In order to claim vehicle expenses , you need to add a vehicle to your business; here are the steps in TurboTax Online:

- Navigate to Federal > Wages & Income > Self-employment income and expenses

- Edit your business

- Choose add expenses for this work

- Choose Vehicle and Continue

- Vehicle now appears in the list of expenses, choose the pencil icon to the right of vehicle expenses

- Answer the interview questions about the vehicle, and enter the related expenses. Choose to take the actual expenses, not standard mileage.

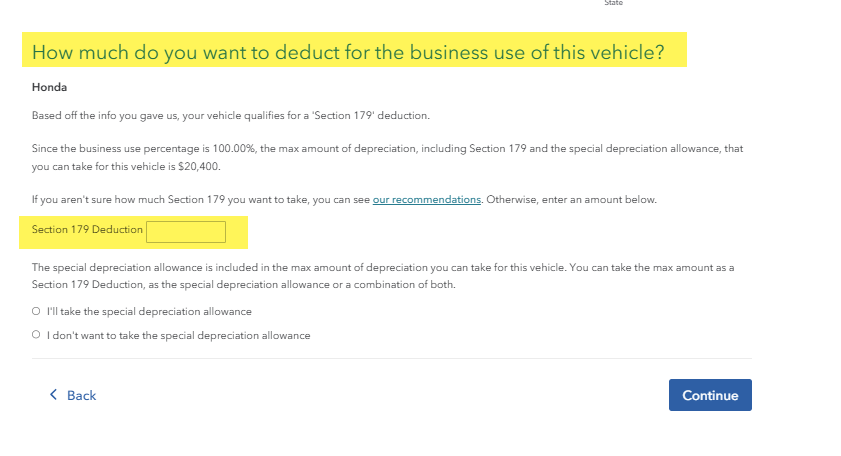

- Continue through interview until you reach How much do you want to deduct for the business use of this vehicle?, where you can take 179 deduction.