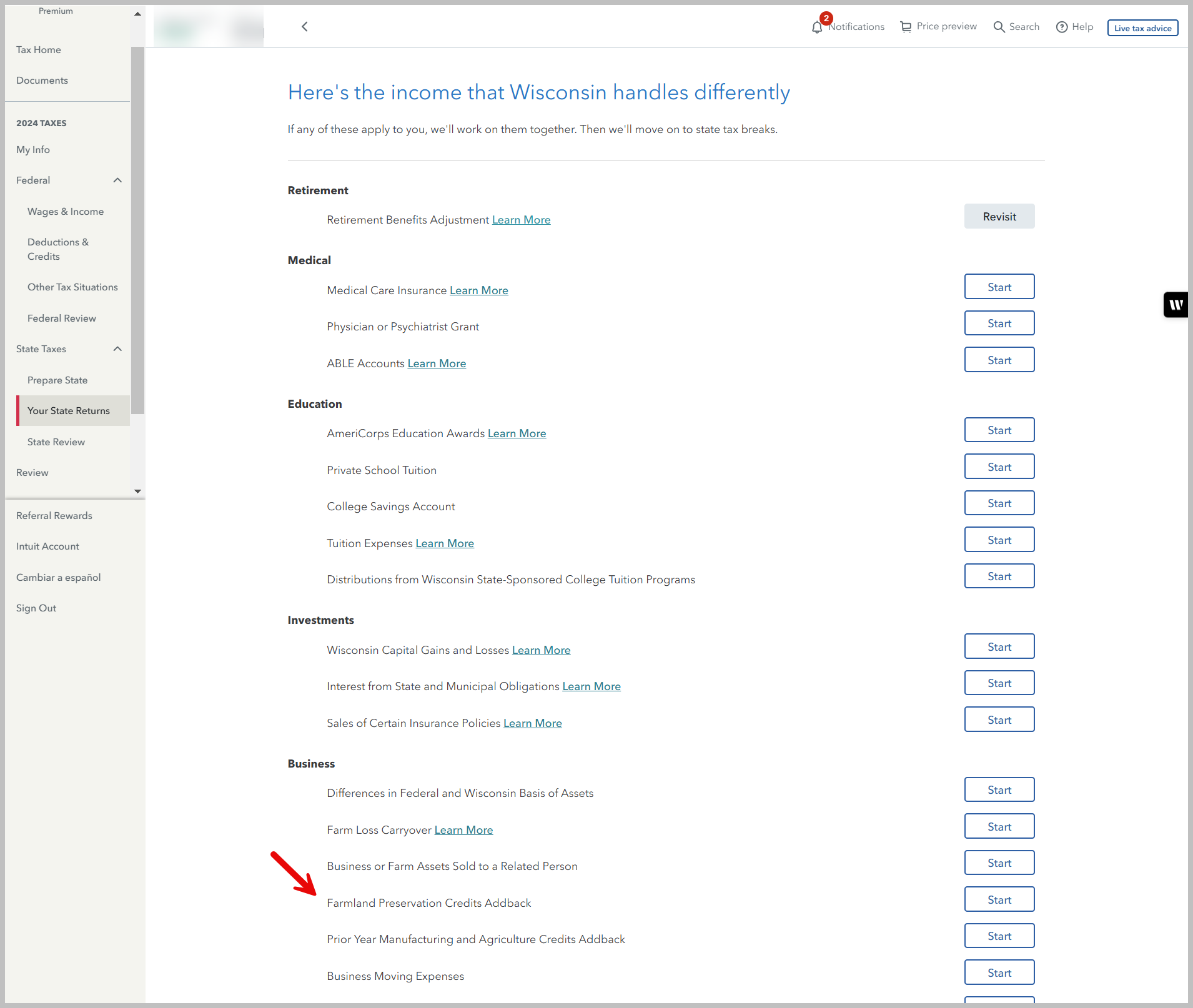

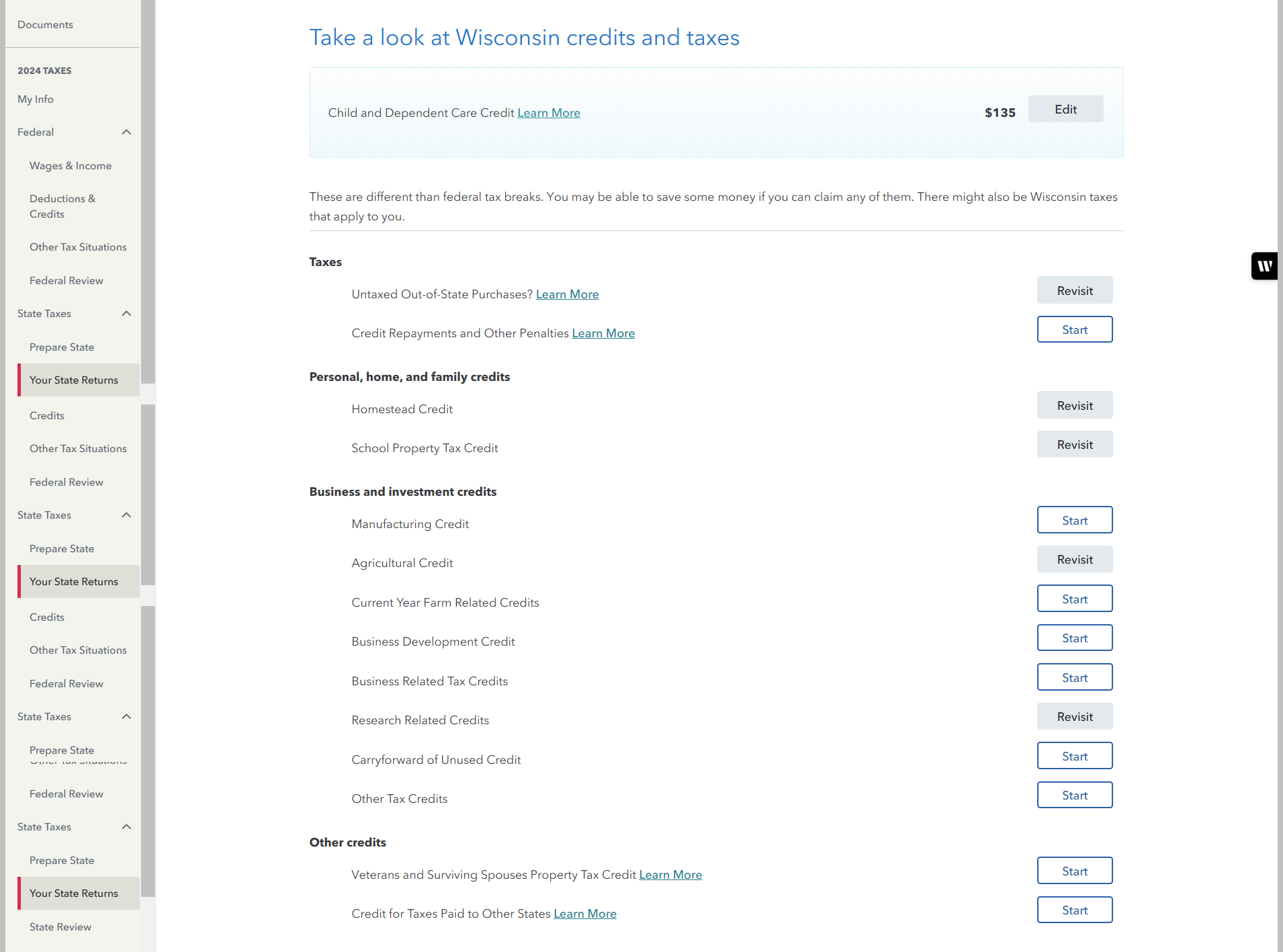

If you are talking about Farmland Preservation credits from Wisconsin, the section you will have to fill out is in the Wisconsin return. In the Wisconsin return, there are two screens that ask about Farmland Preservation credits. One screen is for income and the other one is to claim the credit.

If you received credits in 2023, you might have to add them back as taxable income on your 2024 Wisconsin return. The other screen is to claim the Agricultural Credit. For your reference, see the images below:

If your question is about a different Farmland Preservation credit, please reach out again and give us more details so that we can assist you.