- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 1098-E for adult children

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

We took out loans to pay for our kids' educations when they were in college. They are now adults. We paid interest and received a 1098-E. According to what I have read, we should be eligible for a deduction, but TurboTax is not letting me take it because we have no dependents listed.

How can we claim this deduction in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

You can take the Student Loan Deduction if you are legally obligated to make the payments on the student loans. You don't have to have a dependent on your return to be legible to claim the student loan interest.

To qualify, the interest payments you make during the year must be on a student loan that you took out to put yourself, your dependents or spouse through school. For 2024, if you're filing as Single or Head of Household, your modified adjusted gross income, or MAGI, has to be less than $95,000, or less than $195,000 if filing Married Filing Jointly, to deduct any student loan interest.

Please review the IRS Topic # 45 Student Loan Interest Deduction and the TurboTax article What is a 1098-E: Student Loan Interest? For more information,.

Go back and review your answers on the Personal profile screen to make sure that you didn't select that you could be claimed as a dependent on someone else's tax return. This may be the issue.

- Select your name under My Info

- Select Revisit

- Scroll through the screens to ensure that you have the correct answers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

You can claim the interest deduction, if you meet the three requirements:

- You paid the interest

- You are legally obligated to pay it (co-signing counts)

- The student was your dependent, at the time the loan was used to pay for qualified educational expenses (the TT pop up says “when you took out the loan”)

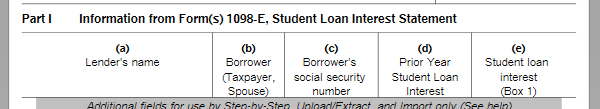

The student loan interest interview is just two questions; did you pay interest and then enter your 1098-E info. Even if you don't have a 1099-E, enter the info anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

This does not solve the problem. Our personal information was entered correctly.

TurboTax is asking me which person was a student in 2024. My childred graduated school before 2024, so there were no students in the family during the year. We are paying off loans that were taken out in prior years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

If you are in the 1098 E section, it is asking the BORROWERS name, not the student name.

If you are in the 1098-T section to enter education expenses it asks for the student name.

Be sure you are in the correct section, and then when asked who the borrower is, if it is joint, then you can enter whoever is first on the loan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-E for adult children

TurboTax asked me if I received EITHER a 1098-E or a 1098-T. It then asked me about Coverdale acounts and 1099-Q, and I replied NO to both.

It then asked me for the name of the person who was a STUDENT in 2024. It would not let me proceed without entering a name.

I decided to try entering the student loan interest directly on Schedule 1 using the Forms interface. To my surprise, I discovered that the amount had already been entered. So, I no longer need to enter it directly through the step-by-step method. This seems to be a shortcoming in TurboTax itself, but at least the problem is solved.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MissMLB

Level 2

skibum11

Returning Member

KellyD6

New Member

jjh

New Member

rrhorton

New Member

in Education