is owed on the 529 distribution amount prior to the 60% being applied", they're not giving you credit for any educational expenses.

You've done nothing wrong (nor has TurboTax [TT]). We're seeing this frequently (it happened to me, personally). Apparently, the IRS has created a problem by not having a form to report the situation where the taxpayer uses all the 529 plan distribution for qualified expenses. Even though you probably entered the 1099-Q in TT, nothing about the 1099-Q went anywhere on the actual IRS forms (if part of it was taxable, the taxable amount (but not any calcs) went on line 8 of schedule 1)

At least two users have reported receiving a CP2000 letter, from the IRS, on 529 distributions. They replied that their child was in college and the distributions were for qualified expenses, which they listed, but they did not provide receipts.. They later received a notices saying they were in the clear. Others have reported that just sending copies of school billing statements satisfied the IRS.

If you have a situation where some of the earnings were taxable, you may have to manually recreate the calculations on the TT worksheet (or contact TurboTax support to help you locate the work sheet). Follow the example above to show the calculation of the taxable amount.

Even if TT made a mistake (and that's unlikely), they only owe you for the penalty and interest on the tax, not the actual tax.

To contact TurboTax (TT) support:

https://turbotax.intuit.com/support/contact/index.jsp

In the search line enter some keywords or question without quotes. On the next page, skip the suggested topic links and scroll down until you see CALL US. It should show the wait times. Week days 5 AM - 5 PM Pacific time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

So here is the situation. I had an excess distribution in 2020 due to paying spring tuition in December, but not getting a receipt until January 2021. Let's use some round hypothetical numbers to go through the details.

- My 529 distribution was $20,000

- My qualified expenses were $12,000

- Therefore, my excess distribution was $8000

- The ESA/QTP Worksheet shows the following:

- Line 5: Total distributed earnings from Form 1099-Q: $8500

- Line 6: Fraction - divide qualified expenses by total distribution ($12,000/$20000 = 0.5454)

- Line 7: Multiply Line 5 by Line 6 ($8500 x 0.5454 = $4636. This is the amount that went into my TurboTax return on Line 8 Other Income.

The IRS is saying that Line 8 on the return should be $8500 not the $4636.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

The IRS is wrong (it happens frequently, particularly with this issue). You should write back to the IRS with the explanation you described above. You should provide some detail on the $12,000 of expenses and preferably receipts (school bills).

Your calculations are a little wrong. Line 6 of the work worksheet is the non taxable portion of the earnings. Line 7 is the taxable portion (total earnings on line 4 minus nontaxable earnings on line 6). Also, $12,000/$20000 = 0.60, not 0.5454)

- The ESA/QTP Worksheet should show the following:

- Line 4: Total distributed earnings from Form 1099-Q: $8500

- Line 5: Fraction - divide qualified expenses by total distribution ($12,000/$20000 = 0.60)

- Line 6: Multiply line 4 by line 5: 8500 x 0.60 = $5100

- Line 7: Subtract line 6 from line 4: 8500 - 5100 = $3400 (taxable amount). This is the amount that shoulda went onto your TurboTax return on Line 8 of Schedule 1 , Other Income.

Another way to look at it: Your non qualified (excess) distribution is $8000. $8000 / 20,000 = 40%. 40% of the $8500 earnings is taxable. 0.40 x 8500 =$3400. There will be a 10% penalty on the $3400, unless you qualify for an exception (you used expenses for a tuition credit and/or they were paid by tax free scholarship.

Room and board, even if living off campus (or at home), are qualified expenses for a 529 distribution (but not for a tuition credit or tax free scholarship).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

Here is a screenshot from the worksheet:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

529 distribution being taxed

My example comes from a different worksheet. Your worksheet appears to be the one used when the student-beneficiary is not your dependent.

Your worksheet needs an amount on line 1 (apparently $22,032). You should send the IRS a copy of that work sheet, in addition to proof of your expenses. I believe Part II of that worksheet itemizes all of your qualified expenses. That should help your case.

Read the IRS carefully to be sure you understand the issue. The non dependent student may have been the red flag. But a 529 distribution is allowed for a non dependent's education, as long as the student is the beneficiary of the 529 plan.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kahumoku2

New Member

DragonVT

Level 2

cp4445526

New Member

maggie01123

New Member

Bosshoney

Level 2